Here are 5 ASX Indices other than the ASX 200 for Investors to Watch Eagerly

![]() Nick Sundich, November 13, 2024

Nick Sundich, November 13, 2024

Here are 5 ASX Indices other than the ASX 200!

ASX All Ordinaries

The All Ordinaries is an indice that is actually older than the ASX 200, established back in 1979. At the time, the ASX was seeking to move away from regional indices and to establish one indice to measure the movement of the markets. Up until 2000, it was the key institutional benchmarket indice for the Australian market, even if it remained more broader than the ASX 200.

It is if you like the S&P 500 of Australia because it has the 500 largest companies in the market, as per the largest 500 securities based on a six-month average total market capitalisation. Liquidity is not a criteria for inclusion, neither is a minimum IWF or a requirement for companies to be headquartered in Australia. Whilst most other indices are rebalanced every quarter, the S&P 500 is only rebalanced once a year – in March. Naturally, just about all of the ASX 200 companies are in it.

ASX Small Ords

This measures companies in the ASX 300 but not in the ASX 100. So in essence, it is companies 101-300. It therefore may be misleading to call it ‘small’, but of course there is no uniform definition of what constitutes small cap and these companies are of course smaller than ASX 100 companies.

ASX All Ordinaries Gold

The S&P/ASX All Ordinaries Gold Index began in 2006. It includes companies in the gold sub-industry of the All Ordinaries Index – in other words, all stocks in the All Ords that are gold companies, explorers, miners and developers alike.

Because the index includes a wide range of companies within the gold industry, it serves as an ideal broad market indicator for the gold industry. As of November 2024, the smallest is $161.1m Strickland Metals (ASX:STK), followed by $320.7m Alkane Resources (ASX:ALK). The three largest companies are Newmont (ASX:NEM), Northern Start (ASX:NST) and Evolution Mining (ASX:EVN), which are all 11-figure companies (i.e. capped in the tens of billions of dollars).

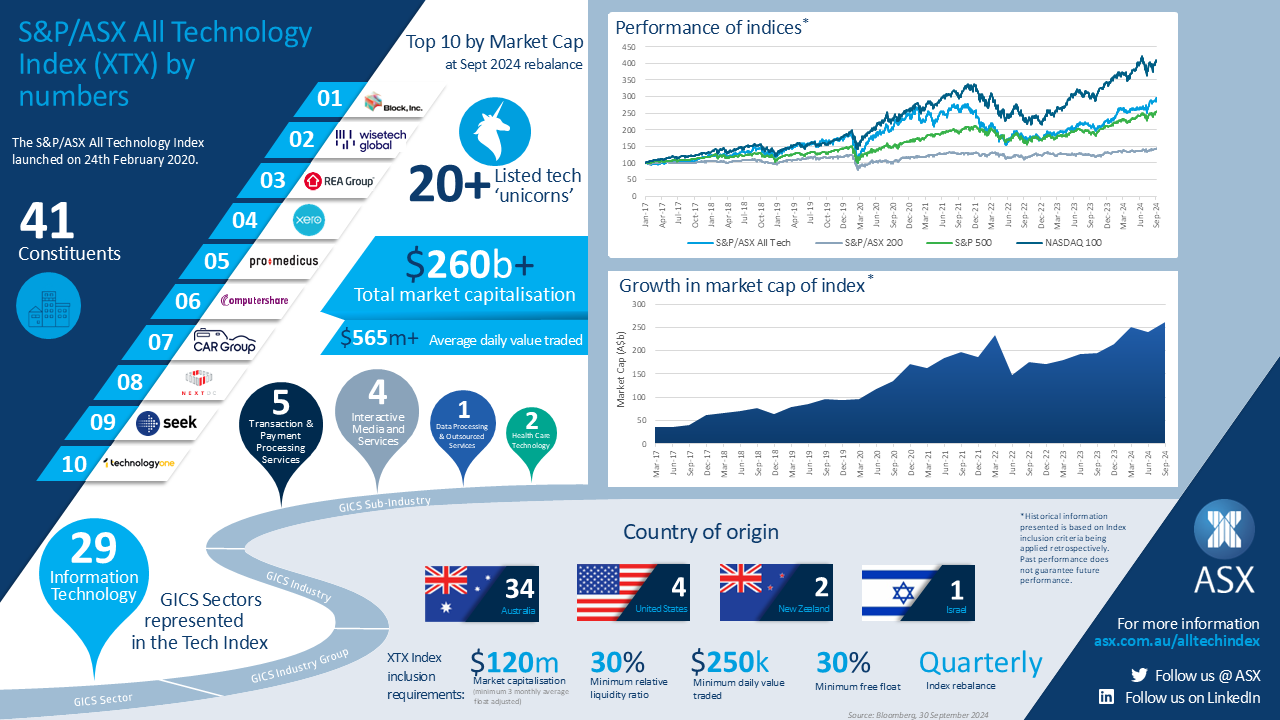

S&P/ASX All Technology

This was launched in early 2020, back in late February when COVID was only just seeping into the news. It comprises of just over 40 companies, intended to be companies growing quickly but yet to qualify for the ASX 300, and companies that may not fall under the traditional GICS classification of tech companies (i.e. health care technology stocks and payment processing services). The list of companies includes Block (ASX:SQ2), WiseTech (ASX:WTC), REA Group (ASX:REA), Xero (ASX:XRO) and Pro Medicus (ASX:PME). Although this indice trails the NASDAQ, it is ahead of other major ASX indices including the ASX 200.

Source: ASX

S&P/ASX Agribusiness

This was launched in 2022, intending to track the performance of agribusinesses on the ASX. This indice recognises the contribution agriculture makes to the Australian economy, and the stock exchange today, not to mention the exchange’s past.

When launching the indice, the ASX declared that it would bring greater awareness for the sector. ‘It will support agribusinesses to grow and prosper by enabling them to tap into one of the deepest pools of investment capital worldwide’, the exchange declared. It will also provide new and exciting opportunities for investors to gain exposure to this sector.

Companies included in the index are principally involved in: the primary production of agricultural products; and/or the production of commodities used as inputs into primary production of agricultural products. Companies that have won their way into this relatively new indice include Bega Cheese (ASX:BGA), Elders (ASX:ELD), A2 Milk (ASX:A2M) and Treasury Wine Estate (ASX:TWE).

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Apple’s iPhone Production in Focus: Is the Tariff Pause Enough to Ease the Pressure?

Apple, one of the largest and most influential tech companies in the world, is no stranger to the fluctuations of…

Why travel shares are getting slammed…and it is not for the reasons you may think

Just when ASX travel shares were out of the COVID-19 doldrums (in that some surpassed their pre-COVID highs), 2025 looks…

Capital Gains Tax on Stocks: Here’s what you need to know

Investors may be liable to pay Capital Gains Tax on Stocks, but may not know the nuances of how it…