Here’s why ASX manganese stocks could be about to break out, and our top 3 picks!

Investors in ASX manganese stocks, like all other battery metal stock investors, have been suffering from commodity prices being in the doldrums, although there could be light at the end of the tunnel for manganese. And it could present a good opportunity for both new and existing investors to make a profit.

What is manganese and why is it important in batteries?

Manganese (Mn) is a chemical element with the atomic number 25. It is a transition metal that is not found as a free element in nature; rather, it is often combined with iron and other minerals. Manganese has long been an essential element used in various industrial processes, especially in steel production and as an alloying element. But in recent years, it has become is a critical component in the production of batteries, particularly in the context of rechargeable batteries used in various applications, such as electric vehicles (EVs), portable electronics, and renewable energy storage.

There are several reasons why manganese is important for battery metals including for its energy density and performance, its cost-effectiveness relative to other metals used in battery production like cobalt, better thermal stability (and thus safety) compared to other metals) as well as better longevity and durability.

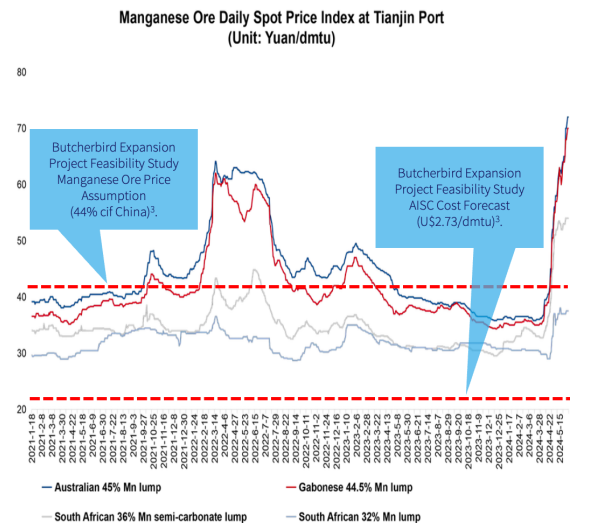

Despite the demand for electric vehicles, manganese prices struggled in 2022 and 2023. The bulk of manganese still goes into steel, mostly towards China, and international prices fell 20-40% across 2022 and 2023 as China’s economic recovery was slow.

Good signs

However, things are turning around. So much so, that one company with a mothballed project is pondering a restart. Element 25 (ASX:E25), the owner of the Butcherbird Project in WA, told investors earlier this week that it was looking into restarting production, only a few months after it put things on hold. Prices at Tianjin, China were at four-year highs at US$8.30/dmtu (dry metric tonne units). A Feasibility Study for an expansion of Butcherbird forecast an AISC (All In Sustaining Cost) of US$2.73/dmtu.

Many factors have impacted the market including political instability in South Africa and adverse weather in Australia. South32 (ASX:A32), one of the world’s largest producer, saw Cyclone Megan damage infrastructure at its NT project, bad enough that exports will not recommence until 2025.

(Source: Element 25)

Complicating things for Element 25 was the capex of a restart. Although this could be paid for via existing stockpile, the company would need to be satisfied that the mine could be self-sustaining. For now, the key offtake partner is OM Holdings (ASX:OMH). But it is ultimately planned for the manganese to be exported to a facility in the American state of Louisiana and be made into high-purity manganese sulphate monohydrate, in a partnership with GM and Stellantis which will use this material for electric vehicles.

Now this is just one company making this move, although all commodity rallies all start with one company taking the gamble on a recovery when it is in the early stages. Other ASX manganese stocks could follow before too long, although it could be too late to join the rally by the time this happens. And so here are our top 3 ASX manganese stocks.

Our top 3 ASX manganese stocks

But for its project closure, South32 (ASX:S32) would be at the top of the list. If Anglo American (LSE:AAL) had been bought by BHP (ASX:BHP), we would no doubt in due course have the latter company on the list too. Enough with hypotheticals, however. Here are our top 3 ASX manganese stocks.

Black Canyon (ASX:BCA)

Black Canyon is another company with a project in WA – the Balfour Manganese Field. The most recent Mineral Resource Estimate found 314 Mt @ 10.5% for 33.1Mt of manganese. 32% was measured and 48% was indicated. This makes it the second highest resource in Australia, only trailing the Groote Eylandt deposits in the Gulf of Carpentaria, prospected for by GEMCO, a company owned 60-40 by South32 and AngloAmerican. Balfour remains at an exploration stage.

Euro Manganese (ASX:EMN)

Euro Manganese has the Chvaletice project in Czechia with a US$1.3bn NPV and 22% IRR. It plans to produce HPMSM (High Purity Manganese Sulphate Monohydrate) for the EV market. The HPMSM market is set to have supply remain stagnant over the rest of the decade, but demand to grow so much so for a 4.9Mt deficit to exist by then. The project is only expected to be commissioned in 2028, although FEED Engineering and other Early Works are underway as are negotiations for project financing.

Jupiter Mines (ASX:JMS)

Capped at over $600m, Jupiter Mines owns the Tshipi Borwa mine in South Africa, the fourth largest in the world, producing 3.5Mtpa and having a 121-year mine life (not that is not a typo, it is 121 years and isn’t even the manganese mine with the longest life, even though it is near the top). It is a dividend payer, having paid an average yield of 12% since its IPO, more than double the ASX average of 5.2%, and has paid out more than double its market cap in over 5 years. It has $73m in cash on hand, zero debt and made a $10m profit in 1HY24.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…