3 reasons why ASX penny stocks have such an awkward reputation

Penny stocks, especially ASX penny stocks, have a bad reputation in the investing world. They are associated with high risk and potential for huge losses and can be seen as more of a gamble than an investment. But is this reputation deserved?

What are penny stocks?

Penny stocks, also known as micro-cap stocks, are a type of stock with low share prices. In the US, they trade between $0.01 and $5 per share. These stocks tend to have a low market capitalization value, and they are often traded over the counter rather than through exchanges like the New York Stock Exchange (NYSE).

In Australia, they trade on the main bourse of the ASX but some may trade on the NSX instead. There’s no set definition of what they are in Australia, although we think one couldn’t say a stock with a 0.1c share price was not a ‘penny stock’.

How are penny stocks regulated?

It is important to note that penny stocks are regulated like any other stock (even the mighty blue chips). In the US, they are regulated by the U.S. Securities and Exchange Commission (SEC) and in Australia by ASIC and the ASX.

In order to protect investors from potential scams and fraud, regulators require certain disclosures about penny stock companies. This includes information on company finances, management background, and other information that may help investors make informed decisions.

In some jurisdictions, there are a number of additional restrictions on how penny stocks can be sold and traded. For example, broker-dealers may be required to provide potential buyers with specific information about the company before they can purchase penny stocks that wouldn’t need to be provided if it were a blue chip stock.

Penny stocks may also not be allowed to be part of major indices (like the ASX 200 or S&P 500), unless they satisfy particular requirements. For the ASX, the specific stock price is not one of them although the US exchanges ban stocks below a certain price from being part of indices.

Why do ASX penny stocks get a bad wrap?

One reason penny stocks get such a bad rap is due to how they’re traded. They usually trade on the over-the-counter (OTC) markets, which don’t have the same degree of scrutiny and regulation as the New York Stock Exchange or Nasdaq. This means there is less transparency in pricing and it can be more difficult to determine a company’s true value.

Another issue with penny stocks is that they are often associated with “pump and dump” scams. This involves an unscrupulous investor or group of investors buying up large amounts of penny stocks in order to artificially inflate their price, then selling them off quickly after the stock has reached a higher price point. The case study of Jordan Belford and his firm Stratton Oakmont, famously depicted in the 2014 film ‘Wolf of Wall Street’, magnified pump and dump schemes.

Finally, there is also the risk that some companies offering penny stocks may not have a viable business model. This can lead to an investment with no return, and if the company goes bankrupt, investors risk losing all of their money.

High risk, high return (sometimes)

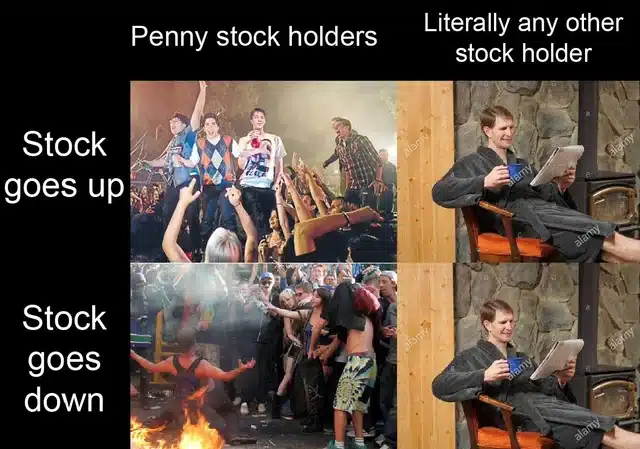

All this being said, they also have the potential for huge returns. As with any investment, it’s important to do your research before buying into a penny stock in order to minimize risks and maximize profits.

Penny stocks may not be for everyone, but they can provide an opportunity for investors to diversify their portfolios and potentially earn big returns with a small investment. Ultimately, the decision of whether or not to invest in them should come down to an individual’s risk tolerance and financial goals.

Experienced investors who understand the risks associated with penny stocks could potentially make a great deal of money—but they should always approach these investments with caution, knowing they are a different kettle of fish to blue chip stocks.

Source: WallStBets/Reddit

How to make gains and avoid losses on penny stocks

The key to making good investments is to do your research and never take unnecessary risks. Make sure you have an exit plan, understand the company’s financials and be aware of any potential scams or pump-and-dump schemes.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…