Aussie Broadband (ASX:ABB): A likeable telco that can reach for the skies again

![]() Nick Sundich, April 2, 2024

Nick Sundich, April 2, 2024

Aussie Broadband (ASX:ABB) is a good illustration of a Telco stock you can like (as opposed to Telstra). Since listing on the ASX in 2020 at $1 per share it has substantially grown its customer base, revenues and, consequently, its share price. It went as high as $5.95 in late April 2022 before dipping after informing shareholders it would only meet the lower end of its guidance. Things have improved in the last year, but it is off its all time highs and suffered a setback with its bid to take over Superloop (ASX:SLC) all but dead. Where to next?

Aussie Broadband (ASX:ABB) share price, log scale (Source: TradingView)

Who is Aussie Broadband?

Aussie Broadband is one of several NBN providers in Australia and prides itself in its high internet speeds and customer service experience. It was formed in 2008 through the merger of two regional telcos – Wideband Networks and Westvic Broadband. Retail telco is a notoriously low-margin business, especially if it’s the NBN – even the major telcos hate it. It is also a thankless industry to be in with customers expecting perfect service, given how much we rely on the Internet.

Aussie Broadband is able to make money through automation systems that lower the cost, but also provide a smooth customer experience, enabling sign-ups that can be done without any on-site work. As for customer service, it is highly rated by customers for its sign-up experience, its products, internet speed and for having a local call centre with low wait times.

Strong growth since listing

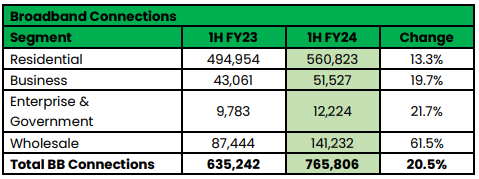

As of December 31 2023, the company had 560,823 residential customers (up 13% year-on-year), 51,527 business customers (up 20%), 141,232 wholesale customers (up 22%) and 12,224 enterprise and government customers representing 765,806 customers in total (up 21%).

Aussie Broadband customer and service numbers as of December 31, 2023

It generated $788m in revenue in FY23, $512m of which was from the residential market and the average revenue is $980 per connection or $82 per month. The average business customer pays $1,889 annually, while wholesale pays over $9,000 and government pays $782.

Since listing, Aussie Broadband has rolled out new products, including mobile plans and white label, rolled out its fibre optic network and acquired telco solutions providers Over the Wire and Symbio. The company made a $5.3m profit in FY22, $22m in FY23 and $9.8m in 1HY24 – although the former figure is down from the full FY23 profit, it is up 14% from 1HY23.

An unblemished record becomes blemished

In May 2022, Aussie Broadband put out a quarterly trading update that spooked investors, who sent shares down 60% in the following 6 months. Although it reiterated its EBITDA guidance, it was towards the lower end of the original guidance – Aussie Broadband provided $27-$30m for the full year just 3 months earlier.

When a company has an unblemished record that suddenly becomes blemished, this can have a significant impact – shareholders can realised negative aspects a company that they may have previously disregarded.

For Aussie Broadband, the most peculiar is that it targets the low-margin retail telco segment. In contrast, market darling Uniti had traditionally been wholesale only as well as an alternative network to the NBN rather than just another provider. We also observe that while the company is NPAT profitable, it is low margin, at just 3% in FY23. As a company that had gone up so much, with such a high valuation and without blemish in its 18 months of listed life, it was an easy target for investors to sell off.

Bouncing back

Over the following 18 months, things improved off the back of ABB’s financial results for FY23 with $788m in revenue (up 44%) and a $22m profit (up 308%). 1HY24 saw $445.9m in revenue (up 18%) and a $9.8m profit (up 14%). The company told investors to expect $105-110m in EBITDA for the full year (up 17-22%), but also to expect $40-45m in capex.

For the past couple of months, Aussie Broadband tried to buy Bevan Slattery-founded Superloop (ASX:SLC). Even though the companies acknowledged it would make strategic sense, the $466m takeover bid (offered in shares) was rejected. Aussie Broadband had accumulated a 19.9% stake in the company, indicating its intentions, but was not only rebuffed by Superloop, but ordered to sell its shares in the company to below 12%. It has sought to set aside the notice.

Why we think there’s share price growth left in it

In the current high-inflation environment, the companies that will perform the best are those that consumers can’t cut back their spending on (without compromising their way of life too substantially). Aussie Broadband is one such company. We admire its growth record since its founding and listing as well as its high reputation in the industry.

The 7 analysts covering the company agree. For FY24, consensus estimates call for the company to surpass $1bn in revenue for the first time and a $44m profit. Then $1.2bn revenue and a $53m profit in FY25. And you can obtain this growth for just 6.6x EV/EBITDA, 19.6x P/E and 0.7x PEG. We think Aussie Broadband, assuming it can achieve these estimates, is worth $5.70 per share, a 60% premium to the current share price.

Keep your eye on Aussie Broadband

Clearly, whether or not you invest in this company all comes down to whether or not you believe it can achieve these targets. We think it can, given the recent acquisitions and its reputation in the industry.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…