Avita Medical (ASX:AVH): It hasn’t catapulted it to the heights envisioned (yet), but there’s hope for the 2026 and 2027

Avita Medical (ASX:AVH/NDQ:RCEL) is a particularly peculiar healthcare stock. The company, these days based in the Californian city of Valencia which is 40 miles north of Los Angeles, is one of the few to have cracked the US market, but things have not been easy.

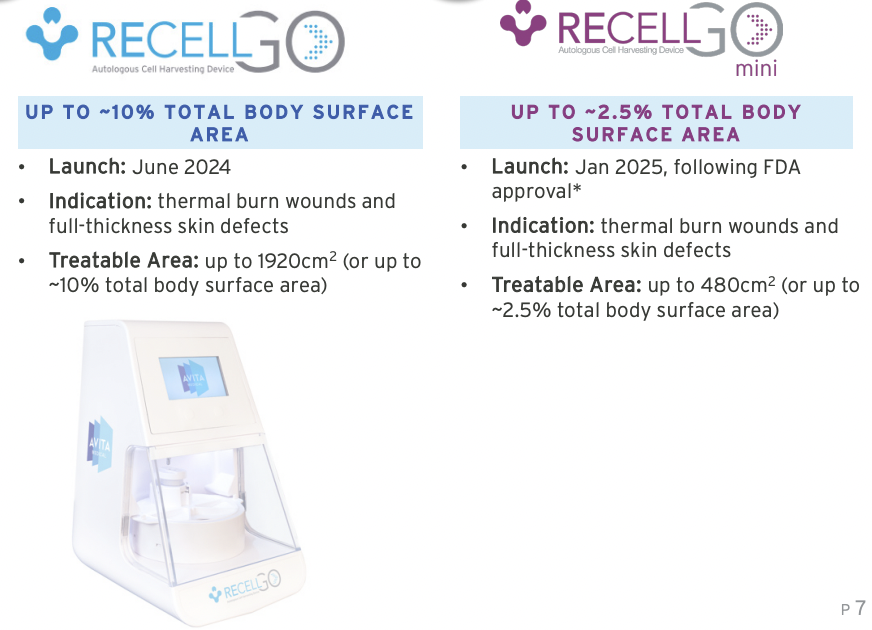

In December last year, received not one, but two Christmas presents from the FDA. On December 19, it announced 510(k) clearance for Cohealyx, a new collagen-based dermal matrix for use in tissue integration and revascularisation. The second, on December 23, was approval for Recall Go mini – a disposable cartridge that can treat smaller burn wounds up to 480 square centimetres.

At the time, we wondered if it could these take the company to new heights in 2025? So far, not so much. The irony is the company is not struggling with costs as many peers are, but revenues are down due to reimbursement delays. The question we want to ask is: Where to next?

In short: We think this could be one of the best medtech opportunities…but don’t expect to see much growth until investors can see evidence.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Who is Avita Medical and what is Recell?

Few companies trace their history back to the Bali Bombings, but Avita is one of them. The Recell technology actually was used in the 1990s, but only in 2002 did people take notice. Recell is a rapid cell harvesting device that enables surgeons to treat skin defects using a patient’s own cells.

It works as a ‘spray-on’ product, which can be done at the point of treatment and with a small quantity of cells. A doctor takes a biopsy on any part of the body and mixes cells into a liquid spray. It is ready for use in 30 minutes and can cover 80 times the area of a skin graft with the same amount of material an ‘ordinary’ skin graft would.

In March 2020, this author spoke to then CFO David McIntyre who put it bluntly,’ There is no cost with taking your own skin and transplanting it. There’s an obviousness and intuitiveness to the product. You don’t need a PhD to understand this, if you do less and get the same outcomes it is best for everyone.’

Within 24 hours of the Bali bombings, patient were being repatriated to Australia and the Perth hospital Professor Fiona Wood was at ended up having the most – with 28 patients, some had burns on up to 90% of their bodies. 25 of the patients under her care survived, and she was named Australian of the Year in 2002.

Slow and steady progress

For around 15 years Avita was building slowly, but couldn’t quite crack the US. But in 2018, this happened following a successful 101-patient trial which was released in April. Not only was Recell shown to work but it was shown to reduce donor skin needed by 97.5% that it could cut treatment costs by 44% of more.

Results from the 2017-18 clinical trial (Source: Company)

From there, shares began taking off, and the FDA gave approval in September 2018. Investors were excited by the opportunity immediately before it but also future potential – the company hinted out-patient burns, soft tissue reconstructions, paediatric scalds and even vitiligo (the same condition that affected Michael Jackson.

Avita shares skyrocketed in the months following approval, but had a difficult couple of years as growth was slower than expected. The stock remained loss-making, and people staying at home meant less people suffering burns and fewer opportunities for meetings by company executives with potential customers. And the company’s initial market was small to begin with, being only in in-patient burns.

But the past couple of years have been somewhat better for Avita and its investors. After shares bottomed out in mid-2022, the company had good news flow. In August 2022, it announced positive clinical trial results in soft-tissue injuries – not just burns but rashes, surgical wounds and flesh-eating disease. A month later, it announced positive clinical trial results for vitiligo. FDA approval for both indications came in June 2023.

And so after achieving US$14.3m in sales during the first full 12 month period Recell was approved (FY20 – the July-June financial year that Australia uses and Avita still did at the time), Avita made US$64m during the 2024 celendar year. Avita than shifted its focus towards making its technology less of a burden on training staff and to improve the efficiency. It developed and got approved Recell Go, the next generation system. Whilst not able to treat larger wounds, it could treat smaller wounds and the company thinks it can open up a larger market. This leads into the news it got just prior to Christmas.

2 Christmas presents

As we noted, Avita got FDA approval of Recell Go Mini, that can treat even smaller areas. Prior to FDA approval, the company believed it had a total market opportunity of 127,000 annual eligible procedures. But now it thinks it has an opportunity of 400,000 annual FTSD eligible procedures plus another 35,000 or so annual burn procedures. It anticipates its existing customers to be interested, in the US, as well as in Australia, the EU and Japan.

Source: Company

Oh and it also got approved Cohealyx, its new collagen-based dermal matrix. This ensures that it can meet skin defects at literally every layer, ensuring that wounds can be closed in a better was than stitches. The company is also exploring wound bed preparation opportunities. The collagen product is being developed in conjunction with Regenity Biosciences and is splitting sales 50-50 for the first year with a 60-40 split for the next 4 years at least.

2025 has not been a good year, but is there hope?

Avita released its Q3 2025 results last week and its commercial revenue was 13% down from 12 months ago. If it was any consolation, opex reduced by 24% of $7.2m and s its net loss was down from $16.2m to $13.2m.

Nonetheless, the reduction in revenue led for the company to cut its guidance from $76-81m to $70-74m. So investors overlooked the good news that Recell Go received CE Mark approval, paving the way for a European launch.

The CEO is currently Cary Vance who replaced James Vance who departed in October after a 3 year stint. He told investors the company would focus on 200 key US burn and trauma centres representing the highest-value opportunities. He said it was due to delayed reimbursement transitions, but things would improve with time.

Analysts are very optimistic about the company with a mean ASX target price of $3.09, just under triple the current ASX share price. US analysts are optimistic too with a price of US$7.46, more than double the US$3.40 it is at right now.

For CY25, they expect US$73.9m revenue but for solid growth in the next 2 years with US$99.4m called for in 2026 and US$150m in 2027. The EPS loss is expected to be only half of what it was the year before at US$1.29 vs US$2.45, further shrinking to US$0.55 in 2025 then to US$0.45m in positive territory in 2027.

It seems analysts expect increased revenues as reimbursement delays end and sales grow from new products. These estimates put the company at just 7.6x P/E for FY27.

Conclusion

To answer the question this article’s title asked, we think that Avita has promise, but will need to eventually reach profitability or at least make progress towards it.

It is clear that it will be more of a slow and steady journey, as opposed to a stock like Dimerix (ASX:DMX) that has clinical trial results, but we think investors have significant reason for optimism with Avita.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…