Bank profits: They’re just one measure of performance. Here are another 3 useful ways

![]() Nick Sundich, May 12, 2023

Nick Sundich, May 12, 2023

Bank profits are heavily scrutinised, especially those of the Big Four. But why do bank share prices fluctuate so substantially given profits are almost as certain as death and taxes?

This is because for professional investors, there are other ways they measure a banks’ performance. In this article, Stocks Down Under recaps 3 of the most popular and useful ways.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Forget bank profits – here are 3 performance metrics

1. Return on Equity (ROE)

Return on Equity (ROE) is a measure of the financial performance of a bank, and is a key indicator used by investors to assess how well their investments are performing. ROE measures the efficiency of a business in generating profits from its shareholders’ investments. It is calculated by dividing net income by the amount of equity held in the company, which reflects both retained earnings and capital contributed by shareholders. A higher ROE signifies that more money is being generated for each dollar invested, making it a key metric for investors when evaluating potential investments.

The main benefit of using Return on Equity to analyze a bank’s performance is that it provides an accurate snapshot of how efficiently the business is operating. By measuring the rate of return relative to shareholder investment, investors can gain an understanding of how well their money has been managed over time and make decisions regarding future investments with greater confidence. In addition, Return on Equity can provide insight into areas where management has done an effective job in controlling costs or creating efficiencies throughout the organization.

Finally, Return on Equity offers a valuable insight into how successful banks have been in utilizing available resources and reaching their long-term objectives. While some banks may focus solely on short-term gains and overlook long-term objectives, other banks with higher Return on Equity will have demonstrated that they have achieved sustainable growth over time without compromising their core values or sacrificing quality service to customers. This makes Return on Equity an invaluable tool for investors when evaluating potential banking partners or investing opportunities in the banking sector.

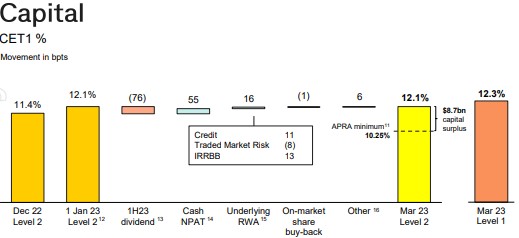

2. CET1 ratio

The Common Equity Tier 1 (CET1) ratio is a measure of the financial strength of a bank’s balance sheet, and it is one of the most important metrics used to assess the health of an Australian bank. The ratio is calculated by dividing a bank’s CET1 capital by its total risk-weighted assets. A higher CET1 ratio indicates that a bank has more capital relative to its level of risk and exposure. Investors use this metric to measure the performance and financial stability of an Australian bank and make decisions on whether or not to invest in them.

In Australia, banks are required by the Australian Prudential Regulation Authority (APRA) to maintain a minimum CET1 ratio of 8%. This means that for every $100 worth of exposure, banks must maintain at least $8 in CET1 capital. Banks that fail to meet this requirement may be subject to restrictions from APRA such as limits on dividend payments or other forms of remedial action.

Additionally, investors can use the CET1 ratio as an indicator for how well a particular bank has been performing over time, compared to its peers. Banks with higher ratios are generally seen as being safer investments than those with lower ratios due to their ability to absorb losses without impairing their ability to continue operating through difficult times. Higher CET1 ratios also provide peace-of-mind for investors who are looking for safe and secure investments in Australia’s banking sector.

You could also compare a bank’s CET1 ratio to earlier periods. We illustrate below CBA’s most recent CET1 ratio (at 1HY23).

3. Earnings Per Share (or EPS)

EPS, or earnings per share, is a metric used to measure a bank’s profitability on a per-share basis. It is calculated by dividing the bank’s total earnings or net income by its total number of outstanding shares. EPS is particularly useful for investors looking for an indication of how much dividend they can expect from a given stock. A higher EPS usually signals that the company is more profitable and may be willing to pay out larger dividends…in theory. But this isn’t always the case in practice. As with any company, dividends are at the discretion of the company’s management

Australian banks often have higher EPS than those in other countries due to their strong reputation and relative stability compared to other markets. This makes them attractive investments and helps to ensure that they will continue to provide dividends year after year. Additionally, Australian banks generally maintain strong balance sheets with high levels of capital adequacy ratios (CARs). This allows them to remain competitive in terms of lending rates, which ultimately leads to higher profits and higher EPS figures.

By using EPS as part of their analysis, investors are able to gain insight into a company’s current financial health and predict how much dividend they can expect going forward. This helps them make more informed decisions when it comes to investing in stocks and can also help to minimize losses if the market turns against them.

Given the relative safety of Australian banking sector, investors can rely on higher EPS numbers as an indication of future dividend payments – although they are no more than an indication and do not represent any certainty for what investors may be paid.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Cettire shares are down over 90% from their all time high as investors follow the leader in selling shares

It hasn’t been a good 14 months for Cettire shares. For a long time after the pandemic, eCommerce was one…

How will stocks be impacted by tariffs? Here are 6 victims on the ASX and how they’re responding

How will stocks be impacted by tariffs? Its a long story, but few stocks can say that there’ll be no…

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…