Bellevue Gold (ASX:BGL): One of Australia’s newest gold producers fell >50% from its peak, but is now recovering

Bellevue Gold (ASX:BGL) is one of Australia’s newest gold producers, but one of the few gold stocks to be down in 12 months.

It timed its run to production to near perfection given gold prices have been booming for the last 3 years and it achieved quite a feat in actually getting there given the struggles of small-cap explorers.

Although the company ‘made it’ in that strict sense, times have been tough with shares having more than halved from their peak. This has led to speculation that it could be a takeover target before too long.

But in recent months, shares have rallied. And maybe some of it is down to continued rallying in gold prices, but the company has been turning things around.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Bellevue Gold’s story

The current company was a tiny shell company known as Draig Resources back in 2016. It bought its namesake project in WA after it had spent 15 years in the hands of Barrick, which had done little work on the project. It had been an operating mine between 1897 and 1997 and produced nearly 1Moz (million ounces) of gold but had appeared to run out of life.

Bellevue Gold was chaired by Ray Shorrocks who bought onboard Steve Parsons, who founded Gyphon Minerals and made a successful M&A exit after finding a 3Moz resource. Tolga Kumova also came onboard as a key investor. The company began a drilling campaign in the last quarter of 2017 and has never looked back, delivering a return of over 5000% to investors.

A monster deposit

It has Total Mineral Resources of 11Mt at 9 g/t for 3.2Moz of gold. 1.7Moz of this is Indicated with the balance inferred. This makes it one of Australia’s highest-grade gold mines. Production has just begun. The company forecasts a 10 year mine life and for $2.1bn of free cash flow, assuming a gold price of A$2,500/oz. This is the stuff dreams are made of.

The company prides itself not just on its ‘rags to riches’ story but how it is fully funded with A$133m in liquidity and has a solid ESG angle. It is aiming for Net Zero by 2026, to be 70-80% renewable energy powered and it has signed appropriate agreements with local Indigenous landholders.

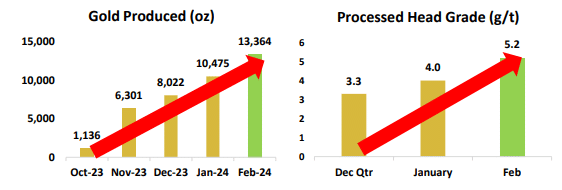

Production began in late October 2023 with the first gold pour. Again, BGL has never looked back. Not just from produced gold, but from a grade perspective.

Source: Company

BGL had issued guidance of 165,000-180,000koz production for FY25 with an AISC of A$1,750-1,850/oz. Within 5 years, it aspired to produce over 250,000/oz per annum and have ‘first-quartile cost positioning’. This was planned to be achieved through an increase in underground ore movement and an increase in processing capacity, with low capital cost.

Bellevue has been aspiring to deliver a significant proportion of its energy from renewable sources. IT is building a 90MW hybrid power station on-site – a mix of wind, solar, thermal and Battery Energy Storage.

But 2025 has been (mostly) difficult

In less than a week into 2025, the company revised its guidance to 150-165,000/oz in light of lower grades encountered.

Despite the company expressing confidence things would improve, it took only 3 months for another downgrade for the same reason (lower grades encountered). The updated guidance was 129-134,000/oz for FY25, and it issued guidance of 150,000/z for FY26 followed by ~190,000/oz for each of FY27-29, and the Resources pinning this outlook at 90% Indicated with just 10% Inferred and 0% measured.

The FY26 figure was a downgrade because the company’s costs had risen so it scaled back its mining fleet and put the processing plant on hold. So it has deferred $75m in capex and issued ASIC guidance of A$2,425-2,525 per share.

On the same day, BGL launched a $156.5m capital raising and it raised that money – with the raise coming 6 months after the last one which was $150m. It said $40m would serve as additional working capital, and the balance was used to close out unfavourable hedging contracts. The gold price is over US$1000 higher than the contracts it entered into.

The future? Maybe a takeover, but now it looks like its turning things around

BGL openly revealed that it had been targeted by unsolicited takeover approaches, without naming anyone. It hired UBS to head a ‘strategic review’ to assess these offers (As well as its performance at the operations generally) and Bill Stirling quit as chief operating officer.

Despite the talk BGL might have entertained a takeover offer and consequently get out (or maybe because of it), the company held a site tour for investors. It reported a lift in mined tonnage in March, but a loss in expected grade performance, but largely fixable or localised.

The company claimed >90% of drivers were within its control and had moved into more consistent mining areas. As for the processing plant, it claimed the 1.35Mtpa expansion was almost complete, and the goal of net zero by CY26 would be met.

Since we last updated this article in June, things have just kept getting better. BGL boasted that it concluded FY25 with ‘record production rates’ with 38,941oz during the quarter and having sold 130,164 throughout the year with an average sale price of A$5,147/oz. It had free cash flow of $67m and cash & gold on hand of $152m.

And crucially, it guided to 130,000-150,000/oz in FY26, at an AISC of A$2,600-2,900/oz; and 175,000-195,000/oz in FY27. This guidance was reiterated following Q1 of FY26. So long story short, it seems by FY27 that while it will have been a slower ramp up than anticipated…Bellevue will ultimately have the high-producing gold mine it envisioned and promised.

Conclusion

At $1.9bn, there are few other >100koz producing gold mines available at this price and there could be more room for upside. It is rare to see a company like Bellevue have such a run of bad luck, at the same time literally all its other peers have had such a great run, in such a strong market for gold; but now the tide is turning.

Nonetheless, we are concerned about the high AISC and what it could mean if gold prices come down. It seems investors have brushed off concerns for now just because gold is over A$5,000; but the tide could turn.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…