Best Nifty Stocks to Buy in June 2024

![]() Ujjwal Maheshwari, June 3, 2024

Ujjwal Maheshwari, June 3, 2024

As we step into June 2024, the Indian stock market is truly a hotspot for investors looking to make their mark. The Nifty 50 has just hit an all-time high, soaring to 23,043.20 at its peak on May 27. Analysts are buzzing with excitement, suggesting the Nifty 50 might swing between 22,500 and 23,500 this week. If you’re thinking about where to invest, now’s the time to get curious about which stocks are shining brightest.

India’s economy is more than just solid. We’ve seen an 8.2% spike in GDP growth this year. This economic energy is driven by strong consumer spending, big infrastructure projects, and innovative tech advancements. Plus, with inflation worries easing off and the Reserve Bank of India holding a steady hand, there’s a strong wave of confidence among investors.

Globally, things are looking up too. The stabilization of oil prices and recovery in key economies worldwide are adding to the optimism. And let’s not overlook foreign institutional investors who are increasingly drawn to India’s potential, pouring in funds and adding to the market’s momentum.

Impact of Exit Polls and Lok Sabha Elections

The upcoming Lok Sabha elections are grabbing the attention of everyone, including investors. The exit polls are showing a likely win for the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA), with forecasts suggesting they could secure over 350 seats. This result is viewed positively by the market, as it implies a continuation of current economic policies and political stability.

Historically, the outcome of elections significantly influences market sentiment. Investors generally respond well to a clear win by the incumbent government, as it indicates a commitment to ongoing policy reforms and likely economic growth. However, unexpected results could lead to market volatility and more cautious trading.

In the days leading up to the election results, we might see some fluctuations in the market. Analysts predict that the Nifty 50 could range between 22,500 and 23,500, with major shifts likely driven by news related to the elections and changing investor mood. If the Nifty pushes past 23,400, it could suggest a stronger market rally, whereas a drop below 22,400 might indicate a pullback towards 22,000.

It’s wise for investors to stay tuned to the election results and the early decisions by the new government, especially regarding economic policy and key appointments like the finance minister. These developments will provide clues about the direction of economic policy. Additionally, the RBI’s monetary policy meeting from June 5-7 will be important for understanding the central bank’s approach to interest rates and liquidity management, which could impact investment strategies.

Top Nifty Stock to Buy in June 2024

Infosys Limited (NSE: INFY)

Last Traded Price (LTP): ₹1,407

Buying Range: ₹1,385 – ₹1,456

Target Price: ₹1,575

Stop Loss: ₹1,375

Upside Potential: 12%

Infosys has been a consistent performer in the Indian IT sector. Over the past few months, Infosys stock has been consolidating within a narrow trading range of ₹1,400 to ₹1,450. This period of consolidation indicates a lack of significant momentum. However, the stock recently broke out of this range, moving above the ₹1,450 level, which was previously a resistance point. This breakout is a strong bullish signal, suggesting a shift in market sentiment from neutral to positive.

The daily stochastic indicator, which measures the stock’s momentum, has reversed direction from the 60 level and is approaching the overbought zone. This shift implies increased buying interest, indicating that the stock may continue to rise. Investors and traders should consider taking a long position in Infosys within the price range of ₹1,385 to ₹1,456. The target for this trade is an upside of ₹1,575, with a stop loss set at ₹1,375 on a daily closing basis to manage risk.

Sumitomo Chemical India (NSE: SUMICHEM)

LTP: ₹462.9

Buying Range: ₹460 – ₹470

Target Price: ₹495

Stop Loss: ₹425

Upside Potential: 7%

Sumitomo Chemical India has shown strong potential despite recent declines. The stock is currently trading near its 200-day exponential moving average (DEMA), a crucial indicator of long-term trends and support. Technical analysis reveals a bullish crossover in the daily Moving Average Convergence Divergence (MACD) indicator, suggesting a potential upward trend reversal.

Additionally, a bullish bat pattern has appeared on the weekly chart, indicating that the recent downtrend may be nearing its end. These combined indicators suggest a favorable buying opportunity. Investors should consider entering long positions within the price range of ₹460 to ₹470, with a target of ₹495 and a stop loss at ₹425 on a daily closing basis.

MTAR Technologies (NSE: MTARTECH)

LTP: ₹1,800.95

Buying Range: ₹1,780 – ₹1,853

Target Price: ₹2,250

Stop Loss: ₹1,742

Upside Potential: 25%

MTAR Technologies has experienced significant volatility, with a sharp downturn from its peak of ₹2,920. However, the stock has found stability within the ₹1,800 to ₹1,900 range, forming a solid support base. A bullish divergence on the daily MACD scale indicates weakening downward momentum and a potential reversal.

Given these technical developments, investors should consider buying MTAR Technologies within the ₹2,100 to ₹2,150 price range. The target for this trade is an upside of ₹2,250, with a stop loss set at ₹1,742 on a daily closing basis to protect against further declines.

Shriram Finance (NSE: SHRIRAMFIN)

LTP: ₹2,385

Target Price: ₹2,670

Stop Loss: ₹2,270

Upside Potential: 12%

Shriram Finance has taken support near the long-term trendline zone at ₹2,270 levels. After a short period of consolidation, the stock has formed a bullish candle on the daily chart, indicating a potential rise. The RSI is gradually rising, signaling a trend reversal with significant upside potential.

With a positive chart outlook, investors should consider buying Shriram Finance for an upside target of ₹2,670, keeping a stop loss at ₹2,29=70.

Fertilizers and Chemicals Travancore (NSE: FACT)

LTP: ₹672.6

Target Price: ₹790

Stop Loss: ₹650

Upside Potential: 17%

Fertilizers and Chemicals Travancore has shown a gradual rising trend, taking support near ₹670. A bullish candle formation with substantial volume participation on the daily chart strengthens the bias. The RSI is well-placed and gradually rising, indicating a trend reversal with significant upside potential.

Investors should consider buying FACT for an upside target of ₹790, with a stop loss set near ₹650.

Chennai Petroleum Corporation (NSE: CHENNPETRO)

LTP: ₹915.40

Target Price: ₹1,075

Stop Loss: ₹900

Upside Potential: 17%

Chennai Petroleum Corporation has formed a higher bottom on the daily chart, taking support near ₹830 and witnessing a decent pullback. The RSI is well-placed and indicates a trend reversal, signaling a buy with substantial upside potential.

Investors should consider buying Chennai Petroleum Corporation for an upside target of ₹1,075, keeping a stop loss at ₹900.

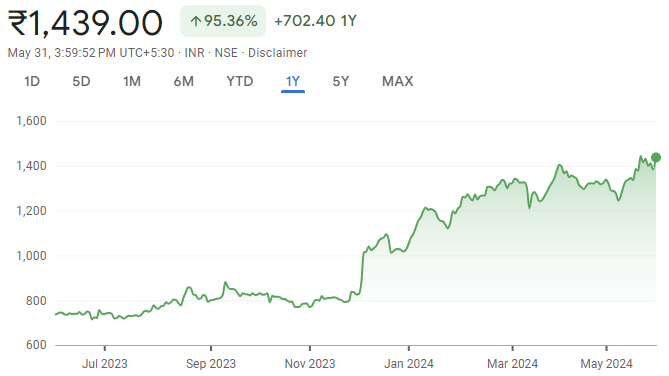

Adani Ports and Special Economic Zone (NSE: ADANIPORTS)

LTP: ₹1,439

Buying Range: ₹1,410 – ₹1,450

Target Price: ₹1,585

Stop Loss: ₹1,360

Upside Potential: 10%

Adani Ports has broken out above the consolidation zone of ₹1,224 to ₹1,400 on the weekly chart, with a strong bullish candle indicating the continuation of the uptrend. The stock has established a support base at ₹1,188, holding above the 38% Fibonacci retracement level of the rally from ₹395 to ₹1,425.

The weekly RSI has given a crossover above its reference line, generating a buy signal. Investors should consider buying Adani Ports within the ₹1,400 to ₹1,372 range, targeting ₹1,542 to ₹1,585, with a stop loss at ₹1,308.

Whats Ahead for Nifty?

Looking ahead to June, the trajectory for the Nifty 50 appears cautiously optimistic but will hinge largely on the outcome of the Lok Sabha elections and subsequent economic policies. With exit polls predicting a solid win for the BJP-led NDA, there’s a prevailing sentiment that the political and economic environment will remain stable, which typically fosters positive market movements.

If the election results align with these predictions, we can expect a continuation of pro-growth policies and possibly new reforms, which would reassure investors and could drive the Nifty 50 towards the upper end of the current analyst predictions.

Investors should also keep a close eye on the Reserve Bank of India’s monetary policy meeting in early June. The central bank’s stance on interest rates and liquidity management will provide further clues about the economic outlook.

What are the Best Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

This Time is Different: Marcus Templeton said this phase was costly in 1933, but here is when it may be true

‘The investor who says, “This time is different,” when in fact it’s virtually a repeat of an earlier situation, has…

The Canadian Securities Exchange is buying the NSX! So will Australia finally get a legitimate second exchange?

The big news for Australian investors this week isn’t rate cuts or what Trump may or may not do on…

RBA Cuts Rates Again: Which Sectors Are Set to Benefit Most from This Decision?

The Reserve Bank of Australia (RBA) has recently cut the official cash rate by 25 basis points, marking the latest…