BHP or RIO Tinto? Which of these 2 resources giants is the better investment and which one has upside?

![]() Nick Sundich, May 27, 2024

Nick Sundich, May 27, 2024

BHP or Rio Tinto? Choosing between these two major miners is no easy feat. In this article, we take a brief look over both companies and make our own choice.

Who are these two companies?

Both of these companies are major mining companies that operate all over the world. BHP is the largest ASX company, capped at A$230bn, while Rio Tinto is third at $190bn. For those who were wondering, the second company is CBA (ASX:CBA) which is just over $200bn.

Among the commonalities between BHP and Rio, these companies:

- are ahead of the ASX’s performance in the longer-term,

- Haven’t been immune from ESG scrutiny, environmental and cultural mishaps, not to mentionCost inflation and commodity fluctuations,

- Are always on the look out for new opportunities, entering into farm-in agreements with small-cap companies that own promising projects and engaging in M&A activity; and

- Are heavily exposed to macroeconomic trends and geopolitical tensions. In particular, they have fluctuated in conjunction with fortunes in the Chinese economy, with Beijing being a major iron ore customer.

How do they differ?

But where these two companies differ boils down to their commodities.

BHP’s key commodities are iron ore, metallurgical coal, and copper, accounting for 96% of revenues. It was exposed to oil and gas but sold its portfolio to Woodside (ASX:WPL) in 2022. In FY23, it made US$53.8bn in revenue and a US$12.9bn profit. These figures may seem impressive but were down 17% and 58% respectively due to lower commodity prices. BHP produced 1,717kt copper, 257Mt of iron ore and 29Mt coal. Of these, iron ore derived the most revenues ($24.8bn).

Rio Tinto’s portfolio is far more diverse, but the three key commodities are iron ore, aluminium and copper. It is the first of these that is most important to the company, as it produced 331.8Mt from the Pilbara alone. On a group-wide basis, Rio made US$54bn in revenue (US$32bn of which was from iron ore) and a US$10.1bn profit during CY23. It paid out 60% of its underlying earnings as a dividend, equating to US$4.35 per share.

BHP or Rio Tinto? Which one is the better long-term performer?

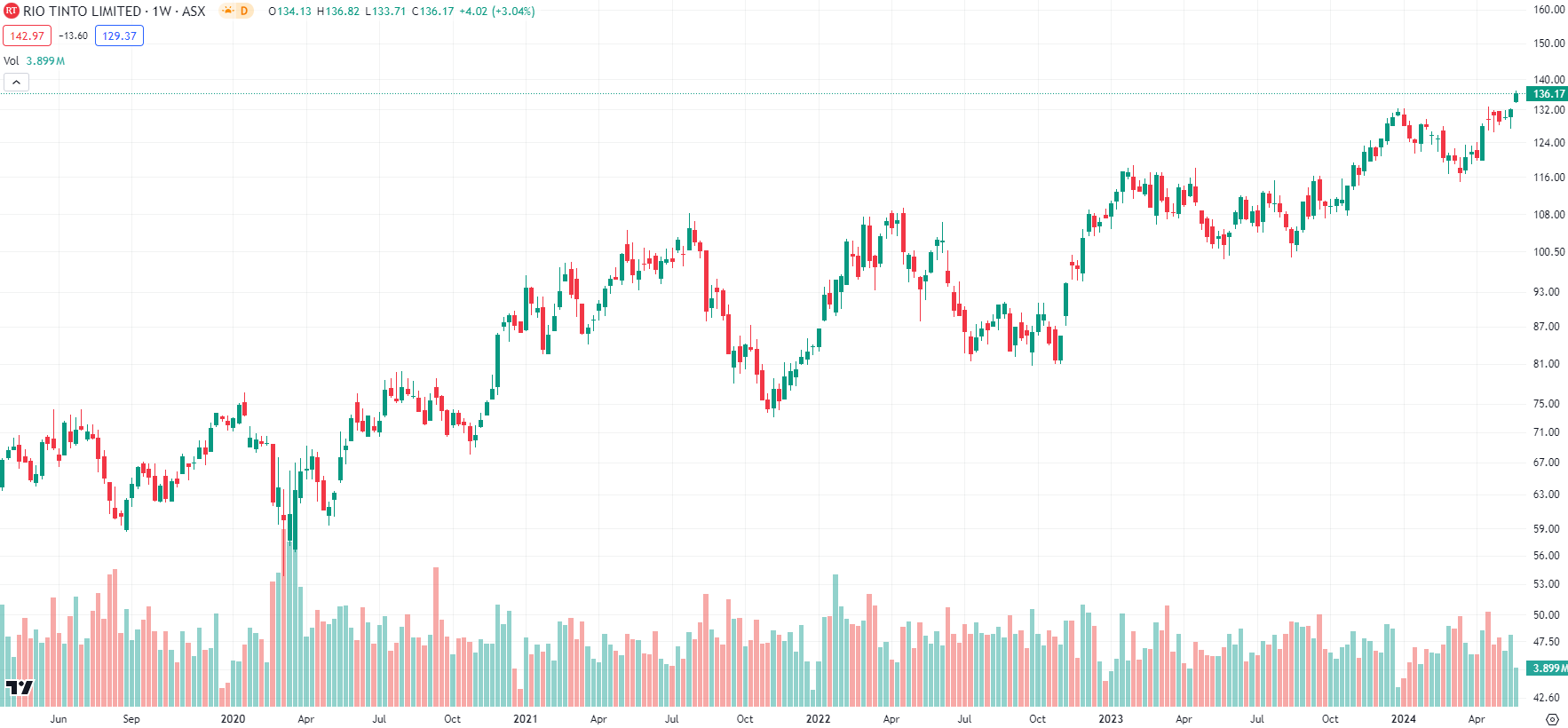

It is Rio Tinto, with a 24% 12-month return and a 34% 5-year return.

Rio Tinto (ASX:RIO) share price, log scale (Source: TradingView)

Looking at BHP, it is only up 6% in one year and 23% in 5 years.

BHP (ASX:BHP) share price chart, log scale (Source: TradingView)

Why is this so? This is highly debatable, although there are a few reasons why:

- BHP appears to be prioritising investment over shareholder returns (i.e. dividends). Just look at its attempts to buy Anglo American and persist despite being repeatedly rebuffed by Anglo’s management.

- BHP’s exposure to coal and nickel has particularly impacted its top and bottom lines. In its 1HY24 results, it had to write down its WA Nickel assets by US$2.5bn. To be fair, it is not the only nickel company that has had to make 10-figure write downs, but Rio has no exposure to nickel, or coal.

- Rio is unique in not just having exposure to aluminium, but having an established business. This commodity has been less volatile in the past couple of years compared to copper and iron ore, is the most common metal on Earth, and just as useful as copper, but more recyclable and lighter.

Which one has the better future?

At first glance, neither. Both stocks are covered by dozens of analysts across their multiple listings, and the mean 12 month target price is 3-5% below their current prices on all the exchanges. We think analysts are not optimistic about commodity prices.

However, we noted the points above about Rio and add into the mix that it is the ‘cheaper’ stock at 10x P/E for FY25, and having a market cap of over A$40bn less than BHP. So even if neither stock is facing a substantially better outlook than the other, investors may lean towards Rio Tinto given everything above.

What are the Best ASX Mining Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…