Bio Gene Technology (ASX:BGT): Commercialising a new class of insecticides

![]() Nick Sundich, September 9, 2024

Nick Sundich, September 9, 2024

Bio Gene Technology (ASX:BGT) ASX-listed AgTech company developing two compounds – Flavocide™ and Qcide™ – as insecticides. Investors may hear the word insecticide and think that Flavocide™ and Qcide™ are just another couple of consumer insect sprays (such as Mortein) and wonder whether the market really needs it. How can Bio Gene’s compounds stand out from the intense competition?

The simple answer is because both are superior to existing solutions and are less toxic.

What are Flavocide™ and Qcide™

Flavocide™ is based on a naturally occurring compound, flavesone, but produced synthetically. Flavocide™ has a unique mode of action not present in any other commercial product today, one that specifically addresses insecticide resistance. The fact that resistant pests have not encountered any other marketed insecticide that is able to overcome their resistance bodes well for how Flavocide™ will work.

Various efficacy studies have been undertaken, including through the University of Technology in Sydney and Purdue University in America that demonstrated Flavocide™ has great efficacy and can control a variety of pest species resistant to currently available chemical products. This includes mosquitos at both the adult and larvae stage and species that are responsible for several of the most dangerous vector diseases including (but not limited to) Yellow Fever, Malaria, Zika and Dengue Fever.

Meanwhile, Qcide™ is a botanical oil product containing several compounds with tasmanone as the major component. It is extracted from the leaves and branches of a rare Australian eucalypt cultivar selected by BGT, the Gympie Messmate, by utilizing a steam distillation process. Eucalyptus cloeziana trees are currently being grown in plantation farming systems by sub-contractors in Far Northern Queensland.

Like Flavocide™, Qcide™ too has undergone a range of research collaborations involving some of Australia’s leading academic and research institutions. These are not just focused on demonstrating efficacy of the product against pests, but also how to deliver process improvements in relation to tree growing plant propagation, tissue culture, chemistry analysis and oil extraction. This will ultimately ensure BGT can deliver a product that can meet the stringent demand of end markets.

The mission of Bio Gene Technology (ASX:BGT): Commercialising a new class of insecticides

Even with insecticides on the market today, this has not eradicated the problems that insects can cause – particularly in public health and agriculture – let alone prevented these problems from worsening. Problem insects in general are becoming more abundant due to climate change and are increasingly resistent to products currently on the market today. To illustrate with a couple of examples:

- 40% of the world’s crops are lost to pests every year, equivalent to over 1.3bn tonnes of food; and

- Vector-borne diseases account for over 17% of all infectious diseases globally and cause over 700,000 deaths annually.

There is an urgent need insecticide solutions to come to market, that are more effective than today’s solutions. And not just any new products, but those with new and unique Modes of Action that are not present in existing insecticides. The last time an entirely new class of insecticides was commercialised occurred in 2008, when Japanese chemical producer Nihon Nohyaku commercialised the first Diamide product. This insecticide class rose to US$1.5bn in global sales within five years and has maintained a double digit market share ever since.

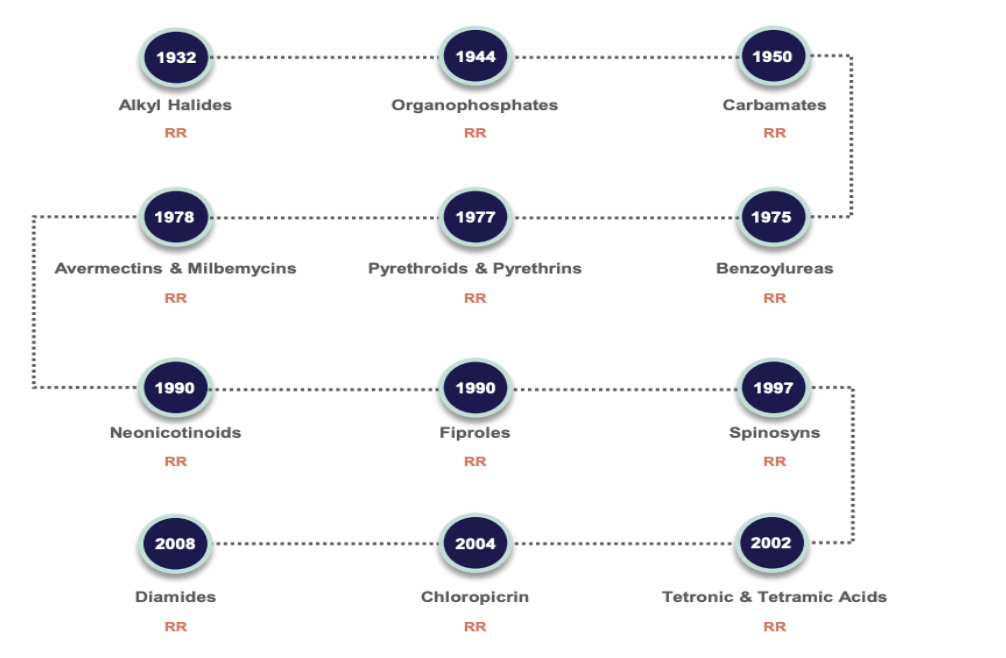

The figure below provides a rough 9-decade history of classes of insecticides that have been discovered. Some of these remain popular to this day. For instance, Organophosphates still generate over US$1.7bn per year. However, insects gradually develop resistance over time, thereby requiring a need for new classes to come to market

Source: Company

Although BGT has some way to go before it can commercialise its products, this occurrence would again represent a new class of insecticides because there are no beta-triketone insecticides on the market today. Flavocide™ and Qcide™ would not just be another pair of insect sprays amongst dozens on the supermarket shelves, it would represent a completely unique new range of products with mechanisms not existing in the market today.

A US$31bn Total Addressable Market

Bio Gene is targeting five key markets that represent a Total Addressable Market (TAM) of over US$31bn: Public Health, Grain Storage, Crop Protection, Animal Health, and Consumer Applications.

Source: Company

The largest of these is Crop Protection, that includes Grain Storage, which accounts for just over 52% of the market opportunity. Insects and pests can impact production of grain and crops and end-product quality. Grain and crops infested with or damaged by insects are essentially worthless in the end market. The problem is becoming increasingly accentuated because of insect resistance, but also because some insecticides can adversely impact beneficial insects such as bees and parasitic wasps that can be positive for crop production.

Public Health, Consumer Applications and Animal Health are also important markets for BGT because of the diseases that pests (particularly mosquitos) can cause to people and animals (both domestic pets and production livestock). Pest diseases are expected to become worse due to climate change, increasing urbanisation, the world’s growing population and (again) the resistance of insects to existing solutions on the market.

Making progress

While BGT is still at the development stage, it is engaged in several collaborations (including, programs with Envu (ex-Bayer Environmental Science) and Clarke Mosquito Control) that have developed into commercial agreements and are providing further evidence of the superiority of the company’s products.

Earlier in September 2024, BGT achieved pilot-scale production of Flavocide™ in conjunction with Rallis India, a major Agri-sciences company and subsidiary of Tata Chemicals – showing Flavocide™ can be produced at a consistent quality and yield at precommercial scale. BGT aims to file its application for its first regulatory approval for Flavocide™ Active Ingredient with the Australian regulator (APVMA) at the end of CY25, with a regulatory approval target for mid-CY27.

Pitt Street Research finds there is significant upside

Our friends at Pitt Street Research have covered the company since February, and published its latest note on Bio-Gene this morning. It has valued the company at $31.8m in a base case and $42.8m in a bull case on an Enterprise Value basis. Accounting for the current number of shares on issue and the company’s cash balance, these figures equate to 16.9c per share and 22.3c per share respectively. These are significant premiums to the current share price.

Conclusion

Bio-Gene Technology is an exciting company, seeking to commercialise an entirely new class of insecticides. This feat has not been accomplished by any company since 2008, but history suggests there could be a massive payday if the company can pull it off.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Apple’s iPhone Production in Focus: Is the Tariff Pause Enough to Ease the Pressure?

Apple, one of the largest and most influential tech companies in the world, is no stranger to the fluctuations of…

Why travel shares are getting slammed…and it is not for the reasons you may think

Just when ASX travel shares were out of the COVID-19 doldrums (in that some surpassed their pre-COVID highs), 2025 looks…

Capital Gains Tax on Stocks: Here’s what you need to know

Investors may be liable to pay Capital Gains Tax on Stocks, but may not know the nuances of how it…