Investors are wrong about Blackstone Minerals’ (ASX:BSX) Ta Khoa project, but here’s why big things are coming in the next 6 months

![]() Nick Sundich, November 12, 2024

Nick Sundich, November 12, 2024

Blackstone Minerals (ASX:BSX) and its Ta Khoa project have been misperceived by investors. You’d be forgiven for thinking BSX is an exploration company first with processing and refining facilities as a side-hustle. In reality, it is a processing and refining company first, and while it has an underground mine, this mine will provide a tiny portion of minerals that will be processed. And although the journey has been longer and more difficult than had arguably been expected, we think the journey could be about to make a turn for the better.

Nicholas Sundich, analyst at our parent company Pitt Street Research, visited Ta Khoa last month and shared his insights in a note published earlier this morning. We recap the insights shared in his report.

Recap of Blackstone Minerals (ASX:BSX) and Ta Khoa

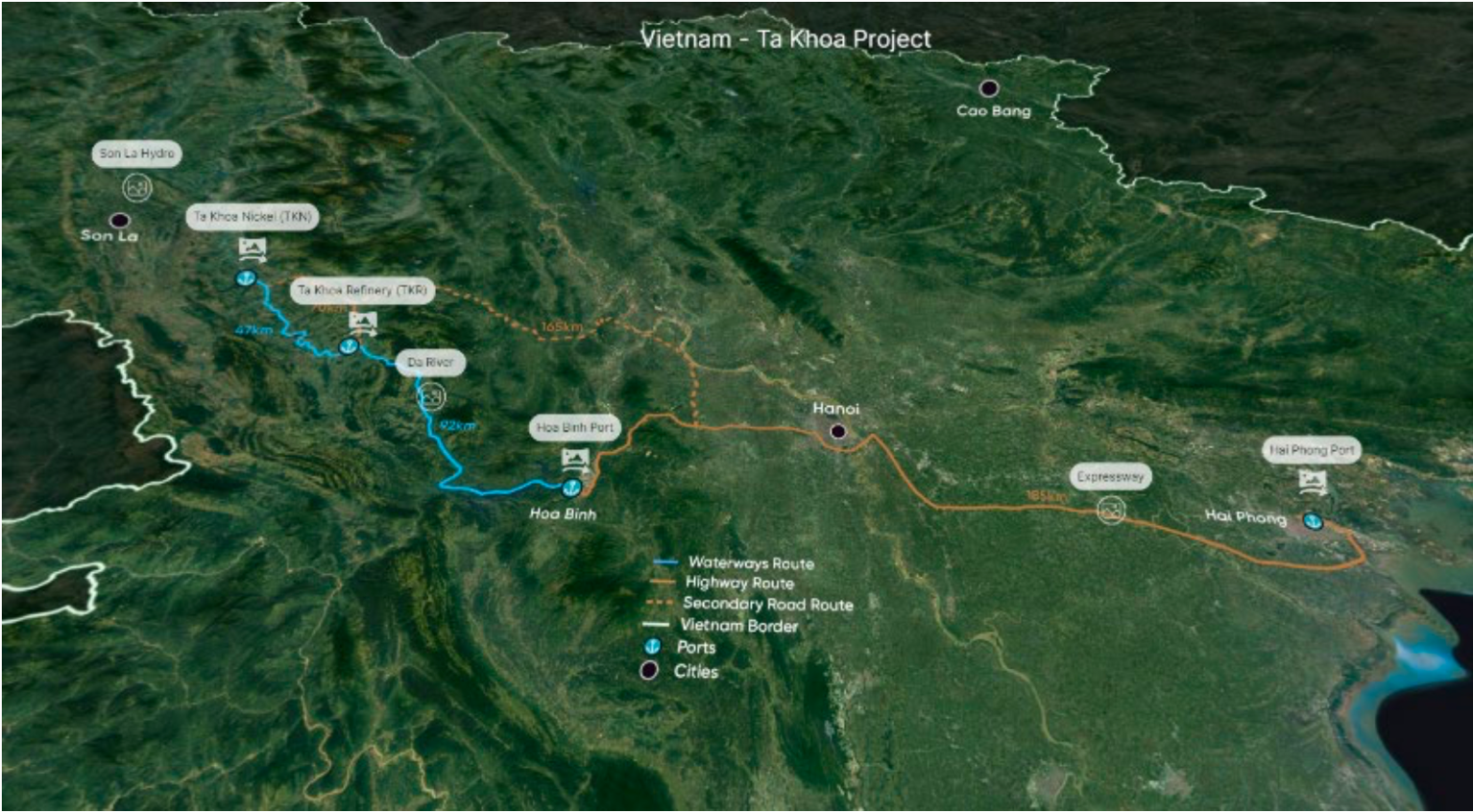

The Ta Khoa Project is 180km west of downtown Hanoi and 55km from Son La, the provincial capital. Blackstone has the following facilities in the area:

- Ta Khoa Nickel (TKN), the nickel deposit accessed via an underground mine – Ta Khoa has an Indicated Mineral Resource of 102Mt grading 0.38% nickel, and an Inferred Resource of 28Mt grading 0.36% nickel for a total of 130Mt at 0.37% nickel;

- The Ta Khoa Refinery (TKR) which currently hosts a pilot plant,

- A core shed with all 130,000 metres of core drilled at the project and

- The ‘Blackstone Mining Information Centre’: A project site with workers accommodation. There are individual rooms, as well as a dining hall, a meeting room for hosting visitors as well as company meetings, as well as a soccer field and volleyball court.

Source: Company

The bulk of Ta Khoa Nickel is at one of the four deposits – at Ban Phuc. Ban Phuc is an underground mine accessible from the surface. Immediately adjacent to Ta Khoa Nickel is a Pilot Plant, a Concentrate Shed and a Concentrator.

These facilities do not comprise of the Ta Khoa Refinery (TKR) – this will be a new development and the full-scale operation that the PFS envisioned. It will still be in the Son La Province but in a different commune – the Bac Phong Commune in the Phu Yen District (Figure 10). It will be adjacent to the Da River which will connect it to the company’s other facilities and make transportation to the end ports easier. It will also have a reduced community impact with the need for resettlement cut by 70%.

The refined product from Ta Khoa NCM811 is Nickel-Cobalt-Manganese with an 8:1:1 ratio in the battery cathode. This is to say: 80% nickel, 10% cobalt and 10% manganese. NCM batteries in general are just one type of batteries that can be used – Nickel-Cobalt-Aluminium (NCA) are one other example. But NCM811 are becoming increasingly popular given they can store more energy and reduce the overall weight of the end-product. Both these properties will result in more operating time and lower maintenance costs.

At full capacity, TKR will produce over 700,000 tonnes of residue. The company has identified an opportunity to utilise this to build bricks. With 730,000 tonnes of residual per annum, along with 96,000t of sand and 136,000t of cement, this could lead to 19.2M bricks per annum.

Source: Company

Ta Khoa is compelling

The 2021 PFS for TKR generated compelling economics. These were headlined by a 67% IRR in the Base Case and 98% in the so-called Spot Case, that utilised commodity prices applicable at the time of the study. It anticipated US$451m in average annual operating cash flow and US$4.5bn in the 10-year life of the project. The post-tax NPV (using an 8% discount rate) was US$2bn.

The 3 upcoming catalysts to look for

There are 3 catalysts for investors to look for in the next 6 months. The first is the release of a Definitive Feasibility Study (DFS) for the project. When the DFS is released, investors should see that the project still stands up economically and the next two catalysts will be closer.

Second, the granting of an Investment Certificate. This will in effect be the all clear from regulators. The DFS will be key to the granting of an Investment Certificate, because the certificate will be limited to the amount that a company has applied for. The company already has had Ta Khoa integrated into Vietnam’s National Mineral Master Plan and obtained Reserve Council Approval. The company had to submit reserves to authorities, who then undertake a thorough review of the the company’s case (i.e. visiting the site and doing their own lab tests).

Third and most important will be a potential offtake/investment deal for the project. In particular investors need to look for BSX to exercise the option to acquire 100% of the Wabowden nickel sulphide project in Manitoba Canada as this option has a deadline to be exercised early December. The company told investors at the time the deal was announced that this would remove its need to secure third-party feed to fill the refinery for decades, because the Ta Khoa Mine would not be enough. And Wabowden actually has a resource more than double that of Ta Khoa.

If these 3 happen, we expect investors’ perceptions on the company to change completely.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Xero (ASX:XRO) delivered another stellar result in FY25, but is there further upside? Here are 3 reasons why we think it does

Xero (ASX:XRO) is one of the ASX’s best-performing tech stocks over the last decade, offering accounting software helping SMEs do…

Cleanaway Waste Management (ASX:CWY): Is its $5.9bn price right or a load of rubbish?

This week’s Australian stock of the week is Cleanaway Waste Management (ASX:CWY). Capitalised at $6bn, it is Australia’s biggest waste…

Investors are excited about Core Lithium’s planned re-start of Finniss! But here’s why they’re overreacting

Core Lithium’s (ASX:CXO) planned re-start of Finniss has got plenty of investors excited. Shares closed yesterday 35% higher than the…