What is CAGR and why do listed companies like using it?

![]() Nick Sundich, May 17, 2024

Nick Sundich, May 17, 2024

Although it is not as commonly used by ASX-listed companies, Compound annual growth rate (CAGR), is a growth metric you’ll hear from some entities – especially big companies that have been through significant growth.

What is CAGR?

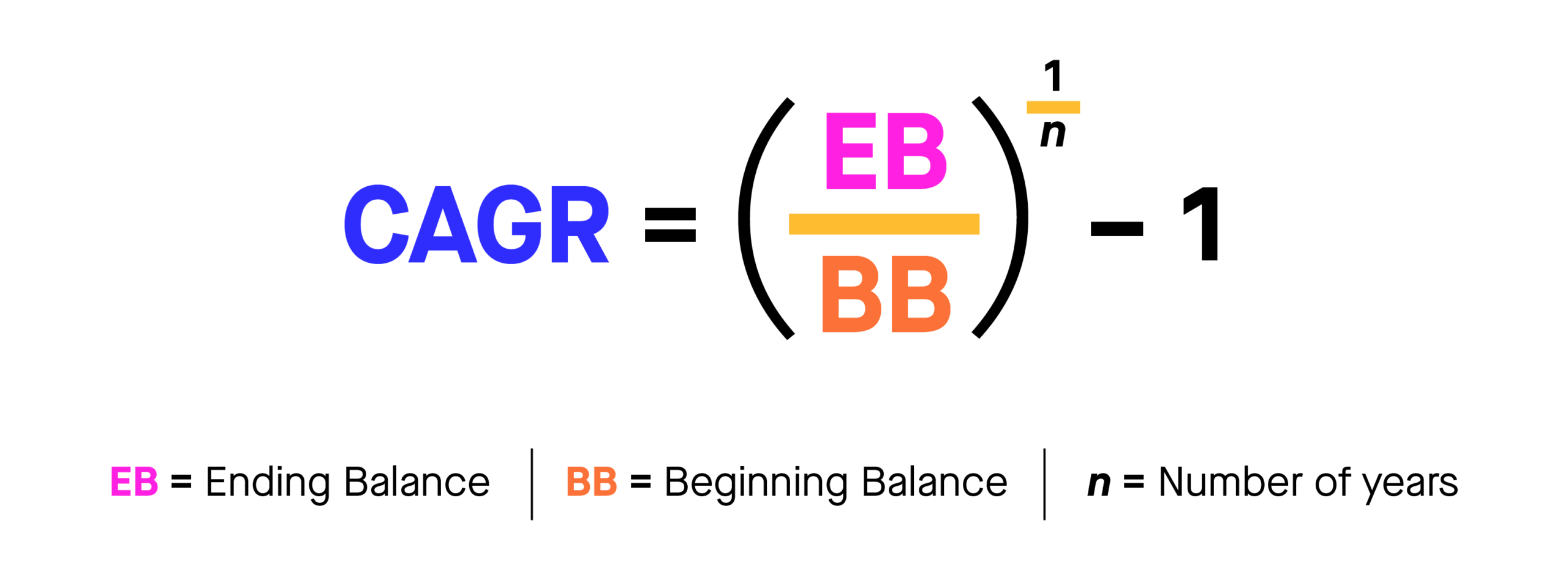

Compound annual growth rate (CAGR) is a business and investing metric used to measure the rate of return that an investment or a portfolio earns on average over a given period of time. CAGR takes into account both the positive and negative effects of compounding interest, providing a more accurate understanding of the average return on the investment.

CAGR is calculated by taking the value of an investment at the beginning and end of an investment period, then dividing its value by its duration over time. This calculation results in a single figure which can be used to compare investments on different timelines and across asset classes. For example, comparing the 10-year CAGR of two different stocks will provide investors and analysts with an easy way to evaluate their performance against one another.

In addition to being used as a benchmark for evaluating investments, CAGR can also be used as a measure of how successfully companies are creating shareholder value. By tracking CAGR over multiple periods, it’s possible to identify trends in corporate performance. This provides useful insight into how well companies are investing capital and managing risk, allowing investors to make more informed decisions when selecting companies to invest in.

Will CAGR be higher than regular percentage growth?

Yes, CAGR (Compound Annual Growth Rate) tends to be higher than regular percentage growth due to its ability to account for the compounding effect of multiple periods. Compounding means that each period’s gain is added to the total gain from previous periods, resulting in a larger overall change. Therefore, CAGR can accurately reflect the financial growth of an entity over a given time period.

For example, let’s assume an initial investment of $100 has a growth rate of 10% per year for five years. If we look at the regular percentage growth rate, we will see that after five years the amount would be $150 – a 50% increase. However, if we look at the compound annual growth rate (CAGR), which factors in compounding effects from previous years, we can calculate that after the same five-year period our investment would have grown to $161.05 – a 61.05% increase.

The bottom line is that CAGR tends to be higher than regular percentage growth because it takes into account compounding effects and therefore provides a more accurate assessment of financial performance over time.

Why do companies like using it?

ASX companies like to use CAGR (Compound Annual Growth Rate) to demonstrate performance to shareholders for a few reasons. Firstly, this metric gives a better indication of how well the company has grown over time because it provides an average growth rate across multiple years. This allows shareholders to see consistent growth over time instead of just isolated spikes or dips in performance from one year to the next.

CAGR also shows the shareholders how much their investments have grown in value since they began investing with the company. It is especially useful for companies that have experienced volatile periods or large changes in their share prices, as it allows them to compare their current performance with past performance and understand how long-term investments may have benefited them.

Finally, CAGR helps investors and analysts accurately forecast future performance by providing a more reliable measure of expected returns than traditional percentage growth methods. With this information, stakeholders can make informed decisions about whether they should invest in the company or not by looking at projected returns based on current trends and expectations.

So, is CAGR good or bad?

In our view, CAGR is useful because it smooths out volatility by providing investors with one simple figure they can use to compare different investments or assets across multiple time periods.

It also eliminates the need for complex calculations such as compound interest or geometric mean returns, since it enables investors to focus their attention on one key metric without having to worry about fluctuations in market returns or other external factors which could affect their analysis.

Look at the broader picture

Nonetheless, as with any other investing metric, it should not be the sole factor investors use to make decisions. Investors need to consider why the company has been growing and whether or not this growth can continue.

They should look at the company’s audited accounts, analyst reports and further research of their own about the company and the market it serves. Because after all, you won’t hear about a company’s CAGR figures if they’re bad or if there’s no hope of the growth continuing in the future!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

How US Gold Tariffs Could Impact ASX-Listed Gold Stocks

Gold has always been more than just a metal; it’s a barometer for economic uncertainty, a safe haven in times…

JB Hi-Fi’s 18-Month Rally: Can the Bull Run Keep Going?

JB Hi-Fi’s share price has been on a tear over the past 18 months, climbing by more than 80% and…

Why Gold, Lithium, and Iron Stocks Are Soaring—4 ASX Miners Leading the Turnaround

The Australian resources sector is back in the spotlight, with gold, lithium, and iron ore miners delivering standout gains in…