Calmer Co (ASX:CCO): It’s the only ASX stock in the fast-growing kava space!

If you haven’t heard of kava before, you probably haven’t heard of Calmer Co (ASX:CCO), but you’ll be hearing a lot more about both in the years ahead. Calmer Co, once named after its flagship Fiji Kava brand, is the only ASX-listed company in the kava space.

Kava is a beverage in the South Pacific derived from Indigenous plants. It has traditionally been confined to the Pacific Islands but has been growing in popularity around the world because of its sedative, anaesthetic and euphoriant properties.

It has grown in popularity for many reasons including destigmatisation of it in Western countries, growing awareness about mood and health benefits that can be derived from it not to mention the lifting of long-standing prohibitions on imports.

This time it is different for Calmer Co

‘Sounds good’, you might say,’ But haven’t we heard this all before?’ This company has been listed since 2018 and did not have success in the earlier years. Its original approach was to focus efforts on attempting to sell Fiji Kava products via Chinese cross border channels, coupled with unprofitable sales at Chemist Warehouse in Australia under a distribution agreement announced in April 2021. This approach failed to deliver shareholder value – there’s no shying away from that fact.

But things have improved in the past few years through several initiatives that focused on profitable sales and distribution agreements, not to mention increased product innovation and liberalisation.

Until December 2021, the company was only able to import products as complimentary medicines, but it obtained approval to import drinking kava into Australia under the Kava Pilot Importation Program facilitated by DFAT.

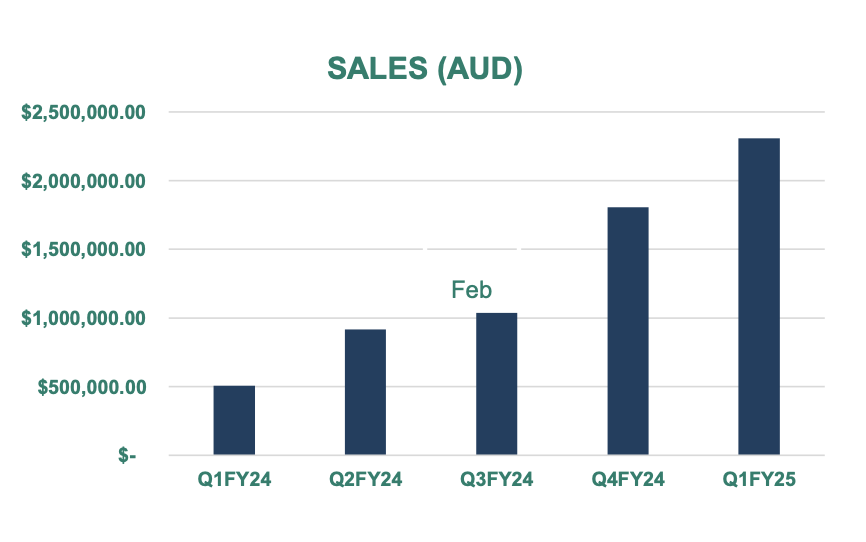

Good marketing has resulted in substantially rising sales all throughout FY24. In the June 2024 quarter sales were A$1.8m as opposed to just $0.5m in the September 2023 quarter. On an annual basis, the company recorded $4.3m in FY24, up 139% from the year before.

Source: Company

FY25 has begun on a solid note with 2.3m in sales reported in Q1 already surpassing half of the FY24 sales in one quarter, a 28% increase on the prior quarter and a more than 300% increase on the prior corresponding quarter. This strong growth trajectory potentially puts The Calmer Co. on the path to being cash flow break even in FY26. Moreover, the company has built up a customer database of >50,000 people and has turned many of them into paying customers.

There’s more growth to come

How will the company continue to grow. We see three drivers of mechanism. First, a growing awareness of the health benefits of kava, particularly to aid conditions such as anxiety and insomnia.

The increasing acceptance around the world of cannabis in medicine, after so many decades of its stigmatisation, suggests that kava could have a similar path. But while the cannabis market is intensely competitive with several players, Calmer Co is one of the few companies globally that is in this space, already has products on the market and a significantly large moat.

Second, new products and in new jurisdictions. The company has indicated future products that could grow sales in the future. One of these is flavoured kava shots which are under development for launch in the USA. Another is flavour enhancing boosters (beginning with Mango and Peach). These are currently launching in Australia alongside kava drinking accessories including a cordless kava blender.

The Calmer Co. believes that Europe and the US are important markets, the former once the import ban comes off. Interestingly, kava as a social beverage is very popular in the US. The Calmer Co. estimates that there are now more than 450 kava bars in America, with a significant concentration in the state of Florida. A good example of a kava bar is Miami Kava & Coffee, which has three bars in the metro area of that city.

And third, the potential for kava to take a market share for alcohol, as consumers turn to low and no alcoholic beverages. This is a US$11bn market according to the IWSR, the benchmark data source for the alcoholic beverage industry.

Consider the following facts about kava, some of which we have already considered:

-

- It is already a drink for special occasions in the Pacific Islands and amongst Pacific Islander peoples who have migrated to other countries (when and where kava importation has been permitted of course),

- Consumers are seeking beverages that support their wellness goals. Kava has relaxing properties, but without the negative side effects of alcohol,

- Drinking kava offers the chance for consumers to be more culturally aware by experiencing another culture, and

- The ways for consumers to access Kava products (Calmer Co.’s and others) is continuing to grow. There are an increasing number of ‘kava bars’ in Western jurisdictions. Specifically, over 240 in the USA and a handful in Australia11. Moreover, products are available in supermarkets (Calmer Co.’s are in Coles).

For all those reasons, we see a big opportunity for kava to obtain a market share in the low to no-alcohol beverage market. And Calmer Co., as one of the leading kava companies and an aspirant to become the most dominant kava company in the world, would be poised to benefit.

Our friends at Pitt Street Research released an initiation note on the company this morning. The report Calmer Co at $56.1m in a base case scenario and $72.5m in an optimistic (or bull) case scenario – equating to 1.8c per share and 2.4c per share respectively under the current number of (diluted) shares on issue. We encourage investors intrigued to find out more about the company to read the report.

Conclusion

It is commonly said that the most dangerous words in investing are ‘this time it’s different’ – a phase coined by Sir John Templeton. But Calmer Co’s performance in the past couple of years compared to the preceding half-decade show that it really is different.

Calmer Co has always been a market leader in the kava space, but is seeing rapidly growing sales in Australia and internationally. Moreover, it has several tailwinds that could spur further growth in the future.

Calmer Co is a research client of Pitt Street Research. Pitt Street directors own options in the company.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…