Capricorn Metals (ASX:CMM): Its sequel gold mine will be even better than the original

![]() Nick Sundich, May 21, 2024

Nick Sundich, May 21, 2024

Capricorn Metals (ASX:CMM) is one of several gold miners on the ASX that has slid under the radar of many investors, but delivered spectacular returns to those who took the gamble. In the last five years, it has gained over 900%, all thanks to one gold mine in WA. And the company is about to bring a second mine into production, that could be even better than the original one.

Capricorn Metals (ASX:CMM) share price chart, log scale (Source: TradingView)

How Capricorn Metals (ASX:CMM) reached its riches

Capricorn Metals’ flagship project is the Karlawinda Gold Mine, near Newman in WA’s Pilbara. The deposit was discovered by IGO (then known as Independence Group) back in 2008 and Capricorn bought it in 2016. It entered production in the middle of CY21 (right on June 30) on time and on budget. Prior to entering production, the plan was for it to be a 100-120,000 ounce a year mine. So far so good, it has produced over 120,000 ounces from the former alone in FY23, at a ASIC of US$1,208/oz.

The irony is that this company was close to throwing this all away. Regis Resources tried to buy Capricorn in 2018 but was unsuccessful. Perhaps for the better, because the bid was only 11c per share. Ironically, Capricorn’s board was for it, but major shareholder Hawke’s Point indicated opposition to the proposal. We digress.

A money pit…in a good way

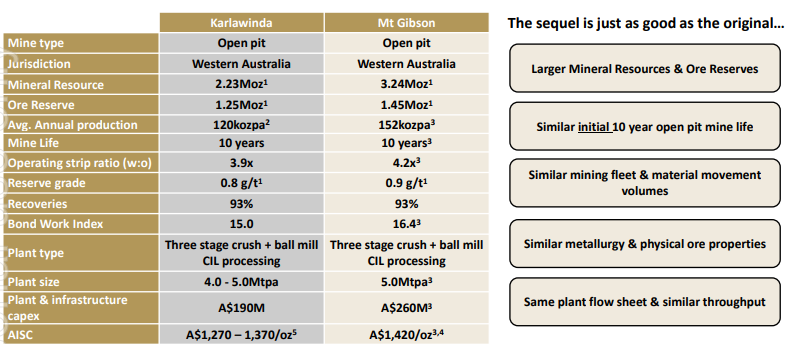

Karlawinda is an open pit mine that is anticipated to last another 10 years and possesses 1.25Moz Ore Reserves and 2.23Moz Mineral Resources. This does not account for the prospect for further discoveries at the project, which could enable a mine life extension. In the 2.5 years to December 31 2023, the company produced nearly 300,000 ounces with $386m operating cash flow. It made $85m+ profits in the last two financial years before a hedge restructure. For FY23, it has issued guidance of 115,000-125,000 ounces production, at an AISC of A$1,270-1,370/oz.

If you thought this all sounds good, wait until you hear about the other trick the company has up its sleeve.

Mt Gibson – a second company maker

Capricorn Metals is hoping to do the same with Mt Gibson, a historic gold mine in the Murchison region of WA that had produced >868koz gold between 1986 and 1999. The project was mothballed for 30 years due to low gold prices in the 1990s – we’re talking A$450/oz – and remained mothballed for 20 years. Capricorn picked it up in December 2021 when it was granted tenure.

Ever since, the company has built up a 1.45Moz Ore Reserve Estimate, with an operation delivering A$1.2bn in free cash flow and with an NPV of A$828m. It anticipates an average of 152kozpa for the first 7.5 years and a full mine life of 10 years. Again, the company thinks it can extend this, given the average pit depth is only 140m.

Think the sequel sounds better than the original? So does the company. The development is fully funded with A$258m banked up to December 2023. Capricorn is hoping to commence production within 12 months of completing the permitting process, which it has just commenced.

Source: Company

What analysts think

There are 7 analysts covering the company and they expect revenue of $354.4m (up 10%) and a profit of just over $100m in FY24, followed by $366m revenue and a $110m profit in FY25. Analysts expect first revenues to flow in FY26, with $410.8m revenue and FY27 to see $744.5m, with a profit nearly double that of FY25. The mean share price is $5.53, a 14% premium to the current share price. Our valuation is $5.26 per share, up 10% from the current price.

Evidently, there is growth potential, but may not be realised for a couple of years unless gold prices continue to rally above and beyond what the market expects. It does not yet pay dividends either, so investors wanting income would be better off in an even larger company such as Newmont or Northern Star.

However, Capricorn Metals could be one to hold for the long-term.

What are the Best ASX Gold Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…