Cincinnati Financial (NDQ:CINF): An Ohio-based P&C insurer that has lifted its dividend an astonishing 62 years in a row!

This week we are taking a deep dive into Cincinnati Financial (NDQ:CINF).

As Stocks Down Under Concierge expands into international shares, we’ll be writing more about them in the coming months – but don’t despair, we won’t be neglecting the ASX. We thought we’d start with a company that we thought was one of the most undervalued shares on Wall St.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Who is Cincinnati Financial?

First of all, we need to clarify that Cincinnati Financial is not one of those regional banks that has been sold off over fears that it’ll go bust as well. In which case, even if you believed it wouldn’t go bust, why not wait until we’re sure the crisis has passed?

No, Cincinnati Financial is a Property & Casualty (P&C) insurance firm based on the outskirts of Cincinnati, Ohio.

It was founded in 1950, has lifted its dividend an astonishing 62 years in a row, and is the 20th largest insurance company in the USA.

The company has over 1,900 agency relationships with 2,786 locations and there are agencies across 46 states. Although it has a focus on lower-margin products, it issues high volumes and takes market share. It has a modest share in most states – Ohio is the most with 4.5%, but it hopes to grow market share over time.

It makes money from insurance premiums and earnings from its float (the large sum of premium income not paid out in claims). Cincinnati Financial endured 13 years of record low interest rates where it had to rely on the latter, but looks to be moving towards the former as insurance premiums grow.

Shareholders have been richly rewarded over that time.

Cincinatti Financial (NDQ:CINF) share price chart, log scale (Source: TradingView)

Risks associated with Cincinnati Financial

We can’t blame investors for being uncertain about the insurance industry. Yes, it might be perceived as a safe haven, but perhaps this company (like its equivalents on the ASX) has three risks.

- It may have to make increased disaster pay-outs due to wild weather conditions.

- Consumers may cutback their spending on insurance as interest rates rise.

- It is at risk if investments underperform

Consensus estimates call for 46% EPS growth in FY23 and 20% growth in FY24. The target price is US$120.50 which represents 25% upside to the June 29 closing price (US$96.64).

So evidently, none of which will be the case. But really?

Let’s address the first point. Cincinnati Financial is more familiar with disasters than its cousins Down Under. Indeed the most recent hit was a US$161m hit from Winter Storm Elliott in 4Q22. But if it had not been for this storm, it was on track for a good combined ratio for the quarter, 2.5% better than the figure for the first 9 months of 2022.

It has 215% investment leverage and its bond portfolio alone exceeds insurance reserves liability by ~7%.

Secondly, its customers love it – 92% of policyholders are satisfied with them. And despite increasing premiums, it has not experienced significant churn.

We will admit that the third is a risk and arguably moreso for Cincinnati Financial because it relies more so on equities – stocks are 43% of its investment portfolio while many other insurers rely predominantly on bonds.

However, its Compound Annual Return is well ahead of the S&P 500 and no individual stock accounts for over 8% of the portfolio. That stock is Apple in case you were wondering. Although the portfolio lost 10.9% in 2022, the S&P 500 lost 18.1%. It also outperformed the S&P500 in 2021, a year in which the S&P500 gained over 28%.

Cincinnati Financial has a US$12.7bn bond portfolio too, that consists bonds from 1,700 issuers – 80.4% of which are rated investment grade.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Vulnerable to a recession?

We will concede that the Cincinnati Financial share price and bottom line might be vulnerable to a recession – its EPS declined during the GFC.

But keep in mind that the bottom line stayed in the black and it is by no means certain that the US will enter a recession, let alone that it’ll be anywhere near as bad as the GFC. Because Australia dodged a recession in 2008, it is easy to forget just how much of a hit it was to the USA – US GDP fell over 4% from peak to trough (at the time the largest decline since World War 2, since surpassed COVID-19).

We think the key reason the US won’t enter a recession, or at least it won’t be as bad as in Australia, is because the bulk of mortgages are at fixed 30 year rates. So while some costs will go up, mortgage interest won’t be one of them for people with existing loans.

And while incentive to get mortgages is lower right now, there’s nothing to stop consumers getting a mortgage now and refinancing two or three years down the track when rates go down.

Why doesn’t Australia have fixed 30-year mortgages? Essentially because there is no Aussie equivalent of Fannie Mae or Freddie Mac – but that’s a topic for another article.

Why would you consider Cincinnati Financial?

Cincinnati Financial is aiming for a 10-13% Value Creation Ratio (VCR) over the next 5 years.

The VCR is an insurance metric meaning the total of growth in book value per share plus the ratio of dividends declared per share to beginning book value per share.

This goal is in line with the 11.2% achieved from 2018 to 2022 (which was achieved in spite of some volatility over that time). Cincinnati Financial thinks there’ll be 3 performance drivers:

- Premium growth above the industry average;

- A combined ratio consistently 95-100%;

- Investment contribution;

We’ve addressed the latter of these above – this company has a diversified investment portfolio.

As for premium growth, it achieved 6% in the first quarter of 2023 and some individual products were even more. In fact, it would be higher but for modest 3% growth in the commercial division as all other divisions were ahead of 6%.

Although Cincinnati Financial saw slowing growth for several quarters and investors feared business interruption losses would be covered by the pandemic, the majority of court rulings have put those fears to bed.

The company hopes to drive continued premium growth through new agency appointments as well as expanded marketing and service capabilities.

Looking to its combined ratio, it is currently 100.7% – 10.8 percentage points higher than 1Q22. We also note that the VCR is 3.1% for 1Q23, within the target on an annualised basis, even though it slipped into negative territory in 2022.

We also note it generated $250m in net cash flow from operating activities in 1Q23, up 26% in 12 months.

Undervalued

As we noted above, consensus estimates call for 46% EPS growth in FY23 and 20% growth in FY24. The target price is US$120.50 which represents 25% upside to the June 29 closing price (US$96.64).

Cincinnati Financial is trading at 1.4x Price to Book (P/B), given its closing share price on June 29 2023 was US$95.55 and its Book Value Per Share is US$68.33.

Not it is not the most undervalued by any means. If this business was liquidated at this price, you could see a return above and beyond its assets. Traditionally a company with a P/B multiple below 1 would be perceived as undervalued.

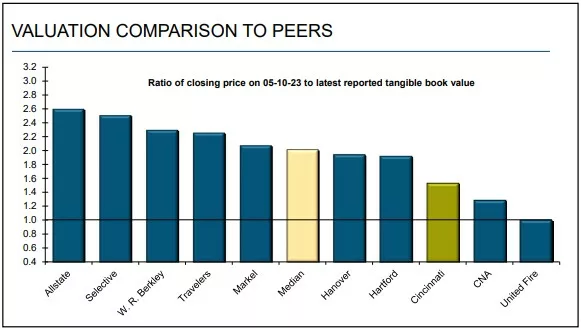

But it trades at a discount to its peers. The consensus estimates price puts it at 1.76x P/B, but even this would be a discount to that of its peers. A P/B of 2x would be US$136.66 – a 43% premium to the current share price.

Cincinnati Financial valuation (Source: Company)

Cincinnati Financial one of many opportunities on overseas markets

Even if you won’t think of Cincinnati Financial again after reading this article, we hope we’ve illustrated that there are countless opportunities on overseas markets – even beyond the big names you might think of (the FAANG stocks for instance).

And so you’ll be hearing more about them from Stocks Down Under over the next few months.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…