Close the Loop (ASX:CLG): Why has the once buoyant metals recycling business halved since its FY24 results?

![]() Nick Sundich, October 28, 2024

Nick Sundich, October 28, 2024

Close the Loop (ASX:CLG) is one of the few opportunities for investors wanting exposure to the waste management industry. CLG listed in 2021 with a market capitalisation of $65.9m, and closed its first trading day with a value of over $100m.

It purported to be, ‘Australia’s most advanced vertically integrated design, manufacturing, collection and recycling company that reduces waste to landfill and gets recycled content back into new products’. The company’s listed life was nuanced…that is, until a couple of months ago.

Close the Loop (ASX:CLG) share price chart, log scale (Source: TradingView)

Close The Loop has been downhill since its FY24 results

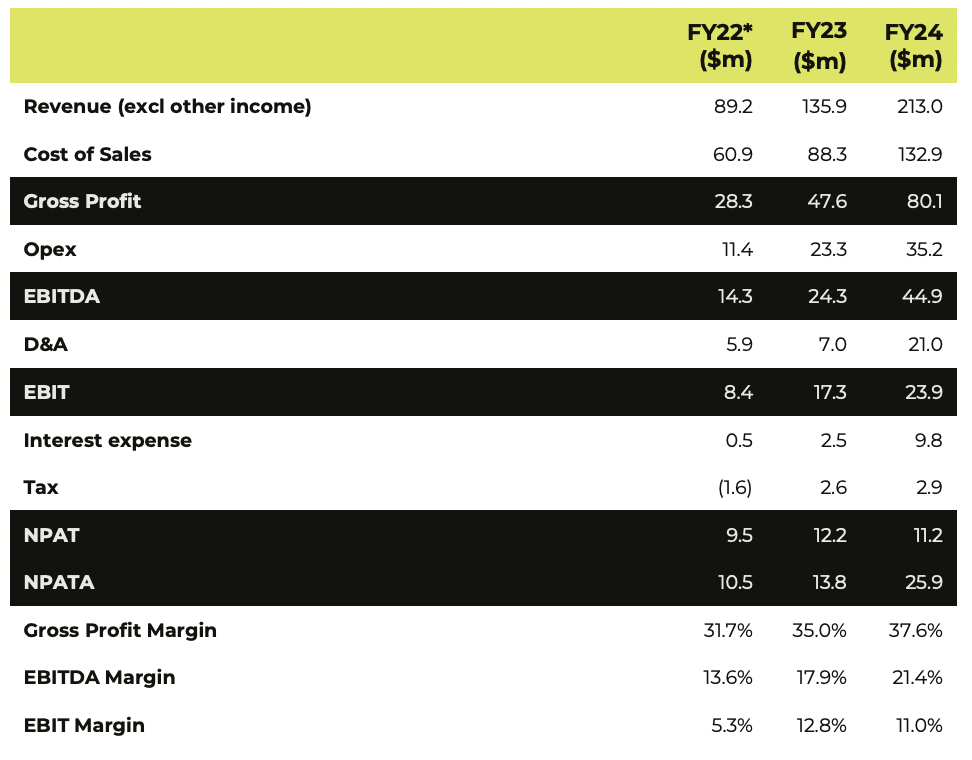

At first glance, what was not to like? We’re not talking about a company like Baby Bunting (ASX:BBN) that faced shrinking margins and intense competition. Nor a company that missed its guidance. CLG met its guidance of $219m revenue and $45m EBITDA, even though these figures were up 59% and 85% on the prior corresponding period. Its profit was $26m, up 87%, and its cash from operations was $32m (up 57% and a 71% conversion rate).

Neither was it because of acquisitions that were not paying off. 18 months on from the purchase of Texas-based ISP Tek Services for US$66m, the North American division represented 58% of revenue and 74% of EBITDA.

Nor was it because of the loss of key customers. The company enhanced its partnership with HP in FY24, becoming a ‘Certified Refurbished Platinum Partner’ and winning the right to recycle 25,000 laptops a month. Even so, the company decreased customer concentration without being specific.

Perhaps it had a bad outlook? Not that the company revealed, telling investors the outlook was ‘encouraging’ and there may be future M&A. Investors were told to expect revenue and earnings to grow ‘by several times in the next three to five years’.

CLG has a debt problem…

…or at least investors perceive it does. The company has total borrowings of $83m ($14m short-term and $69m long-term). With total cash of $40.6m, it has net debt of $42m. We will credit that the company has reduced its borrowings by $4m in the last 12 months. But it has an interest expense of $9.8m, a figure that is nearly four times higher than the $2.5m in FY24. So while it has $23.9m EBIT, it only made an $11.2m profit. Also concerning was a high level of depreciation and amortisation, which was $21m. Hence, the company decided to publish an “NPATA’ (basically a profit without amortisation). Certainly looks better than its NPAT.

Source: Company

The bulk of the company’s debt is US$52.5m in loans from PGIM’s private credit arm Pricoa Private Capital granted when it bought ISP Tek Services. CLG has told investors that it was talking with its lenders to restructure its debt to reduce interest. It has a total of A$56.1m in bank loans and A$11.5m (US$7.5m) in convertible notes. The latter is due in late April 2026. The terms of the bank loans are not disclosed in the company’s report, as they are needed to be in US company annual reports. In fact, in US company annual reports, companies need to disclose the projected repayments over the next 4-5 years specifically and the remaining balance for all years thereafter.

As a consequence, CLG investors are led to speculate as to the impact debt repayments will have. The only clue they have gotten from the company is that..well…would it be trying to refinance the debt facilities if it was ‘all well and good’?

Conclusion

Debt is good debt…if it can be paid back. And it seems CLG investors are so worried about its burden, that they are willing to overlook everything else about the company. We anticipate something will give soon.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

This Time is Different: Marcus Templeton said this phase was costly in 1933, but here is when it may be true

‘The investor who says, “This time is different,” when in fact it’s virtually a repeat of an earlier situation, has…

The Canadian Securities Exchange is buying the NSX! So will Australia finally get a legitimate second exchange?

The big news for Australian investors this week isn’t rate cuts or what Trump may or may not do on…

RBA Cuts Rates Again: Which Sectors Are Set to Benefit Most from This Decision?

The Reserve Bank of Australia (RBA) has recently cut the official cash rate by 25 basis points, marking the latest…