Cobre (ASX:CBE): Becoming BHP’s latest exploration partner has set this stock on Fire

![]() Ujjwal Maheshwari, January 30, 2024

Ujjwal Maheshwari, January 30, 2024

Last week marked a significant turning point for Cobre (ASX: CBE), an ASX-listed junior copper exploration company. In an astonishing development, Cobre’s market valuation more than doubled in less than 30 minutes that morning, following a groundbreaking announcement that it was BHP’s latest exploration partner. The company’s share price skyrocketed by 112.2% to 8.7 cents per share, a dramatic increase from its previous close at 4.1 cents.

Who is Cobre?

First of all, let’s recap Cobre for the sake of investors who haven’t come across it before. This company is a copper explorer with projects in Western Australia and Botswana. In the latter jurisdiction, it has a package of copper and silver exploration tenements in the Kalahari Copper Belt (KCB) and it actually has the second-largest tenement package.

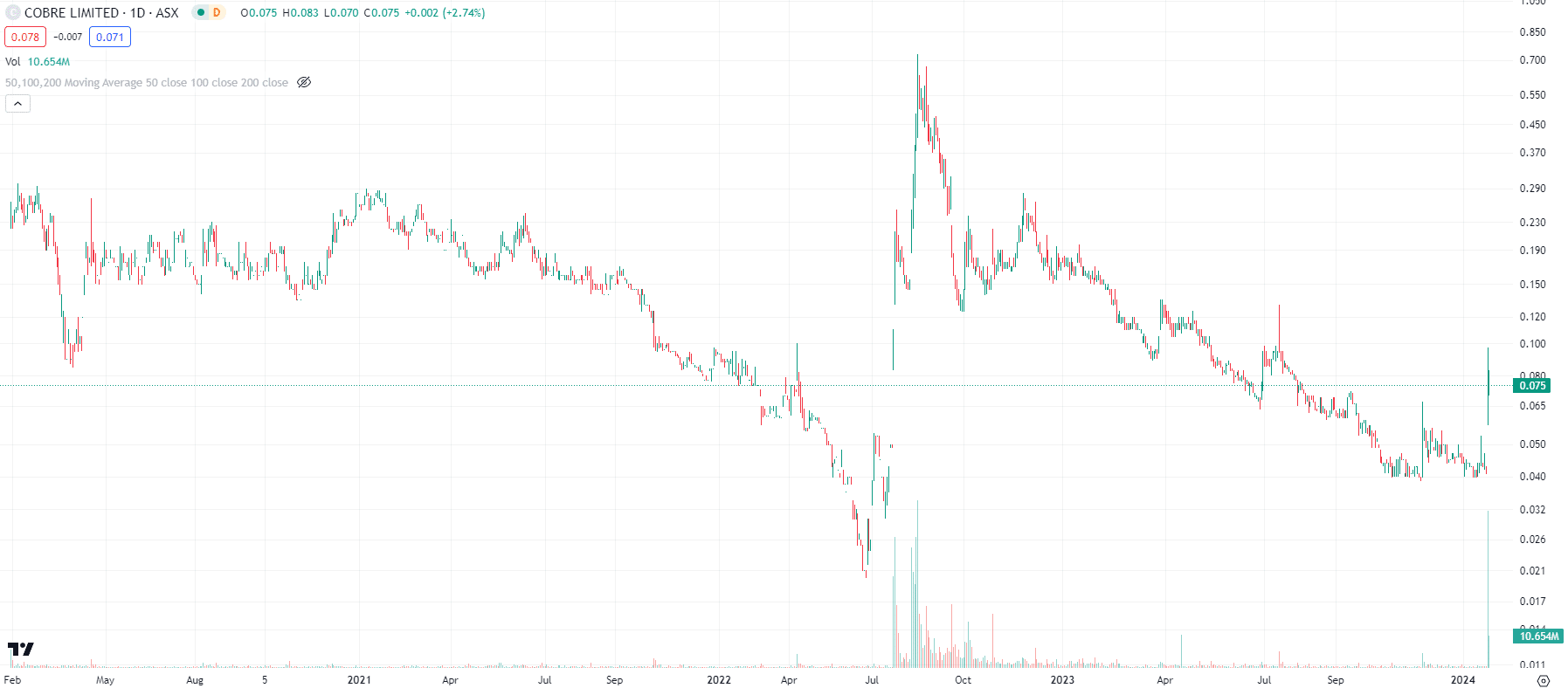

The company listed in early 2020 at 20 cents a share and after 18 months of trading roughly at its listing price, shares retreated in the bear market of 2022. The KCB is regarded as one of the world’s most prospective areas for yet-to-be-discovered sediment-hosted copper deposits by the US Geological Survey and is emerging as a new copper production belt.

Shares are listed at 20c per share and have been volatile. After treading water for 18 months, they fell between June 2021 and June 2022 until it went as high as 56c in late 2022 with good drilling results. Unfortunately, momentum dropped off just as fast as it took off.

Cobre (ASX:CBE) share price chart, log scale (Source: TradingView)

BHP’s 2024 Xplor Program Selection

Cobre’s sudden market uplift stems from its selection by BHP (ASX: BHP) to participate in the mining giant’s 2024 Xplor program. This program aims to assist companies in the critical minerals sector to expedite their operations, potentially paving the way for long-term partnerships with BHP. Throughout the six-month program, Cobre will receive US$500,000 (A$760,644) in non-dilutive funding and access to BHP’s internal expertise and global network, a significant boon for its exploration efforts.

Cobre plans to channel this funding towards accelerating its Kitlanya West Project in Botswana. The conclusion of the Xplor program leaves the company with no obligatory ties to partner with BHP, yet the potential for a future collaboration looms large. However, the Xplor deal incorporates an option for BHP to maintain certain pre-emption rights at Kitlanya West for 12 months post-program.

Cobre’s partnership with BHP reflects a shared vision of uncovering new critical mineral deposits essential for the global energy transition. The grant, a non-recurring opportunity, underscores BHP’s confidence in Cobre’s potential to unearth significant copper-silver deposits. Moreover, it aligns with BHP’s strategy of nurturing early-stage mineral exploration companies and fostering innovative approaches to mineral discovery.

Management’s Clear Vision

Cobre’s management has articulated a clear strategy to utilize the funds in progressing targets they believe could harbour tier-one copper-silver deposits. This strategy received a confidence boost from BHP, particularly given the “encouraging new targets” identified at Kitlanya West in November. The recent drilling results have expanded the target size to an impressive 4 km x 1.2 km, demonstrating the project’s escalating potential.

Cobre CEO Adam Wooldridge expressed enthusiasm for the unique opportunity the program presents, highlighting it as a testament to the technical merits of their team and projects. This partnership, as envisaged by the company;’s leadership, promises to add substantial value for shareholders while furthering their exploration endeavours.

Cobre’s Diverse Portfolio

Apart from Kitlanya West, Cobre is also diligently working on its Perrinvale project in Western Australia’s Panhandle Greenstone Belt. Here, the company has discovered a rare VHMS deposit enriched with high-grade copper, gold, silver, and zinc. This discovery follows in the footsteps of Sandfire Resources Ltd (ASX: SFR), which unearthed Australia’s last significant VHMS deposit over a decade ago. Cobre’s Executive Chairman, Martin Holland, attributes this achievement to the CEO’s dedication and the exploration team’s efforts. This milestone not only validates his company’s vision for the Kalahari Copper Belt’s tier-1 potential but also signals a new chapter in its growth trajectory.

Keep your eye on Cobre

Early-stage explorers are always risky so we would urge caution with this stock. Yet there is no doubt that it now has a significant advantage over many of its peers, given its new alliance with BHP.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…