Coda Minerals – One of the world’s most inexpensive copper plays

![]() Nick Sundich, March 29, 2023

Nick Sundich, March 29, 2023

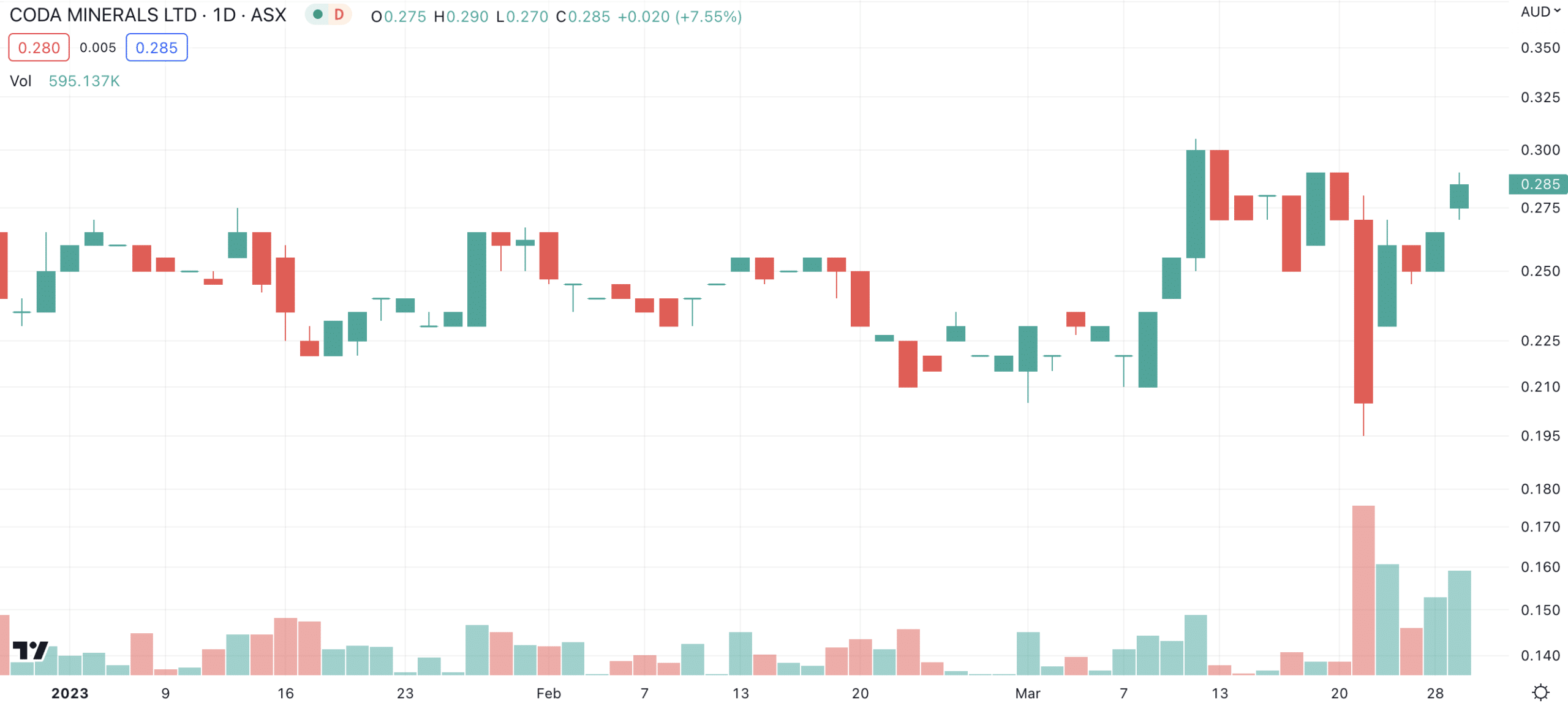

Thursday 23 March 2023 was not a great day to be a shareholder of Coda Minerals (ASX:COD), developer of a copper-cobalt project in South Australia called Elizabeth Creek.

Coda stock opened at 27 cents, the same as the previous close, and for a while it was 28 cents, but by 4:00 PM poor old Coda was changing hands at just 20.5 cents, a price that capitalised the company at $29m.

Coda Minerals (ASX:COD) share price chart, log scale (Source: TradingView)

This in spite of a newly published Scoping Study that put a pre-tax NPV on Elizabeth Creek of A$570m using an 8% discount rate, and gave the project a juicy 26.5% Internal Rate of Return.

So you could pick up a potentially very valuable copper mine at less than 10% of its maiden valuation.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Elizabeth Creek

Elizabeth Creek is, if you will, the consolation prize for the old shareholders of Gindalbie Metals. Back in April 2006 that company had brought in Anshan, China’s second largest steel producer, to develop the gigantic Karara iron ore deposit in the in the Mid-West region of Western Australia.

Karara had a couple of billion tonnes of the good stuff in reserve, and around 2007 Gindalbie with just 52% of Karara was worth north of A$800m.

However by the time the mine commissioned in 2013 iron ore prices were falling like a stone and the mine was never able to be worked profitably.

Anshan ended up taking over Gindalbie with its 48% of Karara in 2019 for a mere $26 million, plus – and this is an important plus – a deal to demerge a Gindalbie-owned copper-cobalt project in South Australia then called Mt Gunson into a new company.

That company, Coda Minerals, went public on ASX in October 2020, after Mt Gunson’s name was changed to the more euphonious Elizabeth Creek.

Before we tell you more about Coda, we need to acknowledge that the current board of the company had nothing to do with the mining decision or development of Karara, but were all involved around the time of, or after the write down of the mine, essentially trying fix it up and find some value.

Elizabeth Creek as a standalone was their solution, and we reckon it was a great one.

The company was called ‘Coda’ Minerals because in classical music a ‘coda’ is the concluding passage of a piece or movement.

If Karara was the main movement, one that turned progressively more dissonant as it went on, Elizabeth Creek was meant to be the harmonious coda.

We think it’s turning out that way, although you wouldn’t think so from the current share price.

Emmie wasn’t bluffing

Initially Coda Minerals and Elizabeth Creek, where Coda was earning 75% from another explorer called Torrens Mining, were well received.

The IPO, which raised $8.5m at 30 cents a share, was heavily oversubscribed. Investors liked the fact that Elizabeth Creek was in ‘elephant country’, only 100 km south of the mammoth Olympic Dam copper mine of BHP and only 135 km north of Port Augusta.

The eastern part of the Gawler Craton had already given the world Olympic Dam as well as the Carrapateena and Prominent Hill mines of Oz Minerals (and now also part of BHP).

The investors also liked the fact that there was already a JORC-compliant resource of 159,000 tonnes of copper and 9,400 tonnes of cobalt on an indicated basis within the 700 sq km project area.

And they liked the fact that there were different styles of copper mineralisation in the project area – Zambian style sediment-hosted copper-cobalt, as well as IOCG copper deposits – increasing the chances that something bigger would show up.

Coda Minerals’ initial exploration strategy at Elizabeth Creek was twofold.

Firstly, it sought to build out known Zambian-style resources across multiple prospects, including Emmie Bluff, the lead prospect.

Secondly, it went after the copper-gold IOCG targets that had only been lightly touched by previous drill work. When the first IOCG mineralisation was intersected at Emmie Bluff Deeps in June 2021 the market got seriously excited, bidding Coda stock up to north of $1.70 a share.

However the stock has more or less trended back since then. In 2021 many observers of the company felt that the Elizabeth Creek deposits were still too small. And many wondered how the deposit would be mined given the angle it sits in the earth.

What are the Best ASX Copper Stocks to invest in ASX ?

Check our buy/sell tips on the Copper Stocks in ASX

Coda Minerals now has a much bigger deposit, and one that can actually be mined

By December 2021 Coda Minerals had a much larger resource than at IPO – 1.1 million tonnes of contained copper equivalent across three deposits, versus 280,000 tonnes previously.

There was 43 million tonnes in indicated and inferred resources grading a very healthy @ 1.84% copper equivalent at Emmie Bluff.

There was 18 million tonnes indicated at @ 1.14% CuEq at another prospect called Windabout. And there was 1.8 million tonnes, also indicated, at @ 1.67% CuEq at the MG14 prospect.

Coda was reasonably sure there was more where that came from given the number of untested targets. And not long after the resource upgrade Coda owned it all, with the 2021 exploration success prompting the company to acquire Torrens Mining in a February 2022 stock swap.

The problem with mining at Elizabeth Creek has been solved, at least on paper, since November 2022. Windabout and MG14 were easy because they were open-pittable.

But Emmie Bluff was a different story because it’s a long and flat but very thin seam (ie only two to 15 metres in thickness) of Zambian-style mineralisation about 400 metres from surface.

On first glance that looked next to impossible to get to via conventional mechanised hard rock mining. Coda, however, reasoned that since miners had been mining those kind of deposits in both the Zambian and Congolese sides of the Copperbelt for a long time, alternative approaches were available.

When Coda’s consultants looked at Emmie Bluff they quickly saw that long-hole open stoping with pillars would do the trick.

With this approach a series of holes would be drilled through the orebody, explosives would then be placed to create a series of stopes from which ore could be extracted, but pillars would be left behind to keep the stopes open.

The result would be multiple faces to work simultaneously, no backfilling required and low ore body dilution. Coda estimated that this could allow Emmie Bluff to be worked for 14 years at a steady-state rate of 2.5 million tonnes or ore p.a.

Low production costs

With the right mining technique Coda was able to move quickly to the Scoping Study which hit the streets on 23 March. As we noted above, the economics were compelling, with a pre-tax NPV of A$570m and a 26.5% IRR after only 14 years of mine life across all three deposits.

The study modelled steady state production of 25,000 tonnes a year of copper and 1,000 tonnes a year of cobalt.

And the flowsheet was pretty straightforward, with copper produced by standard solvent-extraction/electrowinning, zinc precipitated from the electrolyte as a zinc carbonate product, and cobalt recovered from the zinc-lean raffinate via solvent extraction.

In other words, not too different from the kind of copper-cobalt mine you’d develop in the Copperbelt today.

Some might be critical of Coda on the prices it used, namely, US$4 a pound copper, which is about the current spot price, and US$60,000 a tonne cobalt, which is a little less than double the current price.

We’re not concerned because this is a Scoping Study – copper could reasonably be higher by the time the PFS comes out given the supply/demand assumptions a lot of people are talking about, and cobalt, that volatile battery metal, was north of US$80,000 just under a year ago.

What this study shows is that Elizabeth Creek is highly valuable should present conditions prevail. The all-in sustaining cost estimate in the Study was a low US$2.72 per pound of copper equivalent.

Some serious project finance dollars are required, but the jurisdiction is Tier 1

Which brings us back to the poor reception for the Scoping Study. We think investors didn’t like the pre-production capital cost of A$277m. Again, we’re not concerned.

For one thing, South Australia is a little more Tier 1 than a lot of other copper-cobalt jurisdictions, so raising that kind of project finance is not unreasonable.

For another, it’s also not unreasonable to think a major will potentially be interested in a piece of this action between now and the Final Investment Decision around 2025.

And, of course, there’s plenty more exploration upside at Elizabeth Creek so it’s very reasonable to expect more NPV where the original Scoping Study came from.

All that said, you’ve got to feel a little sorry for Coda’s CEO, Chris Stevens, right now. All that hard work proving he and his team have a world class deposit and the market shrugged its shoulders on the day.

We think, however, that continued recovery of copper in 2023 could make it a little more worthwhile.

Investors ought to take a closer look at this one.

Check out our video interview with Chris Stevens here!

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…