Colgate (NYSE:CL): There’s more to it than toothpaste – it could be the best way to profit from the growth in pet products!

Nick Sundich, August 5, 2024

In Australia, we know Colgate (NYSE:CL) primarily as a toothpaste brand. But there’s a lot more to this 217-year old company than you may think. We think this stock may be the best way to gain exposure to the growth in pet care.

Who is Colgate?

Colgate is a consumer products company, headquartered in Manhattan, New York and present all over the world. Its purpose is ‘Reimagining a healthier future for all people, their pets and our planet’.

Named after co-founded William Colgate, it sells not just toothpaste but brands across pet nutrition, personal care and home care. It sells products ranging from Palmolive shampoo, to Hills pet-food, Ajax home cleaning products even an LED device that can remove 10 years worth of stains in just 3 days.

Of course toothpaste is important to it as it has a 42% market share, along with a 32% share in the manual toothbrush market. And it has market leadership because it keeps innovating with new versions that have a great impact on oral health than competing products. And it does not just sell consumer toothpaste but professional brands used by dentists.

A diverse sales mix

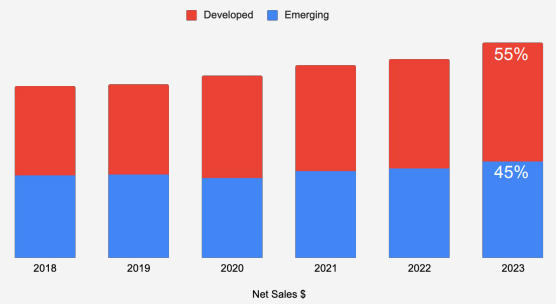

It is highly diversified in its revenue stream with no geography with over 22% – that title held by Latin America. It has a 55-45 revenue split between developing markets and emerging markets. While inflation has led to many consumer companies’ products falling, it as been the opposite with Colgate, even as it raised prices. And its growth has been occurring across both developed and emerging markets.

Source: Company

Most pleasingly, it has been able to maintain margins in spite of increasing marketing spending. The company has grown gross margins and operating profits for four straight quarters, and the latter metric by double digits.

Colgate (NYSE:CL) share price chart, log scale (Source: TradingView)

Colgate has been paying dividends to shareholders for 128 years and has raised dividends consistently for the past 60 years. It has returned US$28bn to shareholders, through dividends and stock buybacks, over the last decade. It has one of the best ESG angles of any company as it expands into more countries – reaching children worldwide in countries with poor oral health standards.

The best way to gain exposure to pet care

We all know the pet market is growing substantially with the spike in pet ownership during the pandemic. Colgate is exposed to this area with its Hills Pet nutrition products. Although they only account for just over 20% of the company’s total sales, it is growing faster than any other segment. In the June quarter of 2024, it recorded $1.1bn in net sales, up 5.5% year on year. The company’s entire sales only rose by 4.5%.

The company anticipates further sales growth as it captures more of the market, having undertaken the purchase of brownfield facilities from other companies and building of its own facilities. Fortune Business Insights estimates that the market is worth US$246.7bn right now and will grow to US$368.9bn by 2030 – representing a CAGR of 5.92%. As many pet owners can attest to, pets can be like family members. So pet owners won’t be cutting back expenditure on their furry (or feathered) friends.

Good growth to come, yet reasonably valued

For the full 2024, the company expects net sales growth to be 2-5%, including a negative forex impact, but organic sales growth to be 6-8%. Consensus estimates expect $20.2bn in revenue (up 4%) and $3.54 EPS (up 27%). For 2025, $21bn in revenue (up 4%) and $3.90 EPS (up 10%). The mean target price, drawn from 22 analysts, is US$100.88 per share (roughly in line with current share price). It is trading at 16.9x EV/EBITDA and 26x P/E for FY25, both only a slight premium to the average across S&P 500 stocks. And it is trading at a PEG of 2.9x.

Is Colgate a buy?

It is hard to find US-listed companies with consistent, solid EPS and sales growth as Colgate. Nonetheless, it appears that the company is ‘fairly valued’ right now, unless it can outperform analyst expectations – and the bar is already high in light of the company’s performance in the last 12 months.

What are the Best ASX stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…