Lendlease (ASX:LLC)

- Lendlease stock recently went to a ten-year low and has since rebounded somewhat.

- The company benefits from an end to the current round of interest rate hikes, expected in the 2nd half of 2023.

- Covid impacted major developments globally, but this is no longer an issue for Lendlease.

- Lendlease has a massive development pipeline of A$121bn.

Our investment strategy for Lendlease (ASX:LLC)

- Entry price on 8 August 2023: $8.38.

- Buy LLC up to $8.70.

- Our minimum target price for LLC is $10.40. Our secondary target price is $12.00.

- Use a stop loss at $8.00.

Who is Lendlease?

Lendlease is a Sydney-based property company that specialises in large-scale urban renewal and redevelopment. The company’s basic model sees its access significant tracts of real estate in major global cities, bring in capital partners and then design and build a new, more valuable precinct over several years. Lendlease is currently working on a $121bn development pipeline where it makes money from development services as well as from asset purchases and sales. Lendlease has a major Construction business that often works alongside the Development business.

In addition to developing and constructing property assets, Lendlease is also a major manager of property funds with its Investment Business. At the end of June 2022, the company had $48bn in Funds Under Management and $33bn in Assets Under Management. The company makes money from management fees.

Lendlease is currently trading not far above its ten-year low of $6.76 in March 2023. The stock was hampered in 2022 and into 2023 by rising interest rates, which were a negative for the property sector globally. We believe a stabilisation in interest rates in the second half of calendar 2023 and a return to normal conditions for the building industry post-Covid can return Lendlease earnings and with it, more bullish investor sentiment around the company.

Our investment thesis for Lendlease:

- Lendlease has a distinct competitive advantage. Very few companies in the property industry can manage projects at the scale on which Lendlease frequently works. The company can operate globally, but with local expertise.

- Lendlease has a massive development pipeline. In late-2022 this stood at $121bn, in addition to which there was $18bn in current work in progress, which was a record. The pipeline, properly replenished from year to year, can provide years of growth for Lendlease. A good example of the multi-year value of a project is the Milan Innovation District (MIND), which will transform Milan’s former expo site to become a new precinct for science, knowledge, and innovation. Lendlease will be involved in this project for about 15 years.

- Lendlease’s financial position is enviably strong, with only 16.8% gearing (net debt to total tangible assets, less cash) per the end of December 2022 and $2.4bn in available liquidity to draw on.

- Lendlease is undergoing renewal under Tony Lombardo, who became Global CEO in June 2021. In FY22 the company cut more than $160m from its cost base, exited its non-core Services business, sold $1bn in various property assets and formed $11bn of partnerships to drive growth in Funds Under Management.

- Lendlease stayed profitable in FY22 and 1HY23, despite its challenges. On revenue of $8.5bn, down 2%, Lendlease saw FY22 EBITDA drop 12% to $809m. The reason for the earnings decline was lower completions on the Development business and disruptions in the Construction business. We think Covid had a lot to do with both and that the result was a creditable one for Lombardo and his colleagues. In 1HY23 EBITDA rose 78%, to $278m, on a 13% revenue improvement, driven in part by an 8% growth in funds under management to $48bn.

- Lendlease is growing its Investment business. The Investments segment saw both Funds Under Management and Assets Under Management grow in FY22 and turn in a Return on Invested Capital (ROIC) of 9.7 per cent, above the company’s 6-9% target. To achieve this in a difficult year for property was quite an achievement and bodes well for continued growth beyond FY23. In 1HY23 the ROIC was 7.1% within the expected range of 6.0-7.5% for FY23.

- Lendlease’s Development business has a long tail. While completions were down in FY22, the business increased its Work in Progress and Pipeline during the year. We believe Pipeline is important because, as we noted above, Development projects are usually long dated. One important new project secured in 2022 was the One Circular Quay development in Sydney, announced in July. It will not be completed until FY27.

- Lendlease’s Construction business is winning new work, with $2.9bn secured in the second half of FY22, as against $2.4bn in the first half. In 1HY23 another $2.3bn in new work came in, down only 4% on the previous corresponding period.

- Lendlease expects to enjoy particularly strong returns from FY24, where its target for ROIC in the Development business is 10-13% and its EBITDA margin target for the Construction business is 2-3%.

- Lendlease has a strong growth profile for the next few years, with FY24 seeing a step change as the company achieves its strategic objectives.

- There was significant director buying of stock late last year, with six directors in the market in late November at around $7.90 per share. There has been no director buying so far in 2023, we think because the trading window is closed.

LLC director buying

What went wrong at Lendlease?

- The increasing interest rate environment was bad for the property sector globally and in Australia. In 2022 the S&P/ASX 200 Real Estate Index (XRE) fell from 3,946 points at the end of 2021 to just 2,760 points at the end of September, a drop of 30%. Since September 2022 the Index has increased 11%, to reach 3,085.2 points by 4 August 2023.

- Covid hampered constructing work on new projects.

- In FY22 the company saw reduced completions and work in hand in the Development business.

What we expect will go right

- The company is able to move faster on key projects, now that Covid is not disrupting its business anymore.

- We think commencements will accelerate in the Development business from here.

- It’s reasonable to expect good returns on the company’s property funds.

- The company can partly re-leverage its balance sheet should external financing for projects become more difficult to secure.

- Peaking interest rates in 2HY23 and gradually declining interest rates in 2024 should lead to improving sentiment around stocks and property stocks in particular.

Lendlease (ASX:LLC) share price chart, log scale (Source: Tradingview)

Initial price target of $10.40, with upside to $12.00

- As can be seen in the chart, LLC broke the downtrend that started in May 2022 and also set a double bottom in June 2023. The stock is now on an uptrend. Additionally, the 50-day Moving Average (green line in the chart) just crossed the 200-day Moving Average (red line), which is a bullish sign.

- The stock was last trading around $10.40 in August/September 2022. This level now forms a resistance level, but from $8.38 (on 8 August 2023) still implies ~24% upside. However, there is also significant resistance in the $8.80 to $9.00 range that needs to be broken.

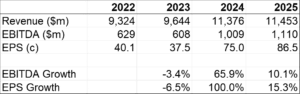

- A share price of $10.40 would imply reasonable EV/EBITDA multiples of 9.9x for FY24 and 9x for FY25.

- A secondary price target is $12.00 (~43% upside) would represent an EV/EBITDA multiple of 11x consensus for FY24 and 10x for FY25, which we believe is very reasonable given the expected EBITDA growth in FY25 of 10.1%.

- Given the expected dividend payouts of 24c and 30c in FY24 and FY25, Lendlease’s yield on the current share price is 2.9% and 3.6% respectively for these years.

Key data

Catalysts for the re-rate of Lendlease shares

We see four main catalysts to prompt a re-rating of the stock from here:

- Peaking, and subsequently falling, interest rates in Australia, which would improve the funding environment for property developers.

- New project announcements, similar to the June 2022 announcement where Singtel indicated that it was partnering with Lendlease on the Comcentre redevelopment.

- Further director buying of stock, which would highlight the inexpensive nature of the stock.

- A solid FY23 result, which has the potential to highlight the turnaround in the story. Lendlease reports its FY23 earnings on 14 August 2023.

Risks

- Continued, higher than expected interest rate increases.

- Increasing labour and other costs.

- Cost overruns in the Construction business.

- A slowdown or reversal in fund inflows.

UPDATE 14 AUGUST 2023

Lendlease (ASX:LLC) releases FY23 results

Concierge Pick Lendlease (ASX:LLC) has released its FY23. To make a long story short: Although the turnaround remains Work in Progress, it appears to be on track.

Lendlease’s Core Operating Profit fell 7% in FY23 to $257m, while its Statutory loss amounted to $232m, due to a $295m impairment as a result of UK regulations that extend the period for defect liabilities from 6 to 30 years.

But on consensus, the company’s profit is expected to rise strongly over the next two years, reflecting the expected recovery in the global property sector. The seeds were sown in FY23 for that growth.

Funds Under Management grew 9% to $48.3bn and Development Work in Progress was up markedly, rising 24% to A$23bn. The company’s ROIC on developments rose from 2.2% to 3.3% and Construction revenue was up a creditable 9%, although the backlog revenue for that division was down 17%.

We believe all of these metrics are encouraging given that FY23 was a bear market year for property.

What to expect in FY24

Lendlease has previously said that it wants to enjoy Return on Equity of 8-10% in FY24 and was able to affirm that it is on track to meet this target as FY24 gets underway, albeit now expecting the lower end.

Importantly, the Development business is expected to have a great year, with target completions more than doubling to more than A$8bn. LLC hinted at potential capital partnering that may accelerate the development pipeline. In Construction, it is expecting margins to improve and for the backlog to ease.

This time the promised turnaround is for real

We think the big reason LLC has suffered in recent years is that COVID has hampered the building industry globally. It also hasn’t helped that shareholders have been impatient with the company having been promised returns from their investment would come for a while now and the company has perceived to be indecisive in the face of activist investors.

But we think the turnaround is finally happening and we should see this in the company’s results going forward. As interest rate cycles peak and supply chain issues ease, the construction and property sectors will recover.

And LLC has begun to show signs of turning around – most notably, completions increased for the first time since COVID, from $2.5bn to $3.6bn. Granted, this is below FY19’s $5.6bn, but we think one of the keys to realising a return on LLC will be this continued recovery back to pre-COVID levels.

The company’s sales of low-margin investments should generate cash flows to redeploy into higher-margin investments. And it expects ~$150m in pre-tax savings due to recent cost reductions.

Potential risks the company has foreshadowed include interest expenses above and beyond the company’s expectations (it expects only ‘modest’ increases) and possible impairments of major projects if it cannot find flagship tenants.

Our target for LLC

After rising initially at the open, the stock is down 5% this morning, we believe mainly due to the fact that the company said it expects ROE at the lower end of the 8%-10% range.

However, we think the turnaround is real and reaffirm our price target for LLC, which is $10.40 per share. Our buy range limit is $8.70 per share and our recommended stop loss is $8.00 per share.

UPDATE 14 AUGUST 2023

We are selling Lendlease as it has fallen through our Stop Loss

Although we only put on Lendlease on 8 August, the stock hasn’t done us any favours.

Market sentiment has deteriorated on the back of slowing economic indicators and property stocks have suffered in line with the broader market.

Although we expect the interest rate environment to improve later in 2023 and in 2024, unfortunately at this time we have to take a 12.6% loss on Lendlease.