ASML (NASDAQ/EURONEXT)

This international Concierge pick is a Dutch company traded on Euronext Amsterdam. But many Australian investors can trade US stocks much easier than they can European stocks. Given that ASML is dual-listed on NASDAQ with higher traded volumes than on Euronext, we provide US$ pricing here as well. Check your trading platform to make sure you can trade international equities.

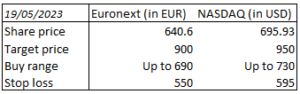

Our investment strategy for ASML (NASDAQ / Euronext: ASML)

- Date: 19 May 2023

- Industry: Technology/Semiconductor equipment

- Share price: EUR 640.60 / US$ 695.93

- Market cap: EUR 252.7BN / US$ 263.4BN

- Buy ASML up to EUR 690 on Euronext or US$ 730 on Nasdaq.

- On a 12-month basis, our minimum target price is EUR 900 per share on Euronext and US$ 950 on Nasdaq.

- Our Stop Loss level for ASML is EUR 550 (Euronext) and US$ 595 (Nasdaq), which implies a maximum downside of 14%.

- Some of our Concierge subscribers may want to play the semiconductor cycle and trade this stock. However, for reasons we explain below, we believe long term investors can Buy & Hold ASML.

Investment strategy summary

Concierge briefing on ASML

Investment thesis: At the start of a new chip cycle

- Lithography is by far the most crucial step in the manufacturing process of semiconductors. It involves transferring the design of an individual layer of a chip onto a so-called semiconductor wafer through the use of ultraviolet light.

- ASML is the dominant player in the market for lithography tools. It has an 80% market share in so-called Deep Ultra Violet (DUV) lithography tools and it is a monopolist in the most advanced lithography equipment, i.e. Extreme Ultra Violet (EUV) tools. Because of this dominant position, the company commands attractive gross margins of more than 50%, where ~35-40% is more common for semiconductor equipment companies.

- To be clear: ASML doesn’t manufacture computer chips. Rather, it makes the machines to do that.

- The company’s key customers are TSMC, Samsung, Intel and SK Hynix. All of them are currently coping with a slowdown in the global semiconductor industry that is driven by overcapacity in certain product areas and the slowdown of the global economy. Combined with rising interest rates in the last 18 months, this has driven down valuations of most semiconductor companies, including ASML.

- And even though ASML’s share price has recovered from the bottom in October 2022, we believe the stock is still very attractive at current levels as we believe the semiconductor industry will likely start its recovery in 2HY23 or early in 2024. ASML, being a key player in this industry, is set to benefit substantially from this recovery and from the improving sentiment around semiconductor equipment stocks in the run-up to that actual recovery, in our view.

- Longer term, ASML should be able to benefit from the ongoing proliferation of computer chips in all sorts of products. To illustrate this point: ASML expects to have between EUR30bn and EUR40bn in sales in 2025 (it had EUR21.2bn in sales in 2022). But by 2030, it expects to have sales between EUR44bn and EUR60bn! It should be obvious that this company has got a lot of growth ahead of it.

The world’s most important technology company you never heard of

- Among Australian investors, ASML is not a household name. Yet, unless you’re a hermit living in a cave, there is a 100% chance that you own a product that was made with the help of ASML. You see, ASML produces certain types of equipment that is used to manufacture computer chips (or integrated circuits, IC’s). And these chips find their way into any electronic product these days…from toasters to mobile phones to rocket guidance systems.

- ASML was co-founded in 1985 by Philips Electronics and ASM International in The Netherlands and was listed on Euronext Amsterdam in 1995. The company was initially just a small lithography player, but through a very strong focus on fundamental physics research, world-class development work and outstanding corporate management, ASML was able to decimate the one-time leading players in lithography, i.e. Nikon and Canon of Japan.

- It is currently the only company that has mastered Extreme Ultra Violet lithography, the most advanced technology around. And not just in a lab, but in high-demanding production environments where the key metric is the number of silicon wafers processed through the machine each hour (wph). Its market share in EUV is 100%, i.e. ASML is a monopolist here. EUV is so complex that Nikon and Canon never even started development of an EUV lithography system 20 years ago, hence ASML’s dominance in EUV today.

- In 1Q23 (March quarter), EUV accounted for 54% of ASML’s revenues. EUV is used to manufacture today’s most advanced chips, with resolutions as small as 3 nanometres (nm). We will explain what this means later on.

- Deep Ultra Violet is an older lithography technology, but is still very much in use in the semiconductor industry for non-leading edge products that typically have resolutions of well above 10 nm (up to 190nm). DUV technology has been around since the early 1990’s, but has undergone continuous improvements in the last 30 years. So, ASML’s DUV product range is quite broad and still accounted for 42% of revenues in Q1.

- The remaining 4% of revenues is accounted for by very old i-line steppers (1%) and revenues from metrology and inspection (3%).

What is lithography in semiconductor manufacturing?

An integrated circuit is made up of many layers that are built on a substrate one by one. These substrates are known as semiconductor wafers. Depending on the type of IC that is being built on the wafers, a chip manufacturer can build anywhere from a few dozen IC’s (e.g. larger CPU’s) up to several hundreds and even more than a thousand IC’s (e.g. small sensors, LEDs, lasers) on a wafer.

For each layer of the chip, four steps need to be completed, i.e. deposition, removal, lithography and modification of electrical properties. As not to overcomplicate things, we’ll just focus on the lithography step here.

Through the process of (micro) lithography, the circuitry design of each individual layer of the chip is transferred onto the wafer. You can compare the process to shining a light on a slide in an old-fashioned slide projector… the slide is a negative of the picture that actually shows up on the white screen.

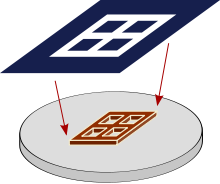

Similar to a slide projector, in lithography the circuitry design for a particular layer of the chip (also known as the mask or reticle) is exposed to ultra violet light. The mask only lets through light according to the required circuitry design (see graphic below).

Schematic representation of a mask

Actual mask with circuitry for 20 chips

Depending on the surface area of the IC’s that are being manufactured, this scanning process will need to be repeated until every IC on the wafer has been exposed to the ultra violet light.

Following an exposure in the lithography process, the wafers are processed further to remove unwanted chemicals and to deposit conducting materials into the newly created circuitry. The wafer is then prepared for the next round of lithography, i.e. for the next layer to be built. This process of preparing a wafer, exposing it in the lithography step and the subsequent etching step, needs to be repeated many times. The more complex and larger the IC, the more steps need to be performed. With certain IC’s having a few hundred layers these days, the number of process steps a wafer has to go through in a semiconductor manufacturing facility (also known as fab), can add up to more than a thousand. It typically takes 3 to 4 months to process a wafer from start to finish.

Why ASML is so dominant in lithography

Even though the company came from humble beginnings, ASML rapidly expanded its market share in DUV from the mid-1990s. One of the company’s strengths was so-called throughput; the number of wafers that can be processed by a chip manufacturing machine per hour.

The company’s big breakthrough came with the launch of the TwinScan in 2001, a machine that could process 2 wafers simultaneously, i.e. one wafer would be measured prior to exposure, while a second wafer was actually being exposed in the same machine. Previously, these two steps had to be done in the same “stage” of the machine, which could only be used for one step at a time. But with 2 wafer stages, the TwinScan allowed for a massive increase in throughput. As soon as one wafer was finished, the next one could be processed without having to “waste” time on the measurement step.

Although ASML was already winning market share with its single stage DUV scanners in the late 90’s, the TwinScan is what set the company apart from its Japanese competitors. This is when the real market share gains started to come through.

Extreme Ultra Violet is the ultimate game-changer

Around the same time the TwinScan was introduced, initial research into EUV had also started. What was clear early on was that in order to commercialise EUV, many billions of dollars would be required in R&D over a long period of time. Additionally, making the next generation of lithography a reality was extremely important to some of the largest players in the semiconductor industry in order to keep up with Moore’s Law. Named after Gordon Moore, a co-founder of Intel who actually passed away in March 2023, Moore’s Law predicted that the number of transistors in IC’s would double roughly every two years.

So, in order to keep Moore’s Law alive long term, three of the largest chip manufacturers, i.e. Intel, TSMC and Samsung, invested a combined US$6.5bn into ASML in 2012 to support the development of EUV lithography. Combine this with ASML’s own EUR6.5bn investment in EUV technology over the years, and it will be obvious that not every company has the financial means to do this…let alone the technical expertise and know how. To give you an idea, some elements of EUV, such as the generation of the light, had to be invented through fundamental physics research.

In other words, about 15 years ago, when they had already lost substantial market share in DUV to ASML, Nikon and, to a lesser extent, Canon weighed up their chances of getting EUV to market timely and competitively, and decided not to pursue it at all. Which is why ASML is now the world’s only provider of EUV systems that cost in excess of US$200m.

The next generation EUV tools, so-called High-NA EUV, will cost between EUR300m and EUR350m when they become commercially available. ASML expects the first so-called R&D tools of this next generation of EUV, used for testing and process development, to be shipped by the end of 2023. Shipment of actual High-NA EUV production tools should start in 2025.

An EUV lithography tool is roughly the size of a school bus

EUV is used only by the largest chip manufacturers

Although ASML never mentions its customers by name, there are only a handful of chip manufacturers that can afford to use EUV tools, including Intel, TSMC, Samsung and a few DRAM manufacturers, like SK Hynix and Micron. The use of EUV has enabled these manufacturers to scale down the size of their chips by reducing the so-called resolution of the circuitry. This is measured in nanometres (nm) and today’s leading-edge manufacturing is done at 7nm and below. Samsung and TSMC have recently started up manufacturing at 3nm, while High-NA EUV will enable manufacturing at 2nm and below from 2025 onwards.

To give you an idea how small that is, 1 nm is 1/billionth of a meter and 13 nm is roughly the length a human hair grows in 1 second (!).

Leading edge manufacturing is mainly relevant for high end applications, such as IC’s for Artificial Intelligence, high end mobile phones, certain military and communications applications, graphics processing etc.

Chip manufacturers who can’t afford EUV have focussed on less advanced manufacturing nodes, i.e. >10nm, using the most advanced DUV tools where ASML has an approximate 80% market share. Many applications, such as in automotive, home appliances, robotics, consumer electronics (other than high end products) etc, don’t need the most advanced chips. So, players like GlobalFoundries, STMicroelectronics, NXP, Texas Instruments etc can make a good living tailoring to the trailing edge of the market.

Geopolitical tensions could increase ASML’s growth

The increasing geopolitical tensions between China on the one hand and a group of allied countries[1] on the other may be a boon for ASML. The Trump and Biden administrations have imposed export bans on a range of advanced semiconductor manufacturing tools, including initially EUV tools and now also DUV tools. In itself this is a negative for ASML that generated ~15% of its revenues from China in 2022, all from DUV lithography equipment.

However, the fear of China someday invading Taiwan combined with the massive semiconductor shortages during COVID, have driven home the realisation that the world is too dependent on chips from Taiwan. The country manufactures 60% of the world’s IC’s and 90% of the most advanced ones.

In attempts to lower this dependency in the future, the US, the EU, Japan, South Korea and India have all set up initiatives to boost domestic chip manufacturing, such as the US CHIPS act. While it will likely take at least three years to start generating meaningful production in new fabs outside of Taiwan, we believe ASML will be a key beneficiary of these developments. All these fabs will need lithography tools and there’s only really one company chip manufacturers can get them from. So, we are very bullish on ASML’s long term prospects.

Chip sector recovery to start in 2HY23, early 2024

As the industry works through the current period of lower demand and excess inventories in certain segments of the chip market, we believe the stage is set for the eventual rebound in the semiconductor industry. Whether this starts in 2HY23 or early in 2024 is not that important to us. We have seen enough cycles since we started covering this industry back in the mid-1990s to know that an upswing always comes.

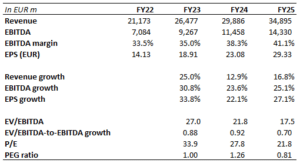

Seen in that light, and combined with ASML’s unusually strong position in this industry, we believe the company’s fundamentals for the next few years look very solid (see table below). In our view, ASML is the key play to make for investors wanting exposure to the semiconductor industry.

(1) This group includes the US, Japan, the UK, Australia, South Korea, Taiwan, the Netherlands, Germany and several others.

ASML consensus forecasts (Financial year is Jan-Dec)

Recovery of the chip sector is not fully priced in

In our view, the market is still struggling to assess what central banks around the world, the FED in particular, have in store for investors for the remainder of 2023 and in 2024. This is holding back share price appreciation of many Tech stocks at the moment, ASML included.

In our view, we are at or very near the peak of the current interest rate hiking cycle. Unless some black swan event happens, we expect to see lower interest rates 12 months from now. As a consequence, we expect to see Tech stocks rerate.

In addition, while the market may expect to see a cyclical upswing in the semiconductor industry starting in the next 6 to 9 months, it hasn’t priced this in yet because of the aforementioned uncertainty around interest rates. But the signs are there, in our view.

In its most recent quarterly report in April, ASML’s biggest customer TSMC left its 2023 Capex budget unchanged at US$32-36bn (after a cut in January). DRAM manufacturers Micron and SK Hynix already cut their 2023 Capex budget by 30% to 50% in September and October last year. DRAM prices have kept on falling so far in 2023 as end market demand is still weak. But given the extreme cyclicality of the DRAM segment, we expect to see stabilising DRAM prices in the next few months and an eventual recovery to start. The latter will drive a renewed investment cycle in DRAM capacity that will benefit ASML’s EUV product range, in our view.

ASML share price (in EUR) since 2008

Target price of EUR 900, or US$ 950 per share

Many Australian investors can trade US stocks much easier than they can European stocks. Given that ASML is dual-listed on NASDAQ with higher traded volumes than on Euronext, we provide US$ pricing here as well.

- Our recommended strategy is to Buy ASML up to EUR 690 on Euronext or US$ 730 on Nasdaq.

- On a 12-month basis, we believe ASML should easily be able to get back up to previous highs and then extend towards the top of the long term trend line around EUR 900 per share on Euronext / US$ 950 on Nasdaq as the chip recovery gathers steam in 2024.

- But based on its dominant position in the industry, we consider ASML to be a long-term holding in any share portfolio. Longer term, we believe the stock will continue on the uptrend it has been on since 2008 (see chart above). So, while some of our Concierge subscribers may want to play the semiconductor cycle and trade this stock, we believe long term investors can Buy & Hold ASML long term.

- Our Stop Loss level for ASML is EUR 550 / US$ 595.

- EUR/USD currency fluctuations can alter this picture.

- Don’t buy this stock for the dividend. The yield is only 1.3% for 2024.

Investment strategy summary

Share price catalysts

- Improving sentiment around Tech stocks in general. Semiconductor investors typically look 9 months ahead, i.e. longer than the market average of 6 months.

- Improvements in chip pricing and inventory levels industrywide are helpful for sentiment, but by the time these improvements come through, chip stocks will already have made substantial moves.

- We believe this change in sentiment is currently starting with ASML’s share price breaking out of the downward short term trend line (see short term chart below).

- Upward changes to ASML’s customers’ sales guidance and Capex budgets, especially TSMC, Samsung and Intel as well as the DRAM players.

- 2Q23 earnings release on 19 July, 7am Amsterdam time.

ASML breaking out of short term downward trend

The risks

- The current slowdown in the semiconductor industry, driven by overcapacity in certain product areas and the slowdown of the global economy, could last longer than we anticipate, resulting in slower than expected pickup in demand for lithography tools in 2024.

- Current geopolitical tensions, between China on the one hand and the group of allied nations led by the United States, may escalate, which could lead to increased uncertainty around Capex plans on the part of ASML’s customers.

- In case of a potential invasion of Taiwan by China, all investment bets are off, including ASML…especially since its biggest customer is Taiwan-based TSMC.

- Additional restrictions on exports to China imposed on ASML by the Dutch government, may limit the company’s growth rate long term.

- If interest rates were to go substantially higher than where they are today (May 2023), valuations for Tech companies, including ASML, could be negatively impacted.

Update 29 May 2023

Why NVIDIA’s massive revenue guidance is great for ASML

Who is NVIDIA?

If you’ve bought shares in our first international Concierge stock, ASML (Buy recommendation issued on 19 May 2023), you may have started following the international semiconductor industry more closely. One the industry’s bellwethers these days is NVIDIA (NASDAQ:NVDA), the world’s largest fabless manufacturer of so-called GPU’s (Graphic Processing Units).

Originally, up to about 10 years ago, GPU’s were mainly just used as additional computing power to process graphics data faster, e.g. in personal computers where they were sitting next to CPU’s (Central Processing Units). Then came Bitcoin, and early Bitcoin miners found that NVIDIA’s GPU’s were very good at mining cryptocurrencies.

The reason for this was that GPU’s can process data in parallel, i.e. multiple calculations can be done at the same time. CPU’s, on the other hand, process data sequentially, which means it simply takes longer to process the same amount of calculations and it uses more energy.

Because of these attributes, it also turned out that these GPU’s excelled at running calculations to train and work with Artificial Intelligence models. And sales of these AI chips has skyrocketed in the last few years.

NVIDIA’s Q2 revenue guidance was huge

On Thursday, the company reported a Q1 quarter-on-quarter revenue increase of 19%, to US$7.19bn, which was nice. But what lit up the stock was the revenue guidance for the current quarter of US$11bn, where the market consensus expectation was “just” US$7.2bn. This much stronger than expected number is driven by very strong uptake of NVIDIA’s AI chips, specifically the latest generation, the H100 (US$40,000 each), which is the successor to the A100 (US$10,000 each). All major Tech companies are developing their own AI models, similar to ChatGPT, and all of them need boat loads of these chips.

As a result of this very strong revenue guidance, NVIDIA shares jumped 24% on Thursday (in the US) and another 2.5% on Friday. But it also pushed ASML up about 10% in 2 days! Why?

TSMC manufactures NVIDIA’s chips … and TSMC is ASML’s biggest lithography customer

NVIDIA is a fabless chip company, meaning it designs its own chips, but outsources the manufacturing of those chips mostly to TSMC in Taiwan, the world’s largest foundry. So, if NVIDIA sees a massive influx in chip orders, TSMC will see its fab capacity utilisation rise. Specifically, TSMC is seeing the utilisation rates of its 5, 6 and 7nm production lines rise. And these critical layers can only be manufactured using Extreme Ultra Violet (EUV) lithography for which ASML is the world’s only supplier. Industry sources are seeing TSMC’s utilisation rates for 6/7nm lines getting close to full capacity for the rest of 2023, while 4/5nm lines are filling up fast.

Given our view that the chip recovery will start some time in the second half of 2023 (see the ASML investment case from 19 May), we believe TSMC may now have to increase its Capex budgets sooner than expected to keep accommodating this surge in demand. In turn, this is good news for chip equipment stocks, such as ASML. And this explains the ~10% share price jump we saw last week.

Naturally, we’re happy with our first international Concierge pick ASML. But we believe there is much more upside this year and next!

Update 19 July 2023: Better than expected Q2 results and increased guidance!

Our overseas Concierge stock pick ASML reported results for Q2 today (June quarter) that we are pretty happy with.

• Sales of EUR6.9bn came in at the high end of the company’s guidance. The market was expecting EUR6.74bn on average.

• Net income amounted to EUR1.94bn (28.1% net margin). The market was expecting EUR1.9bn in net income. The gross margin grew to 51.3%.

• More importantly, new lithography orders in Q2 amounted to EUR4.5bn where analysts on average expected new orders to amount EUR 3.98bn. So, that’s 13% higher than expected!

• And the company’s sales guidance for Q3 amounts to EUR6.5bn to EUR7bn, where the average analyst estimate was EUR 6.51bn. So, we’ll likely see upgrades in estimates there.

Increased revenue guidance

ASML increased its full year 2023 revenue guidance to 30% growth instead of 25% growth, mainly because of additional shipments of DUV (Deep Ultra Violet) systems in 2023. This is the company’s older type technology that commands the highest gross margins. Also, earlier revenue recognition of those systems (on shipment rather than on customer sign off in the fab) is driving revenues higher in 2023.

• ASML’s backlog is now EUR38bn.

• While it’s too early to give guidance for FY24, the company reiterated that trends such as AI, electrification of cars, industrial Internet of Things etc will help drive ASML’s revenues in 2025 to between EUR30bn and EUR40bn with gross margins between 54% and 56%!

• By 2030, it expects to generate between EUR44bn and EUR60bn in revenues with gross margins between 56% and 60%. This is why we think ASML is not just for short/medium term investors. You can own this stock long term!

Needless to say, we’re happy with these results and especially the increased revenue guidance for 2023.

We think the outlook will improve further

We believe DRAM and Flash memory markets will start their recovery in 2HY23, which we expect will translate into stronger order intake in the next 12 months.

We put ASML on Concierge on 19 May at USD 695.93 and it has delivered an 8.8% return so far.

Our target price for ASML is still USD 950 per share on Nasdaq (closed at USD 757.03 last night).

UPDATE 24 August 2023: NVIDIA’s results bode well for ASML

NVIDIA had a blow out quarter and a very good outlook for Q3. We believe this bodes well for ASML.

Check out our article on NVIDIA from 24 August 2023 HERE!

UPDATE 27 September 2023: We are cutting ASML (NASDAQ:ASML)

Although we believe Dutch semiconductor manufacturing equipment company ASML is one of the best Technology companies on the planet, we are cutting the stock from Concierge today.

Following the broad bond sell off in recent days and overall market weakness, the stock fell below our Stop Loss level.

In addition, the ASML chart doesn’t look promising when we look at the technicals, with the 50-day Moving Average now breaking the 200-day Moving Average to the downside (see circle in the chart below).

If the current market sentiment persists for a while longer, we believe the next target level could be as low as US$503 (horizontal line in the chart), which would fill the gap on the chart that was formed in November 2022.

All this leaves us no choice but to cut ASML at a 17% loss.