Core Lithium (ASX:CXO): The share price crashed, but what does FY25 have in store

![]() Nick Sundich, July 9, 2024

Nick Sundich, July 9, 2024

Core Lithium (ASX: CXO) was one of the hottest ASX stocks post-pandemic, not just lithium stocks but all stocks. The company is one of Australia’s newest lithium producers, having begun production at its Finniss Lithium Project in the Northern Territory during April 2023.

However, Core Lithium timed its run pretty poorly. The past year was a volatile one for the company’s share price and it has fallen from $1.67 per share in November 2022 to $0.09 now. Is it time to buy the dip or are you catching a falling knife?

Who is Core Lithium?

Core Lithium’s flagship project is the Finniss Lithium Project covers 500 square kilometres within the NT’s Bynoe Pegamite Field lying 88km trucking distance from Darwin Port.

Lithium was first discovered at Finniss in 2016 and the project has grown ever since. The April 2022 Definitive Feasibility Study (DFS) reported a JORC compliant Mineral Resource of 15 million tonnes (Mt) at 1.3% lithium oxide. The study reported a Pre-Tax IRR of 80%, an NPV of $114m and free cash flows of $158m from $501m revenue. A 180,000tpa operation was anticipated. Keep in mind this was based on a spodumene concentrate price of $981/t, far below the all time high of $8,125/mt in November 2022.

Another thing that was to like about Core Lithium was its leadership. CEO Gareth Manderson spent just over two decades working at Aussie mining giant Rio Tinto both on projects in Australia and Canada.

Production at Finniss began in April 2023.

Core Lithium (ASX:CXO) share price chart, log scale (Source: TradingView)

What’s the big deal with Core Lithium?

Being a lithium company, Core Lithium was a target for investors wanting exposure to the lithium thematic. There is no other commodity undergoing such a rapid expansion in demand over the next decade. But in the last three years, the company has transitioned from explorer to producer, something that cannot be said in respect of many other lithium companies. In April 2022, Core Lithium announced the maiden 3,500 tonne shipment of lithium spodumene concentrate was delivered to Darwin port ready for shipping to Yahua.

Falling lithium prices hurt the company

However, it has not been all smooth sailing. Lithium prices came down from all time highs and may still continue to. And this was not just in spodumene – Lithium Carbonate, for instance, has seen its price drop from an average of US$32,694 per tonne in 2023 to the current price of US$13,012 per tonne. Similarly, Lithium Hydroxide has fallen from US$32,452 per tonne to US$9,591 per tonn

Initially, Core Lithium pledged to remain profitable for a few years even amidst shrinking margins. By the end of 2023 however, it suspended production and told investors it would just focus on processing stockpiled ore.

Spodumene dropped in 2023

The price of spodumene concentrate—lithium ore in layman’s terms— plunged 86 percent throughout 2023. Yes, not good. Most analysts attribute this to Chinese demand dropping in the wake of severe economic turbulence in the Middle Kingdom. Countless economies are also putting their quest for sustainable technology on hold as they battle high interest rates. The US for instance, slowed its EV target from 67% by 2032 to 35%. EVs are continuing to be sold at premiums, making them less appealing to consumers whose income is going backwards amidst high inflation. There is also the reality of increased supply as the world’s lithium producers ramp up capacity.

We noted above that the DFS assumed a price of US$986/t, which delivered Pre-Tax IRR of 80%, an NPV of $114m and free cash flows of $158m from $501m revenue. It is natural investors would get overly excited when prices accelerate to more than 8x that…but now prices are even below that point. Pilbara Metals (ASX:PLS) received barely $800/t in the March quarter of CY24.

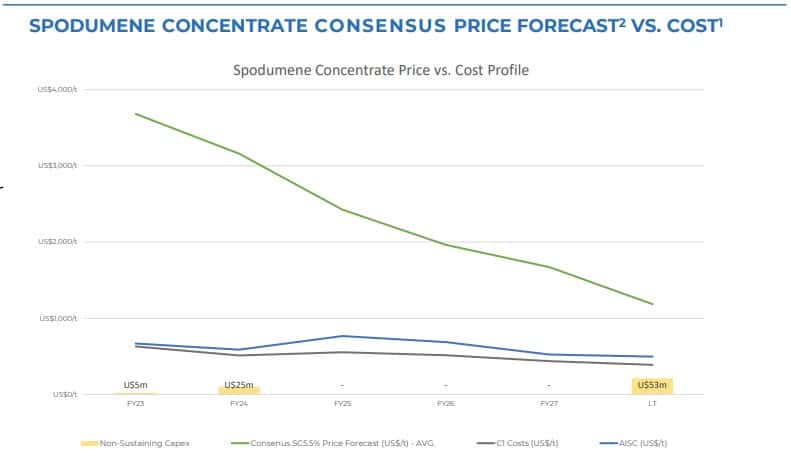

Core Lithium’s pricing estimates (Source: Company)

Why Core Lithium shares gained yesterday

Yesterday (Monday July 8 2024), the company gave an update to investors. Despite pausing production, it is continuing to sell spodumene concentrate it had stockpiled, and it sold 33,027dmt as well as 19,771dmt of lithium fines. Core Lithium is expecting to finish FY24 with just over 95,000dmt produced, which exceeded its previous guidance of 90-95,000. It also exceeded sales guidance with 97,423dmt sold having guided to 80-90,000 earlier.

Core Lithium has an unaudited cash balance of $87.6m, and has commenced assessments to restart production, as well as for drilling programs to commence at promising prospects. This news led to an intra-day price gain of 10%, although there is a still a long way to go for the company to reach its late-2022 highs.

Is this a buying opportunity? The positive side

It all depends on where lithium prices go. Will they rebound? On the positive side, you could just say that those who don’t learn from history are doomed to repeat it. The last lithium boom in 2017 occurred as producers failed to anticipate the demand shock from China’s subsidy-driven roll-out of EVs.

The boom soon turned into a bust as the supply response, especially from hard-rock spodumene producers in Australia, overwhelmed the increased demand. As a result, many lithium projects were deferred or even terminated, building the base for another lithium boom later on.

You could argue history is repeating itself here. The demand for lithium once again soared in 2021 and caught producers off-guard. This time the demand surge was led by Western nations’ decision to take more serious steps in the combat against climate change through green energy transition and EVs.

The negative side

However, the fact is that the lithium market is in surplus and it might take a while to clear. Analysts are not optimistic that this will be soon. Goldman Sachs estimates that lithium spodumene prices will average US$928 per tonne in 2024, US$800 per tonne in 2025, US$978 per tonne in 2026, and US$1,155 per tonne in 2027.

Citi and UBS are similarly bearish on lithium. And in fact, UBS has suggested lithium stocks are still expensive, arguing investors are pricing in spodumene at US$1,200-US$1,480p/t.

And as we noted above, EV sales are continuing to slow. Sure, a 19% rise is expected in 2024, but this would be the slowest in 5 years. Higher interest rates, expensive vehicles, a lack of charging infrastructure all equate to a negative environment for EV sales growth, and thus for lithium and companies in it like Core Lithium.

Some upside to come even if margins shrink

We don’t think lithium prices will return to the crazy highs of 2022. But if Core Lithium can survive the current bear market and prices avoid plunging further, the company can emerge stronger than ever.

Investors should also remember that it is continuing exploration activities at the Finniss project that could have further lithium. Indeed, Core Lithium has a second mine (BP33) that was supposed to commence production in 1HCY24 and deliver 1Mtpa, although this is on ice for now. We also think that it is realistic prospect that it could become a takeover target given it has such a high-quality asset.

So overall, we think even if Core Lithium’s share price sell off could be justified by the fall in lithium prices and the company’s transition from producer to a company with a mothballed project, things could turn around if it re-enters production. However, it will all hinge on where lithium prices go.

What are the best shares to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…