Custodian trades: Here’s why it wasn’t really JP Morgan, HSBC or CBA that risked their money on your stock

![]() Nick Sundich, July 19, 2024

Nick Sundich, July 19, 2024

Custodian trades are trades that make it appear like a major bank has bought or sold your company, but it actually isn’t the case. With custodian trades it is actually the bank buying or selling the stock on behalf of someone else.

What are Custodian trades?

Custodian trades are transactions made by a custodian, which is an institution responsible for safeguarding and managing the assets of an individual or entity. This can include stocks, bonds, mutual funds, and other financial instruments. A custodian is legally responsible for monitoring and reporting the status of investments held in trust accounts to the person or entity whose assets they manage.

When it comes to custodian trades, custodians are charged with carrying out all trading activities on behalf of the trader. This can involve buying and selling stocks for their clients using real-time market data feeds from exchanges, executing orders on their behalf, settling transactions in accordance with agreed upon terms between parties, and providing account statements that accurately reflect the current holdings of each investor’s portfolio.

Custodians also typically handle regulatory compliance issues related to stock trading activities such as ensuring that proper documentation is in place prior to any trade taking place. In addition to carrying out these services on behalf of traders, custodians may also offer other strategic services such as assisting with portfolio optimisation to maximise returns and minimizse risks.

Furthermore, they are often used by institutional investors who need assistance managing large volumes of trades due to their size or complexity. This is particularly true in respect of international shares. In fact, most Australian brokers providing international shares do it through custodian trades. Whether they will or not is a matter up to the individual broker. Either way, it must be disclosed in a product disclosure statement.

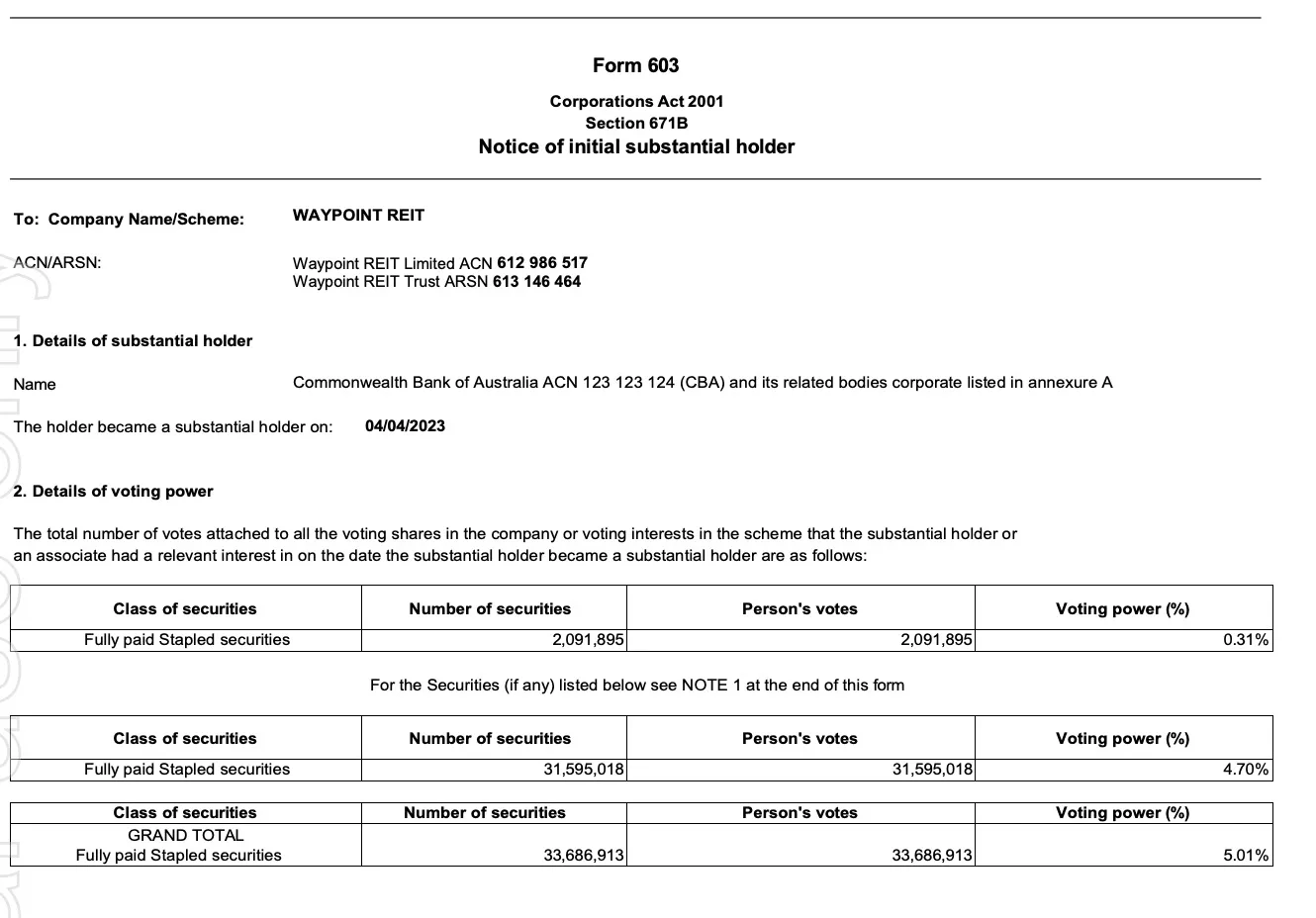

Custodian trades may mean that the custodian is the registered owner even if they are not the beneficial owner. So in this example below, even though the shareholder appears to be CBA, it is actually someone else whom CBA bought on behalf of.

Obviously, it is a different story when a professional fund manager like Australian Ethical (ASX:AEF) buys a stock. Then it is a case of that institution owning the shares in its own right.

Why would certain investors want to use a custodian service rather than DIY?

High net worth and institutional investors often rely on custodians to trade stocks rather than doing it themselves for a number of reasons.

Firstly, custodians are professionals with vast experience in the stock market and are thus better positioned to make informed decisions about trading. They have the expertise required to analyse financial data, identify attractive buying and selling opportunities, and carefully manage investment portfolios.

Secondly, custodians have access to a wide variety of resources that small investors typically don’t possess. For example, custodians can often take advantage of certain professional networks or information portals that give them insight into major market players and strategies. This provides them with an edge that individual investors may not be able to replicate without significant effort.

In addition, custodian trades are regulated by relevant authorities which ensures that they adhere to strict rules and standards when managing investments on behalf of clients. This safeguards their clients from potential losses due to unscrupulous actions or negligence.

The big banks are an extreme example

If you look at the Big Bank’s ownership, it is not uncommon to see >40% of shares owned by custodians, such as HSBC, JP Morgan, National Nominees and Citicorp. Westpac, for instance, has nearly 50% of its shares owned by custodians.

The difficulty is you cannot tell how many individual investors are represented here. This means even though you cannot prove the banks’ claims that they’re ‘Australian-owned’, you cannot disprove it either. If the ABC Fact Check service ever ran an article on the claim that the banks were ‘Australian-owned’, our national broadcaster would conclude ‘It’s complicated’, and rightly so.

What’s the big deal?

Whenever you see that a bank such as HSBC or JP Morgan has become a substantial holder of your company – be aware that it is not really that bank that is the beneficial owner, even if they are the legal owner!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…