Darden Restaurants (NYSE:DRI): A beneficiary of inflation-hit consumers prioritising experiences

![]() Nick Sundich, October 2, 2023

Nick Sundich, October 2, 2023

Darden Restaurants (NYSE:DRI) is the subject of this week’s international stock deep dive. It is the largest full-service restaurant company in the United States, serving over a million customers every day. As interest rates and inflation bite, cash-strapped consumers are prioritising experiences over goods. And this company is seeing the benefits.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Introduction to Darden Restaurants (NYSE:DRI)

This company, headquartered in Florida, owns several restaurant chains. Our favourite is Longhorn Steakhouse, which this author went to during a US trip earlier this year and found it to be the best steak ever.

Darden has other chains including:

- Olive Garden Italian Kitchen

- Cheddar’s Scratch Kitchen

- The Capital Grille

- Seasons 52

- Bahama Breeze

- Eddie V’s Prime Seafood

- Yard House, and;

- Ruth’s Hospitality Group

It has over 1,900 locations across the USA and employs over 190,000 people. The latter (Ruth’s) is another steakhouse chain with over $500m in annual revenue, $860m in annual sales with an average check of $97 and 154 total restaurants. Darden only just bought it in May this year.

Why you might consider it

The company boasts significant scale and as a customer base that is continuing to spend amidst high inflation. Fine Dining is higher margin than fast food or casual dining to begin with, but is also resilient to inflation – not just in the sense that consumers are spending but the company is able to maintain margins by passing on cost increases.

The typical EBITDA margin for casual dining is 11-16% but this is 17-23% for fine dining. 73% of affluent customers expect to maintain or increase spending at dining outlets. It is a segment that it performing even better than pre-COVID levels – each of the last 6 consecutive quarters is 100-108% of pre-COVID levels. In FY23 (the 12 months to May 28, 2023), it recorded $10.5bn in total sales and $8 in EPS. Both of these figures were over 8% higher than the year before.

The company has a strong ESG element with its Darden Foundation that has donated over $110m since 1995 to food charities (helping them buy refrigerated trucks and set up mobile food pantries).

What the future holds

At its FY23 results, the company issued the following guidance for FY24:

- $11.5-$11.6bn in total sales

- 2.5-3.5% same-restaurant sales growth

- ~50 new restaurant openings

- $550-$600m in total capital spending

- $8.55-$8.85 in net earnings per share.

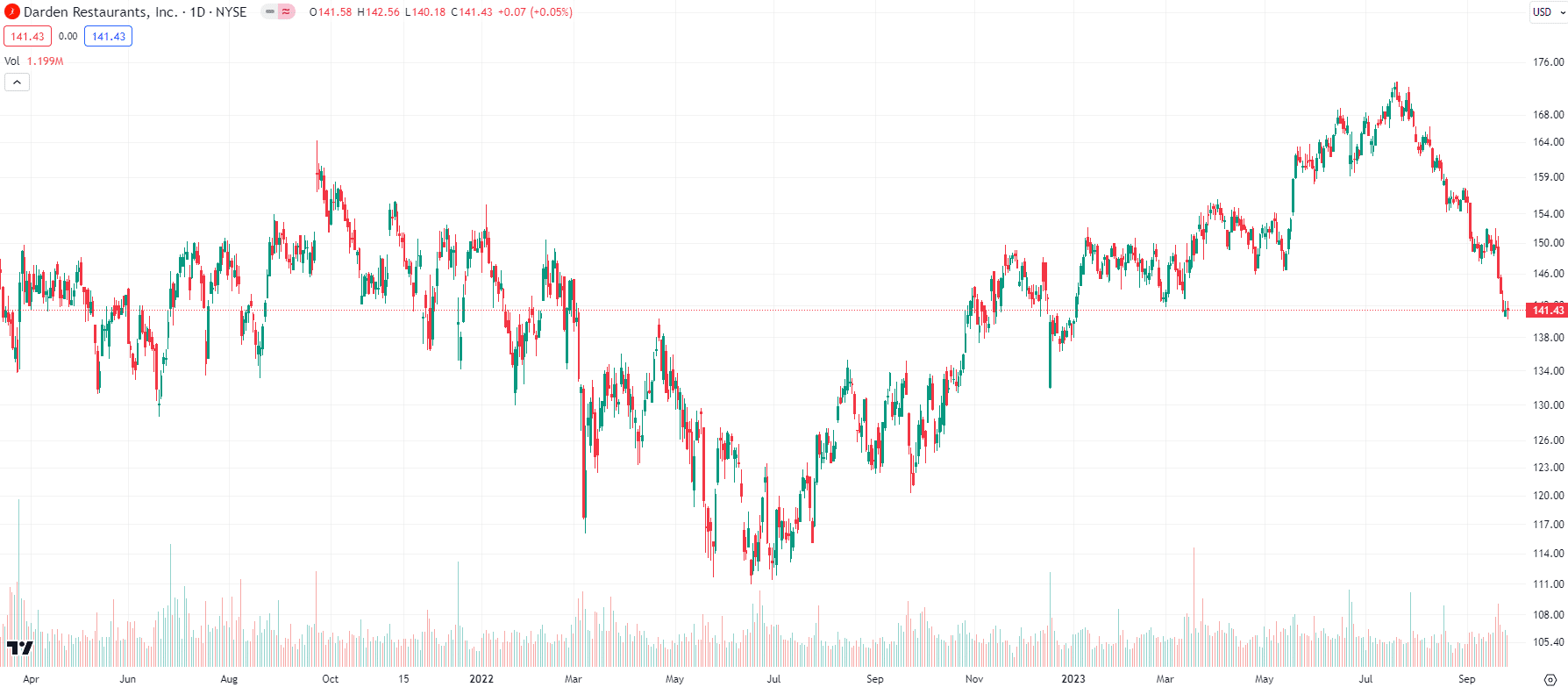

Darden Restaurants (NYS:EDRI) share price chart, log scale (Source: TradingView)

A sell-off in restaurant stocks

During Q1 of FY23, it recorded $2.7bn in total sales with 11.6% growth. However, the company appears to have suffered from a sell-off among restaurant stocks – which even McDonalds (NYSE:MCD) has been unable to escape. There is evidence that some consumers are cutting back on spending – Olive Garden and LongHorn Steakhouse are eating cheaper entrees.

‘Overall, we think the consumer continues to be resilient, but they seem to be a little bit more selective,’ CEO Rick Cardenas told analysts on the company’s conference call. But it has stuck by its guidance and is not leaning into deep discounts to draw customers to restaurants. One tactic is bring back its ‘Never Ending Pasta Bowl’ at Olive Garden. It allows consumers to have unlimited pasta, sauce and toppings for just US$13.99. We’ve seen with Dominos (ASX:DMP), that consumers are willing to pay more for value given its success with the My Dominos Box.

It is important to note that the acquisition of Ruth’s will not be reflected in Darden’s until it has been owned for nearly 16 months. But even so, the company expects now to realise more synergies than previously expected, up to $35m.

A good opportunity at this price

Darden is covered by 28 analysts and the target price is $170.91, well ahead of the $141.43 it is trading at. Consensus estimates expect $11.6bn in revenue (up 11%) and $8.69 EPS for FY24 (up 8%), followed by $12.2bn in revenue (up 5%) and $9.68 in EPS for FY25 (up 11%). It is trading at 16.1x P/E for FY24 and 14.7x for FY25. We think Darden is worth US$190.27 per share on a DCF basis (using consensus estimates) and US$238.69 on a relative valuation basis (using a 23.2x FY24 P/E, using a list of its peers). At the current price, once it has found a technical support level, could be a good chance to buy a good company at a discounted price.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…