Here’s what you need to know about the Digico Infrastructure REIT IPO – the latest data centre opportunity on the ASX!

The $3bn Digico Infrastructure REIT IPO will happen before Christmas and be 2024’s largest IPO – easily usurping Guzman y Gomez (ASX:GYG). Let’s take a look at what you need to know about the listing.

The Digico Infrastructure REIT IPO is Focused on data centres

This REIT will be run by David di Pilla’s HMC Capital (ASX:HMC) and is the third REIT it has listed, not counting the original listing of HMC. HMC Capital has tripled since its late 2019 listing from a share price perspective although its HomeCo Daily Needs REIT (ASX:HDN) is flat and Healthco (ASX:HCW) has halved since its listing.

DigiCo will list having a few seed assets. First, it bought Global Switch Australia for $1.937bn. Global Switch Australia has two adjoining data centre sites in Sydney, representing the only large-scale data centre campus in the CBD and one of the largest of its kind in the entire nation. It has 26Mw capacity, with scope to increase to 88MW in the future, and it made $86m EBITDA during $86m.

Source: Company

Management promised more assets would be forthcoming, predominantly in the United States. And true to their word, they announced the acquisition of iseek, a portfolio of seven co-location data centres. On top of this, HMC already owns US-based infrastructure platform StratCap that has $700m in assets and a $1bn pipeline. The entire portfolio has a 3% average annual contracted rent escalation with customers on long-term deals.

Including assets under exclusive due diligence, it will cost $3.9bn. $2.6bn of this will be paid with the IPO proceeds with the balance negotiated in debt and HMC Capital’s own investments – it has pledged at least $500m. The raise size implies a 26.1x EV/EBITDA multiple for 26.1x.

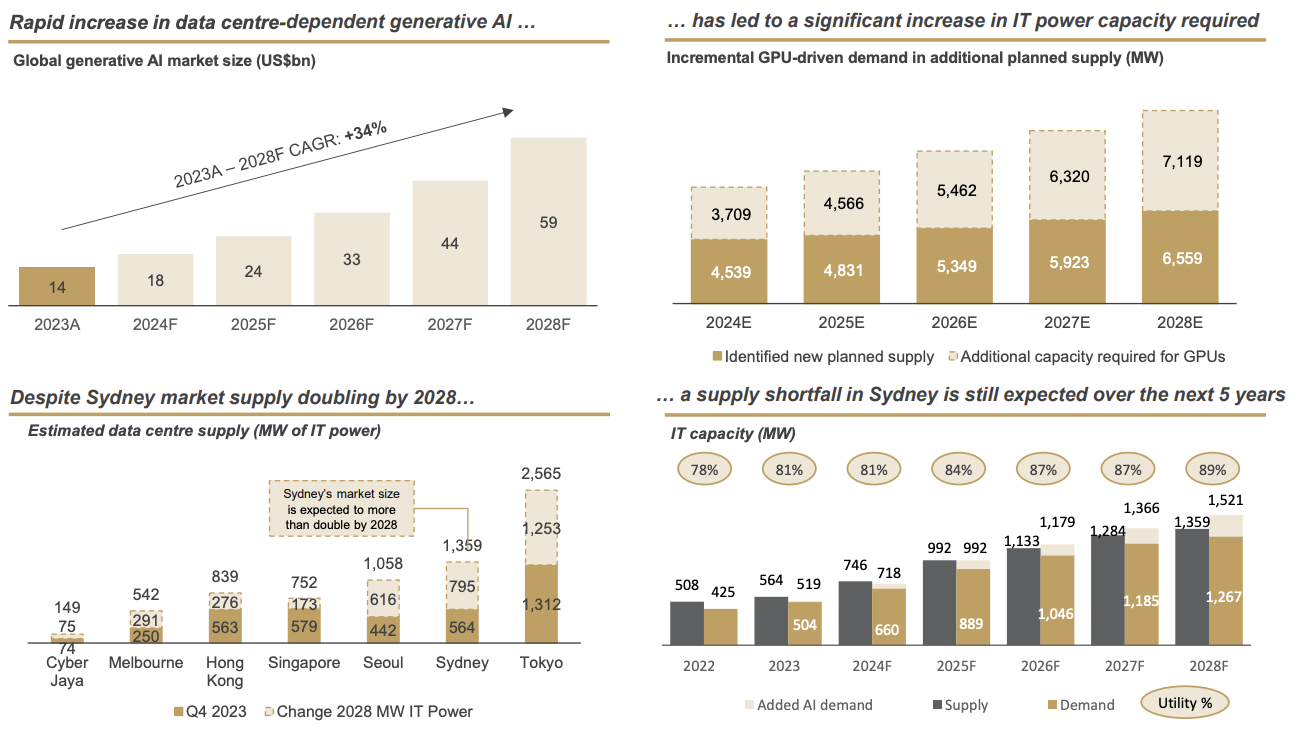

Data centre demand is exploding

Any broker selling an IPO will tell you that the sector the investment they are spruiking is exposed to growth. If you don’t want to take brokers’ words, take the statistics – they don’t lie. In a nutshell: Data centre demand is taking off. This is not just because we are using more and more data with our electronic devices, and also because AI will need more and more data, but companies need their data stored and transmitted securely. You need only look at the success of NextDC and their investors to see how demand has grown.

Source: HMC Capital

Several other things about DigiCo are intriguing

The promise is that DigiCo investors will receive a 4% yield annually, as well as a higher EBITDA margin than high-flying NextDC (ASX:NXT). In return, management will be paid 1.03% of DigiCo’s gross asset value in annual fees to HMC. And it is promised that there is an opportunity for the fund to grow to $15-20bn in the future.

One fascination with the listing itself is that $361.7m, or 22% of the $1.6bn raising, will go towards ‘offer costs’, the bulk of which will be broker compensation although $49m is earmarked for stamp duty of the acquired properties. This is pretty high – normally it is around 6% and very rarely over 10%. Then again, there are four underwriters – JP Morgan, Goldman Sachs, UBS and Macquarie.

The DigiCo board will obviously contain David Di Pilla. The chair will be PwC managing partner Joseph Carrozzi and other board members include former politicians Kelly O’Dwyer and Mark Arbib.

Conclusion

The Digico Infrastructure REIT IPO appears compelling. It is one of the few opportunities to gain exposure to data centres, and with the bonus of dividends which you wouldn’t get from NextDC (at least for the foreseeable future). Obviously the challenge for investors will be to have the same patience that has netted many NextDC investors a fortune, for there could be short-term fluctuations – particularly if the company misses one of its targets. The track record of HMC IPOs should also give investors some food for thought too.

But unless the REIT flops really badly on its listing day, or is delayed into CY25, it will be CY24’s biggest ASX IPO.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…