Dimerix (ASX:DXB): This exciting Phase 3 biotech could be about to follow in the footsteps of Telix and Neuren

Dimerix (ASX:DXB) is one of the few ASX biotechs in the middle of a Phase 3 trial, and it even has data showing the trial is a success. After years of hard work, the company has advanced its DMX-200 drug into a Phase 3 trial, and it has secured commercial deals worth over A$300m even prior to the trial.

Despite being one of the most successful ASX healthcare stocks this year (having gained over 500%), it is priced less than other Phase 3 biotechs, and could gain even more if it is successful – at least if the experiences of Telix (ASX:TLX) and Neuren (ASX:NEU) are any guide.

Dimerix (ASX:DXB) share price chart, log scale (Source: TradingView)

Introduction to Dimerix and DXB-200

Dimerix listed nearly a decade ago with a variety of pre-clinical assets that could fight kidney disease. Eventually it identified DMX-200 as an opportunity and progressed it through the clinic, settling on FSGS when it was clear there was the most promise.

DMX-200 is an oral anti-inflammatory drug called repagermanium, co-administered with an ARB. In other words, is administered to patients already taking the current standard of care (the blood pressure medication known as an ARB) for the treatment of kidney disease. Patients ingest a 120 mg oral dose twice daily. DMX-200 blocks the chemokine receptor 2 (CCR2) pathway, which stops immune cells from moving to areas of the body such as in the kidney where they cause abnormal scarring.

FSGS: A major market need

FSGS is a kidney disease that attacks the kidney’s filtering units where the blood is cleaned (called the glomeruli), causing irreversible scarring and leading to permanent kidney damage and eventual end-stage kidney failure, requiring dialysis or a replacement. The average time from a diagnosis of FSGS to the onset of complete kidney failure is only five years and it affects both adults and children as young as two years old. 60% of those who receive a kidney transplant risk will get re-occurring FSGS in the transplanted kidney. It is a disease that can impact both adults and children and can be caused by a variety of conditions. There are no drugs specifically approved for FSGS anywhere in the world. Any drugs that are used, target symptoms rather than the disease itself.

FSGS is a major market with approximately 220,000 diagnosed sufferers worldwide, about 80,000 of which are in the US. Dimerix has estimated that the biggest 7 markets alone are worth US$3bn per annum – Japan, China, the EU, UK and USA.

Dimerix’s current trial

Dimerix is now in Phase 3 with DMX-200 for FSGS (ACTION3). If successful in this study, the company is expected to gain approval in the US and EU. ACTION3 is currently being conducted at over 70 clinical sites in 11 countries including Australia, New Zealand, Taiwan, Hong Kong, France, Denmark, the UK, Spain, Argentina, Brazil, and the US. New clinical sites have also been planned for China, Malaysia, Italy, Germany, Portugal, and Mexico to enhance the recruitment process further.

There are 2 endpoints to ACTION3, both of which measure creatinine, a chemical waste produce of creatine and is removed from the body by kidneys. The first is the uPCR (urinary Protein to Creatinine Ratio), which essentially measures protein that has leaked into the urine relative to creatinine. The second is eGFR (estimated Glomerular Filtration Rate), the flow rate of filtered fluid through the kidney in millilitres per minute.

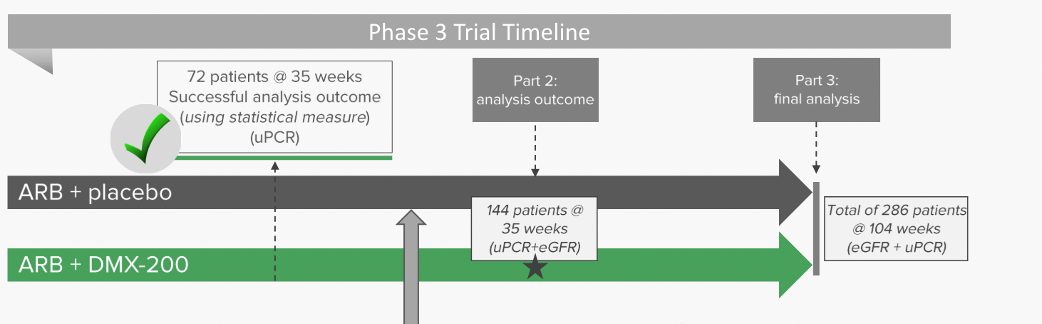

In March, Dimerix announced the first interim analysis to gauge whether the drug was showing efficacy and whether or not it was on track to meet its objective if completed. These results were positive. The analysis, measuring proteinuria from the trial’s first 72 patients, showed DMX-200 was performing better than the placebo in reducing proteinuria. This analysis was a pivotal point as poor results could have meant the trial would be discontinued.

Not only could the trial continue but it allowed Dimerix and its stakeholders to be optimistic that a statistically significant and clinically meaningful result was possible. The Independent Data Monitoring Committee formally recommended the trial continued in light of the results, and also because there were no safety concerns. The positive results from the Phase 3 Part 1 trial paved the way to move ahead with Part 2 of the study. Part 2 will enrol ~144 patients enrolled for 35 weeks’ treatment and will include children up to 12 years old as well as adults.

Source: Company

Although Dimerix doesn’t plan on announcing further interim results prior to mid-CY25, the company will announce when it has enrolled all patients – something which is anticipate in the September quarter of CY24. This would provide a closer estimate as to when exactly these results would be expected. On the investor call of 27 May, to discuss the licensing deal, DXB indicated that it has enrolled roughly 100 patients so far. Earlier in May 2024, Dimerix was permitted by UK regulators to include children from ages 12-17 into the ACTION3 study in the UK, in approving the company’s Paediatric Investigation Plan (PIP) for the UK. The company previously had plans for paediatric treatment approved in Europe and the USA.

Laying the foundations for commercialisation

In October 2023, the company signed a licensing deal with Advanz Pharma, a UK specialty pharma company. Advanz has the right to commercialise DMX-200 for FSGS in the UK, EU, Switzerland, Canada and New Zealand. In return Dimerix received A$10.8m in an upfront payment, followed by up to 132m euros in milestone payments, plus tiered royalties on sales. DXB retained the rights to DMX-200 in all other territories and indications. Although DXB would continue to fund and execute the ACTION3 Phase 3 study, Advanz assumed responsibility for the submission and maintenance of the necessary regulatory filings in the applicable territories, along with all sales and marketing activities.

In May 2024, Dimerix signed another licensing agreement, partnering with Taiba – a privately owned Middle Eastern therapeutics company. Taiba obtained exclusive rights to register and commercialise DMX-200 for the treatment of FSGS in the United Arab Emirates (UAE), Saudi Arabia, Oman, Kuwait, Qatar, Bahrain and Iraq.

These 7 markets have a population of over 100m between them, a high presence of Chronic Kidney Disease (CKD) generally as well as government-funded healthcare. Dimerix will receive up to A$120.5m in upfront and milestone payments, as well as tiered royalties starting at 30% on net sales and decreasing by 5% every 5 years down to 20% on net sales. The upfront payment was US$350,000 (or ~A$0.5m) with the balance to be received on certain development and sales milestones being achieved. As with the Advanz deal, Taiba assumed responsibility for sales, marketing and making the regulatory submissions in the licensed territories. With the Advanz deal, this takes the total milestone payments Dimerix is eligible for to A$340m.

What’s next?

The key milestone investors have to look forward to is the outcome of Part 2 of the ACTION trial. Investors should expect results in the middle of CY25. Specifically, around 35 weeks after the final patient is enrolled in the trial, a step anticipated in the current quarter, considering it had 100 patients enrolled as of late-May. Dimerix has indicated that it will announce when this has occurred, and investors will be able to pencil in an approximate date. The company does not plan on announcing interim results prior to that, although there could be newsflow prior to that, particularly licensing deals for the USA and China which the company is pursuing. Such a deal or deals could be even bigger than the existing agreements with Advanz and Taiba.

Our friends at Pitt Street Research have covered the company for nearly a year now and have valued Dimerix at A$0.84 per share in a base case and A$1.07 in an optimistic case, assuming eventual commercialisation of DXB-200. Even though shares have re-rated significantly, the company is still behind other companies at Phase 3 – even companies without interim data such as Opthea (ASX:OPT). And of course, as we noted earlier in this article, the case studies of Telix and Neuren depict that a company can quickly gain traction (i.e. generate tens of millions of dollars of sales) if a company’s drug works and there are no alternatives around.

Dimerix is poised for success

It may be another 2 years before we see DMX-200 commercialised, but the company has come a long way and is so close to the finish line. If Telix and Neuren are any guide, the company could make a substantial amount of money in a short space of time if it can roll out DMX-200 across its major markets.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…