Elders (ASX:ELD): Is this figurehead of the ASX agriculture sector set for a more stable future?

![]() Nick Sundich, November 26, 2024

Nick Sundich, November 26, 2024

If you thought mining & resources stocks were volatile, you probably haven’t been watching the share prices of agriculture stocks generally, and of Elders (ASX:ELD). After a stellar period of growth between 2014 and 2019 (the first 5 years of CEO Mark Allison’s tenure) where shares quadrupled, they are only up 13% ever since. Shares are heavily exposed to commodity prices (particularly livestock and fertiliser prices). But as Elders released its FY24 results, and revealed a profit less than half of what it was in FY23, it unveiled a $475m acquisition.

Source: TradingView

Who is Elders (ASX:ELD)

Elders literally is an ‘all-rounder’ acting as a one-stop-shop for agricultural services. It provides financing, banking, real estate, wool, grain and livestock trading – in all cases providing middleman services. As a consequence, it does not have the usual production risk that comes with companies that directly sell agricultural produce into the domestic and export markets.

As we mentioned above, Elders has a long history being founded in 1839. The company’s story that almost came to an end during the GFC. Until that point, previous management tried to diversify the company into non-agricultural areas in light of the very long drought during the 2000s, doing so with debt. Current CEO Mark Allison took the job in 2014 and undertook a share consolidation and asset sale that took the company back to what it had always been good at.

In a recent episode that was curious to say the least, Allison announced he was leaving in late 2022, only to backflip in mid-2023 after a replacement couldn’t be found. He’ll be at the helm until at last September 2026.

Being in agriculture is a blessing and a curse

Agriculture should be an economically resilient industry, at least in theory. Ultimately, for 2024-25, the Australian Department of Agriculture, Fisheries and Forestry forecasts the gross value of agricultural production to be $86.2bn, up from $82.5bn the year before and $80.6bn in the year before that. Moreover, the value of agricultural exports is $68.5bn, or $72.6bn when fisheries and forestries are taken account of.

This all flows through to Elders’ bottom line. More production means more business for Elders and high prices (combined with the essential nature of many agricultural outputs) means higher profit margins. On a side note, we also observe this is translating into higher prices for fertilisers and crop chemicals, and Elders is benefiting because it provides these supplies.

Despite being a ‘middleman’, Elders is still exposed to agricultural prices and these prices are dependent on two things – agricultural conditions and export markets. Agricultural businesses suffered from the drought of 2017 to 2019, along with the bushfires in late 2019. This meant less livestock could be bred, less grain could be grown and those that could were of lower quality than otherwise would be the case.

Post COVID-19, the rains have returned and, despite some flooding events, conditions have been better for agriculture and prices have followed suit. Russia’s invasion in Ukraine also had an impact, particularly in the grain market.

Elders’ FY24 results

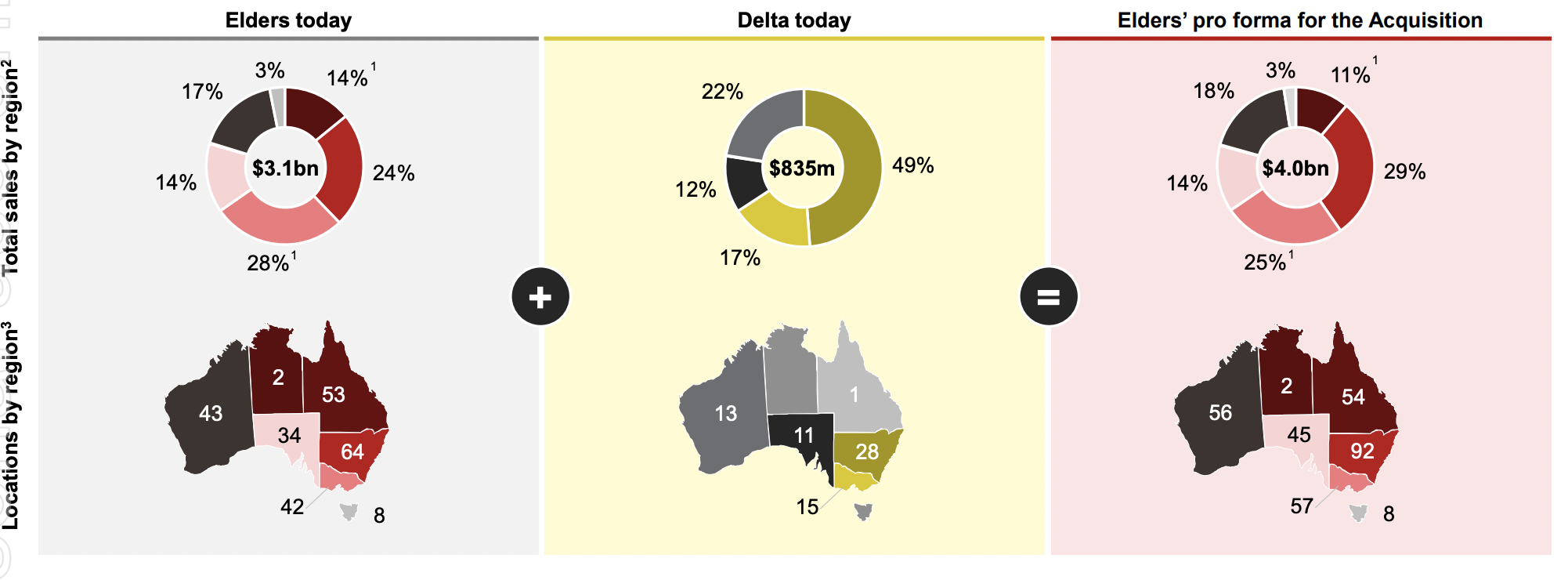

Elders uses an October to September financial year, and so just released its results. The company was able to record a better result than investors had feared earlier in the year because second half trading was better than the first. The company’s sales came in 6% lower than the year before, at $3.1bn. Its underlying EBIT came in 25% lower, at $128m, and its statutory profit came in 55% lower at $110.8m. Elders paid an 18c per share dividend. The company told investors that it expected price stability in livestock markets compared to the year before.

On the very morning it released results, Elders told investors it was purchasing Delta Agribusiness for $485m – 60% in cash and the balance in shares. Delta provides rural products and advisory services and is the third-largest supplier in the nation. Delta has a geographic footprint of 68 locations, with 450 staff across them. Elder investors have been told that Delta’s business model is complementary to Elders, strengthening its existing offerings and providing synergies to both companies. It has been estimated that net EBITDA synergies of $12m per annum will be generated (Excluding implementation costs), along with mid teens-digit EPS accretion post-synergies. Even so, Delta will run as a stand-alone business and not be folded into the broader group.

Source: Elders

There’s reason for upside

Between this acquisition, and the expected turn of commodity prices as agricultural conditions improve, analysts are optimistic about the company. Their 12-month target price is $8.89, a 19% premium to the current price. For FY25, they expect ~10% revenue growth (to $3.42bn) and for 43% EPS growth (From 41c per share to 59c per share), although it is not clear whether or not this accounts for the current number of shares on issue or the future amount once this deal is closed.

But if you thought investing in agricultural stocks is too risky to entertain, you might just be wrong if you look at Elders given its market position.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here are the biggest tax implications of investing in stocks and how to slash your bill

The tax implications of investing in stocks are not often considered when you first start investing, although you may get…

Nufarm (ASX:NUF): Hit by lower commodity prices, adverse weather and Trump’s tariffs

Have some sympathy for Nufarm (ASX:NUF). Companies capped at over $1bn rarely plunge 30% after reporting results unless the results…