Eli Lilly (NYSE:LLY): This US$700bn company is set to beat Novo Nordisk & Ozempic even with this month’s hiccup

For investors who missed the run in Novo Nordisk shares, Eli Lilly (NYSE:LLY) appeared to be the next best thing. And perhaps those who bought into Eli Lilly would have less regrets with Novo Nordisk shares having shed 60% in the last year and Eli Lilly shares gone well. On a market cap basis, Eli Lilly is over 6 times bigger than Novo Nordisk and is actually the world’s largest pharmaceutical company.

Like Novo Nordisk, it has had a historical business aiding people with diabetes and obesity, but also has oncology, immunology and neuroscience drugs too.

But…things took a turn last week, leading to shares falling 17% in a week.

Introduction to Eli Lilly

This company, headquartered in Indianapolis, was named after the Civil War Union Army Veteran and pharmaceutical chemist who founded the company in 1876. It has been a ground-breaking company for the bulk of its existence, being the first to mass produce a polio vaccine and human insulin. It was also the first pharmaceutical company to adopt the concept of straight-line production – an industry standard nowadays.

The company made $34bn in revenue during 2023 and a $5.2bn profit, with its key revenue drivers being diabetes drugs Humalog and Trulicity. It is eyeing off future opportunities, particularly using radiopharmaceutical drugs to treat cancer.

It is up 400% in 5 years and was flat in the last year. That is, until a clinical trial didn’t show the best results.

A rival to Ozempic?

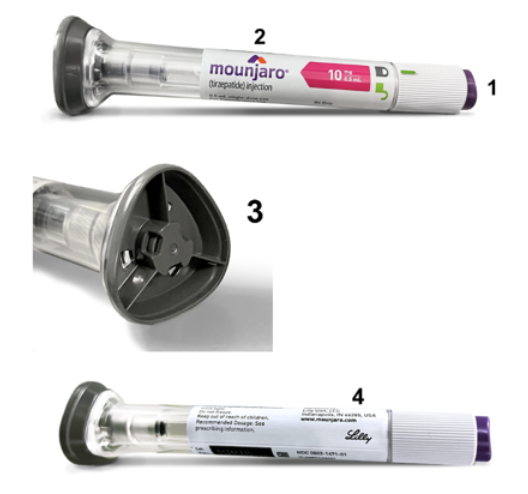

Eli Lilly has a drug called tirzepatide that regulates blood sugar levels and thus helps people with diabetes. In May 2022, it was FDA approved as an adjunct to diet and exercise to improve glycemic control in adults with Type 2 diabetes, under brand name Mounjaro. 18 months on, the FDA approved it as an obesity treatment, under the brand name Zepbound. Yes, the FDA has endorsed it as an obesity-killer. Specifically, it is approved for adults with obesity or who are overweight with at least one weight-related condition.

Eli Lilly’s Mounjaro/Zepbound drug; Source: Company

The drug was shown in a Phase 3 clinical trial to help people lose up to 52 pounds in 16 months – results unparalleled by any other drug. Zepbound is a GLP-1 agonist like Ozempic is, but it imitates a second hormone, called GIP, which – along with reducing appetite – may also improve how the body breaks down sugar and fat.

There has been demand for these drugs, just like Ozempic. In 2023, Eli Lilly made US$5.1bn from Mounjaro in the first full year of sales and 2024 sales were $11.5bn. Mounjaro was the company’s second biggest revenue generator behind Trulicity. Trulicity is an injectable drug to help diabetes, but is dulaglutide based and has not been as effective at helping with weight loss even if it is effective with diabetes and some are using it to help with weight loss.

There’s good news and bad news

Eli Lilly is well positioned to make a mark in the weight-loss drug market. Being first to market will help it build trust and entrench loyalty. Remember that Ozempic is only approved for diabetes and not for obesity. Also, as a company with established facilities, Eli Lilly will be better positioned to meet demand through its existing facilities.

It also has the balance sheet to invest – it told investors in May 2024 it would invest US$5.3bn in a manufacturing plant in Indiana to expand the production of Zepbound, along with other medicines. And even before the investment, the ongoing supply squeeze has ended. It is not the company saying that, but the FDA which had put Zepbound on the list of medicines with shortages, then took it off after nearly 2 years on the list.

But there’s some bad news. Earlier in August 2025, results of a clinical trial for a new experimental pill (orforglipron) was less effective than anticipated – and less effective than Zepbound. Eli Lilly still hailed the results as a success and pledged to submit to the FDA for approval. This was a direct move to counter a rival pill developed by Novo Nordisk which the FDA is already considering and showed numerically higher weight loss numbers. Both Novo Nordisk and Eli Lilly think pills will be the future – why inject yourself when you can just take a pill once a day without any regard to food or water?

There’s also the question of pricing. Zepbound will cost consumers US$1,060 for a month’s supply and this may not be covered by insurance companies, let alone by Medicare. In other countries it is cheaper, but the Trump administration is pressuring US medical companies not to dump the drugs on the cheap in markets like the UK. And so Eli Lilly has publicly disclosed that it will increase the price in the UK from 122 pounds to 330 pounds.

However, if it as effective as has been shown in the clinical trials, people will find a way to afford it. Also, as a high-growth company, there is the risk investors may lose confidence in the company if growth slows down substantially. And the company, like Novo Nordisk, will need to deal with fake and compounded versions of its medications. In fact, it is already fighting lawsuits with med spas purportedly selling fakes.

There’s growth ahead but it isn’t cheap

For CY25, consensus estimates expect US$61.6bn revenue and $22.04 EPS as compared to $45.2bn revenue and $11.71 EPS in 2024. In CY26, $73.1bn in revenue and $28.77 EPS, followed by $84.9bn revenue and $34.81 EPS. If this eventuates, the company will have nearly doubled its revenues and tripled its EPS in just 3 years.

Analysts’ mean price is US$895.77 vs its $701.23 current share price. Its P/E may suggest modest caution with 23x for CY26 but it has a PEG of 0.7x.

On the basis of its PEG multiple, you could conclude that Eli Lilly is worth a buy. We would concur that Eli Lilly has growth ahead of it, although we would add warning that it won’t be an entirely smooth or certain path ahead.

What are the Best ASX stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…