GameStop (GME): How it became the greatest ever meme stock in 2021

The transformation of GameStop Corp. (GME) into a “meme stock” is a fascinating event. It underscores the power of collective retail investor action in the financial markets and its exemplification through social media. It was the first, but was by no means the last.

Who is GameStop?

GameStop Corp. is a video game, consumer electronics, and gaming merchandise retail chain based in the United States and listed on the NYSE.

Before its surge as a meme stock in early 2021, GameStop faced significant challenges that threatened its traditional business model including the increasing digital distribution of games. These were leading to declining sales and profits.

The company had unveiled downsizing plans for its brick and mortar network and to move towards a digital model. The addition of Ryan Cohen, co-founder of Chewy, to its board in January 2021 (right before it became a meme stock) was seen as a positive move. But the meme stock phenomenon dramatically shifted the trajectory for GameStop, injecting unprecedented volatility into its stock price and putting the company at the front and centre of investor attention.

What happened to GameStop? How did it become a meme stock?

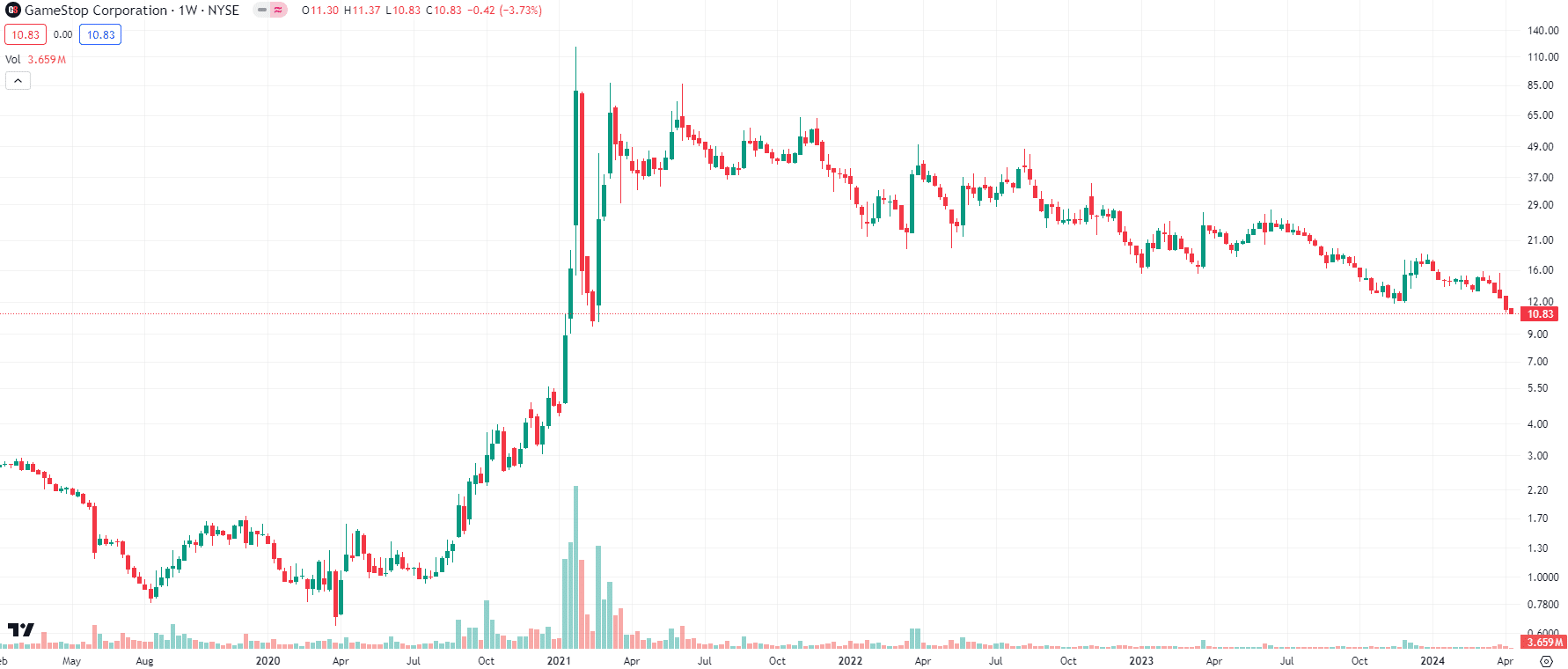

This phenomenon occurred primarily in early 2021, when a sudden and explosive increase in GameStop’s stock price occurred. It captured global attention, challenging traditional market dynamics and investment strategies in a way no other stock price rise had before. Sure, it was not the only company to have an unexpected share price rise, but it was the first to have been sparked by a Reddit thread.

GameStop (GME) share price chart, log scale (Source: TradingView)

A hit on Reddit

The epicenter of the GameStop saga was the subreddit r/wallstreetbets (WSB), a community on Reddit where individuals discuss stock and options trading. Members of WSB began to champion the company as a good investment, highlighting the company’s potential for a turnaround and criticising the extensive short positions held by hedge funds. The narrative quickly gained traction, painting the scenario as a battle between the everyday individual investor and the Wall Street elite.

At the time, GameStop was one of the most shorted stocks on the market, with hedge funds betting against the company’s success due to its struggling brick-and-mortar business model in the digital age. The concentration of short interest (bets that the stock would fall) was quite high. But as retail investors began buying up GME shares and options en masse, the stock’s price started to rise precipitously.

Power to the people

This increase forced short sellers (primarily hedge funds) to buy shares to cover their positions and minimise losses, a process known as covering. This buying pressure from short sellers covering their bets further drove up the price, creating a feedback loop that dramatically inflated the stock’s value. This phenomenon is known as a “short squeeze.”

The situation quickly went viral, drawing attention from the media, celebrities, and even lawmakers. As the story spread, more retail investors were drawn in, eager to participate in what many saw as a once-in-a-lifetime opportunity to make significant gains and, for some, to take part in a larger movement against perceived Wall Street manipulation. There was significant volatility along the way, especially are more and more investors joined in.

Adding fuel to the fire

At the height of the frenzy, several brokerage platforms, most notably Robinhood, restricted trading of GME and other stocks experiencing similar volatility. These restrictions fuelled further controversy and discussions about market fairness and the rights of individual investors, propelling the GameStop saga into a broader debate about retail investing and market regulation.

The saga was amplified by meme culture, with participants creating and sharing memes to celebrate gains, encourage holding, and recruit more investors to their cause. This blend of humour, defiance, and community built a narrative that was irresistible to many, transcending traditional investment logic.

What has happened since then?

Well, there have been plenty of other meme stocks, although none have had such an impact as GameStop, even if some of the companies went up exponentially. Some examples in the US have included Tilray Brands, Joby Aviation and Rivian Automotive. On the ASX, some examples include Douugh and BrainChip.

Turning to GME as an individual company, it has retreated from all time highs. Market observers overall aren’t that optimistic outlook, with some analysis suggesting that the company is still grappling with its business model transition and facing an uphill battle in achieving a significant turnaround. The stock’s performance over the past year, including periods of underperformance against both the specialty retail industry and the broader US market, underscores the challenges it faces in regaining its footing.

What was the big deal about this saga?

The GameStop episode highlighted the growing influence of retail investors and the potential for social media to mobilise individuals toward collective action in the financial markets. It challenged traditional market dynamics, prompted discussions about market regulation, demonstrated the disruptive power of digital platforms in shaping financial narratives and gave rise to the term “meme stock”. If it could happen to a company like GME, who knows which company could be next?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…