Are Guzman y Gomez investors seeing the chickens come home to roost after its post-1HY25 results crash?

![]() Nick Sundich, February 27, 2025

Nick Sundich, February 27, 2025

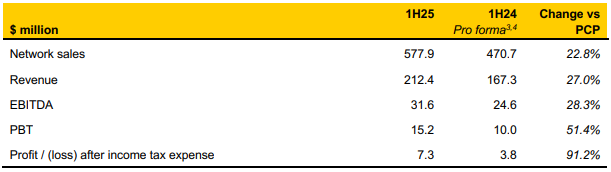

Guzman y Gomez (ASX:GYG) investors lucky enough to buy in at the $22-per share IPO are still sitting on a hefty gain. Those who bought at above $40 per share, where it was sitting not too long ago, would be disappointed. GYG shares retreated after its 1HY25 results, even in spite of the company announcing growth. Was it something in the results investors didn’t like, or were they just profit taking?

Were GYG’s results bad or just not good enough?

At face value, it’d seem the latter. Those percentage figures look great, don’t they?

Source: Company

The company is continuing to open stores, reporting 19 new restaurants, 16 of which were in Australia, taking its total to 239. Whilst companies like Dominos (ASX:DMP) are struggling, it’d seem this company is thriving. After all, franchisees of GYG achieved a median return on investment of 50%. The corporate margin was 18%, up from 17.5% a year earlier.

And the company’s early forays into Asia were paying some dividends. Singaporean revenue was $30.2m, up 36%, while Japanese revenue was $4.6m, up 8.6%.

Now it wasn’t all perfect. The performance in the US isn’t going that well with an EBITDA loss of $5m, 62% higher, and sales just $4.9m, down 13%. But this is just a minority proportion of the group.

The company reported sales for the first 7 weeks of CY25 to be 12.2% above the year before. It guided for the full year to:

- 31 restaurant openings in Australia

- 17.8% corporate restaurant margins

- An 8.3% franchise royalty, and

- To exceed its FY25 NPAT prospectus forecast.

So what are Guzman y Gomez investors’ problems?

Seemingly, investors took the chance to take a profit. And perhaps they fear the forthcoming escrow release. On the day following the release of its FY25 results in August, certain GYG shareholders (which include private equitor TDM Partners as well as Barrenjoey) will be free to sell all of their shares.

These shareholders have already had some of their shares released from escrow and these amount to 13.6% of GYG’s shares on issue. In other words, they were free to sell. It is not yet clear if they have although it was subject the condition that the VWAP of GYG shares exceeds $22 by at least 20% for 10 straight trading days – that was easily met.

The reality

GYG has big growth ambitions – to over 1,000 stores in Australia eventually. But it is very highly priced – at 282.3x P/E for FY25 and 123.8x for FY26. It is even 40.6x for FY29 – 4 years from now.

The company may reach its targets eventually, but is no guarantee to reach the heights. Much of the growth in the company’s share price was driven by hype and FOMO (Fear of Missing Out). Fund managers can be just as embarrassed by missing out on the next big thing than by investing into a stock that turned out to be a dud.

We are not hoping the company goes down because it would be bad for the ASX, to have one of the few high-profile and successful IPOs in recent years to eventually turn sour. But we think the company has gone up too much relative to the progress it had made since listing and we would not be surprised to see a further retreat. Not necessarily in the weeks to come, but perhaps at its FY25 results when the escrowed shareholders are free to sell – unless the company absolutely shoots the lights out.

Stock investing is always a risky business, but particularly when you’re getting into a company driven by hype rather than fundamentals. Yes there’s a chance for further gains, but a risk for big losses too.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Proteomics’ PromarkerD test for DKD has been launched in Australia, and two more tests will launch later in 2025

2025 has been, and will continue to be, a big year for Proteomics, which has just launched PromarkerD onto the…

Should I buy Apple shares from Australia? Can the US$3.3tn behemoth grow any further?

Investors asking themselves, ‘Should I buy Apple shares from Australia,’ are not just considering buying shares any company, but the…

Will Ozempic hurt healthcare stocks? Here are 5 reasons we don’t think so

Will Ozempic hurt healthcare stocks? Investors who’ve been selling healthcare stocks left right and centre – except Novo Nordisk of…