Here are 5 ASX stocks to give up on – if you haven’t wisely done so already

In this article, we recap 5 ASX stocks to give up on – if you haven’t made the correct call to do so already.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

It is more common for us to write about stocks to look at, but this article outlines some stocks to look away from. All stocks will tell you that they have experienced management, a great product, a great market opportunity, a good outlook and implicitly that they will succeed.

But not all do succeed, even if they have all those factors. And of course not all companies really have all those factors. Even those that do may not have it that way forever.

Yes, some companies do succeed. But not all companies that succeed do so immediately, some take their time. You cannot mistake a company experiencing short-term setbacks as opposed to a company that will never make it.

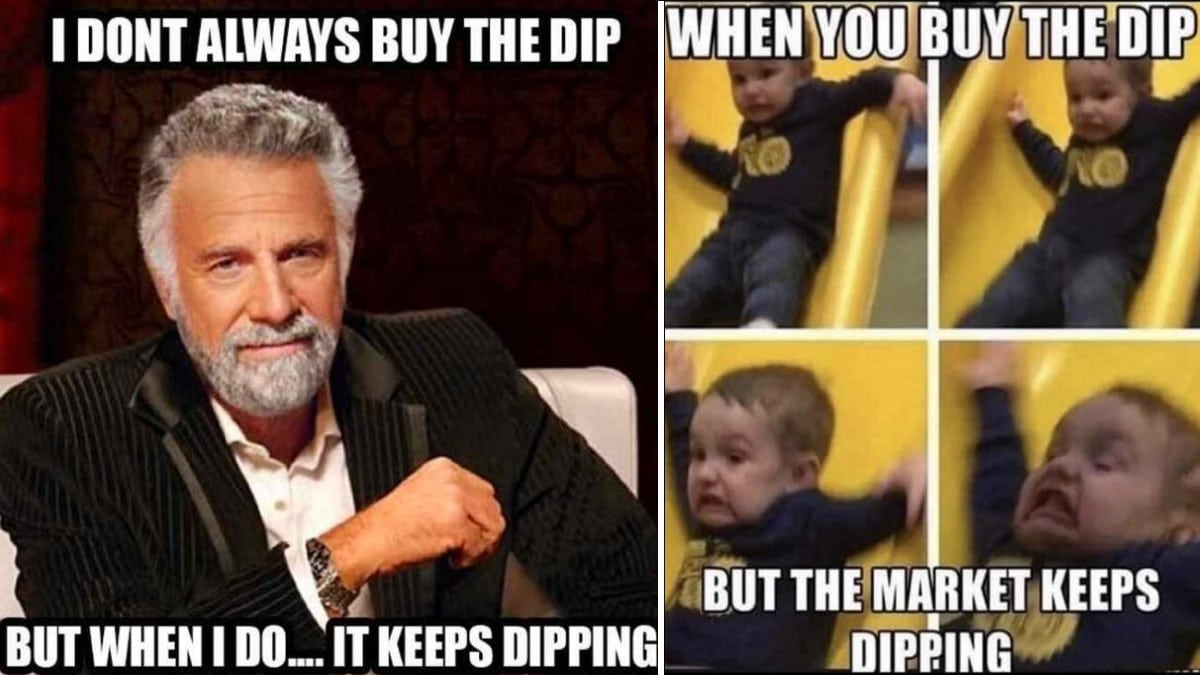

And just as much money can be lost on fallen companies that investors are betting will turn around, both new investors thinking it is time to ‘buy the dip’ and existing investors that want to recoup existing losses.

Source: WallStBets/Reddit

5 ASX stocks to give up on

Zip (ASX:Z1P)

Why would you invest in this one? At first glance, there are a few compelling reasons.

Now that Afterpay has merged into Block, Zip is the biggest BNPL stock. Just maybe, people struggling in these touch economic times will turn to BNPL to pay for essentials, just as they turned to it in good times to pay for avocado toast. It has exposure beyond Australia, including in the enormous US market. And it is becoming profitable.

Yeah, nah.

It is in a fight for its survival to become profitable, hoping that being ‘EBITDA profitable’ will buy it extra time. It has either sold up or wound down operations in 10 of the 14 global markets it operates in.

The threat of regulation, specifically the prospect it could be forced to conduct credit checks on would-be customers, remains as big of a threat as it ever has been.

And spiralling interest rates will increase its debt costs. Hence, why it had to undertake a $24.7m placement just as a ‘liability management exercise’ – in other words, reduce debt. While it did reduce debt by nearly $200, it closed 1HY23 with $2.67bn in borrowings and another $361.55m in convertible notes and warrants.

AMA Group (ASX:AMA)

We’ll be the first to admit that we made a mistake on this one, riding it down to the depths of despair.

It provides repair services and missing parts for road vehicles.

The onset of COVID-19 hit the business because lockdowns meant fewer cars on the road. The company, and the broader industry, has also been hit by persistent component shortages. It also had to undertake a major restructuring of its balance sheet. On top of all this, the company was hit with multiple lawsuits – one from former chief executive Andy Hopkins and another by operators of Smashcare, a smash repair franchise that AMA acquired last year.

So the end of COVID should’ve been a good thing, right? Maybe, but supply chain issues and labout shortages have continued to decimate the company. And there’s no sign things are improving, just look at its latest quarterly.

The stock slashed its FY23 EBITDA guidance to $60-$68m, down from $70-$90m. Although the company recorded positive cash flow from operations, it was only $323,000 and was negative by $3.7m for the 9 months in FY23 to date. It closed the quarter with $20.5m in cash, down from $33.3m at the end of the last quarter.

We don’t think it is beyond the realm of possibility that its share price could rebound, but at the very least, shareholders should wait to see real evidence that the company is turning around.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

AMP (ASX:AMP)

So many companies have fallen in the long-term, but AMP is arguably the biggest fall from grace given what a proud history it had. It was founded in 1849 as a life insurer and only listed in 1998 after being demutualised. Over the next 2 decades, it entered new businesses including financial advice, banking, superannuation and investment managements.

Its reputation was trashed by the Royal Commission through stories of fees for no service, inappropriate advice, charging fees to dead people, policy churning and employing incompetent financial advisers.

The stock is trading at $1.12 per share, down 83% since 2015, and the mean target price among the 9 analysts covering it is $1.17. That doesn’t look like there’s much confidence to us.

The company is hoping to turn things around and is pining its hope on challenger bank AMP Bank and its wealth management platform North. But the industry is ultra-competitive and generates margins nowhere near as high as they used to be.

Magellan (ASX:MFG)

We will freely admit that it is not in our interest for this company to rebound because we think out Concierge product is a direct competitor with traditional fund managers.

At the end of 2021, this stock had $116.4bn in FUM – $30.2bn retail and $86.2bn institutional. Just before Christmas 2022, it gave a trading update revealing it has $50.2bn in FUM – $20.6bn retail and $29.6bn institutional.

Ouch. And things haven’t gotten any better in 2023 – its FUM has shrunk further to $41.4bn. Heck – it fell by $1.3bn in the month of May 2023 alone.

Obviously the investment markets have not performed well, but the issue has been compounded by investors pulling their money – most notably British wealth manager St James’ Place. Magellan been unable to justify the premium fee structure it charges above its peers.

New CEO David George has promised to return FUM to above $100bn, it will be a long way back to the top – although not as long way as getting its share price from $8 to over $60 as it was pre-COVID.

Just as we noted with AMA, we want to see evidence that this is happening before any investors put a cent of their hard earned money into this stock.

Appen (ASX:APX)

Since mid-2020, this stock has fallen from over $40 per share to less than $3 per share.

Appen sources and sells machine learning data to train AI algorithms. Historically, its client base was concentrated around a handful of big tech companies and predominantly for advertising purposes.

Appen has been diversifying its customer base into new clients and markets although investors fear these cash flows won’t be as reliable and as strong as before. This has been showing in its results and in repeated failure to meet its own guidance, let alone consensus estimates.

In FY22, which is the calendar year, its revenue fell by 25% and its bottom line swung from a $28m profit to a $239m loss.

In 2023, the stock has surpassed $3 on a couple of occasions over hype that it can capitalise on the rise of ChatGPT and hope that things can be better because of new management and a cost reduction program.

But it is not being shown in the bottom line. Its revenue in the first four months of CY23 is 21.4% below the prior corresponding period and even underlying EBITDA is down from $7.9m in the black to $12.4m in the red.

You would only buy this company if you were extremely desperate to reduce a capital gains tax bill.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…