Immutep (ASX:IMM): Set to commercialise its lung cancer treatment by 2027

![]() Nick Sundich, May 7, 2025

Nick Sundich, May 7, 2025

Developing a cancer drug is a long journey, but Immutep (ASX:IMM) is more towards the end than the start. A few months ago, when it received its latest capital injection (of $100m), the company told its investors it was less than three years away from commercialising its cancer drug.

Immutep’s share price may not suggest it has gone very far, but its market cap (which is several times more than what it was pre-COVID) suggests otherwise. And it now belongs in the ASX 300. Clearly, there is something brewing here. And perhaps a few more investors woke up to that fact earlier this week.

Immutep’s (ASX:IMM) history

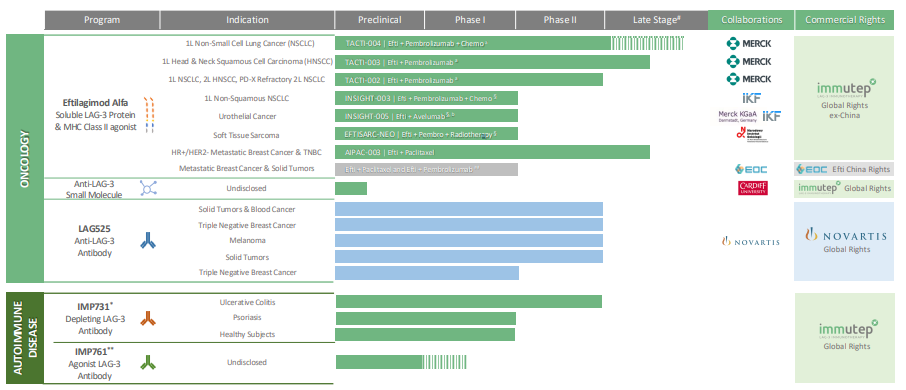

Immutep’s immunotherapy drug is Efti (IMP321), short for Eftilagimod Alfa. Efti works by activating the immune system to work in combination with existing treatments. Specifically, it activates the lymphocyte activation gene 3 (LAG-3), a protein that regulates immune responses. It is combined with Merck’s Keytruda cancer treatment and coupled with chemotherapy.

Keytruda is a cancer therapy that is the first anti-PD-1 (programmed death receptor-1) therapy used to treat cancers, particularly head and neck squamous cell cancer. It has been commercialised for 10 years and generates over US$20bn in sales for Merck. In fact, it is the largest seller. However, it has severe side-effects that can lead to patients discontinuing the treatment. Efti, when combined with Keytruda, reduces the toxicity, particularly in lung, breast and head and neck cancer and makes the treatment work better.

Immutep’s history goes back to 2001 when it was founded by Dr Frederich Triebel, who named it after the Egyptian God of medicine, Imhotep. And LAG-3’s history goes back to 1990.

In a good position

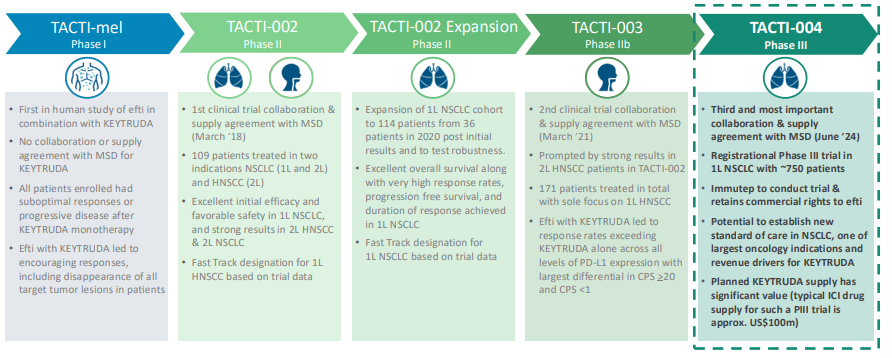

Immutep has its Efti drug in multiple clinical trials against multiple indications. The latest (i.e. the most advanced) are head and neck cancer where the company is about to launch into a Phase 3 trial following strong Phase 2b results. Immutep’s results were spectacular – management claimed the results were amongst the highest recorded for a chemotherapy-free approach in negative PD-L1 patients.

The initial results, shown last year showed an outperformance of 31% ORR (Objective Response Rates) vs 18.5% for Ketruda alone. Follow-up results, issued earlier this week showed a 17.6-month median Overall Survival vs 7.9-11.3 months compared to current standards of care. The big deal is that this was in head and neck cancer patients with PD-LA CPS <1.

What is the big deal here? A patient with a CPS of <1 indicates low or no PD-L1. PD-L1 is a protein involved in immune checkpoint inhibition. Patients without it may not be able to benefit from treatments like Keytrude and Efti because they work by interacting with these proteins.

Source: Company

When it reaches commercialisation, Immutep has a market of US$24bn for Non-Small Cell Lung Cancer (NSCLC) alone – a figure expected to double by 2031. What’s more is that the company has FDA Fast Track designation for this indication. After a long journey, Immutep is just starting Phase 3 trial for this indication with 750 patients. The company has consulted with the FDA about the trial and it has given positive feedback for the trial. This may sound like much ado about nothing, but it would have been a major setback for the regulator to require changes to the trial.

Interim analysis is expected in late 2026-mid-2027. This may seem a while, but the drug could thus be commercialised within 3 years given it has a Fast Track Designation.

Source: Company

Another Phase 3 company

Companies in Phase 3 are a fascinating breed. Having passed Phase 3, it is clear their drugs work in humans and are more likely to make to market than not. Nonetheless, Phase 3 trials still have to be done, and this can take years and years to complete. Companies can still attract investor attention through licensing deals and pursuing other indications. And when the trial is a few months from reporting, investors can get excited about forthcoming results.

At over A$500m Immutep may be a big too highly-priced to buy right now considering it is yet to start the trial, in our view. There are cheaper stocks in Phase 3 like Dimerix and Paradigm Biopharmaceuticals. However, Immutep is a company to keep your eyes on.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Who are the most successful investors of all time? Here is our top 4

Who are the most successful investors of all time? This is a question up for debate although here are our…

AFT Pharmaceuticals (ASX:AFP): A gem of a dual-listed healthcare company

AFT Pharmaceuticals (ASX:AFP) may not spring to mind as the best company to have come out of New Zealand. Many…

R&D: Which companies spend the most on it and how do they set their budgets right?

R&D (Research and Development) is an important activity undertaken by ASX-listed companies of all kinds. This is most prominent in…