Insurance stocks: How do they operate and are they a safe investment?

![]() Nick Sundich, October 26, 2023

Nick Sundich, October 26, 2023

‘Uncertainty is the only certainty there is’, wrote mathematician John Allen Paulos and insurance stocks help their clients deal with uncertainty.

There is high demand for insurance services, both from consumers and from businesses facing heightened risks in the next few years. However, both markets will want ‘value for money’ and to be paid out when insured events happen. And so we thought we’d recap how these companies operate and whether they really are as safe an investment as you may think.

How Insurance stocks operate

Insurance companies operate by providing financial protection against potential loss or damage. They are a form of risk management that individuals and businesses can use to safeguard themselves from unexpected events.

The basic principle behind insurance is the transfer of risk from an individual or business to an insurance company. In exchange for paying a premium, the insurance company agrees to provide coverage for certain types of losses or damages. This allows individuals and businesses to protect themselves from financial ruin in the event of an unforeseen disaster.

Types of Insurance

There are many different types of insurance that exist, each designed to protect against specific risks for specific clients. Some common types of insurance for consumer markets include health insurance, life insurance, property insurance, and liability insurance.

- Health Insurance: This type of insurance helps cover the cost of medical expenses for individuals and their families. It can include coverage for doctor visits, hospital stays, prescription drugs, and more.

- Life Insurance: This is a contract between an individual and an insurance company where the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person. This provides financial support for loved ones in the event of a tragedy.

- Property Insurance: This type of insurance protects against damage to physical property, such as homes or businesses. It can cover losses due to fire, theft, natural disasters, and other events.

- Liability Insurance: Liability insurance provides coverage for legal expenses and damages in the event that an individual or business is found legally responsible for causing harm to another person or property.

- Business Insurance: Then there are several types of business insurance, ranging from providers to SMEs to large corporate providers such as QBE (ASX:QBE).

How Insurance stocks protect themselves

If no insured events happen, then it is great to be an insurance stock. But, not so much if insured events do happen. So how do they protect themselves?

First of all, insurance stocks carefully assessing risks and implementing strategies to minimize potential losses. This includes setting premiums at a level that is appropriate for the risk being insured, as well as establishing policies and procedures for handling claims. Insurance stocks may just opt not to insure certain events at all – for instance, some smaller companies may refuse to insure drivers with a bad record. Larger companies may for instance refuse to insure larger businesses for the risk of employee misconduct damaging the company if it cannot see there are appropriate policies in place that might stop such occurrences from happening.

And if clients keep claiming, insurance stocks may hike premiums accordingly to account for the risk. Insurance companies also use reinsurance, which is when they transfer a portion of their risk to another insurance company. This helps spread the risk and prevents one major claim from causing financial strain on a single company.

Investors are liking insurance stocks right now

Insurance stocks are amongst the ASX’s best performers, at least among large caps. While the ASX 200 has barely budged in 12 months, QBE is up 29% in the last year and IAG is up 18%.

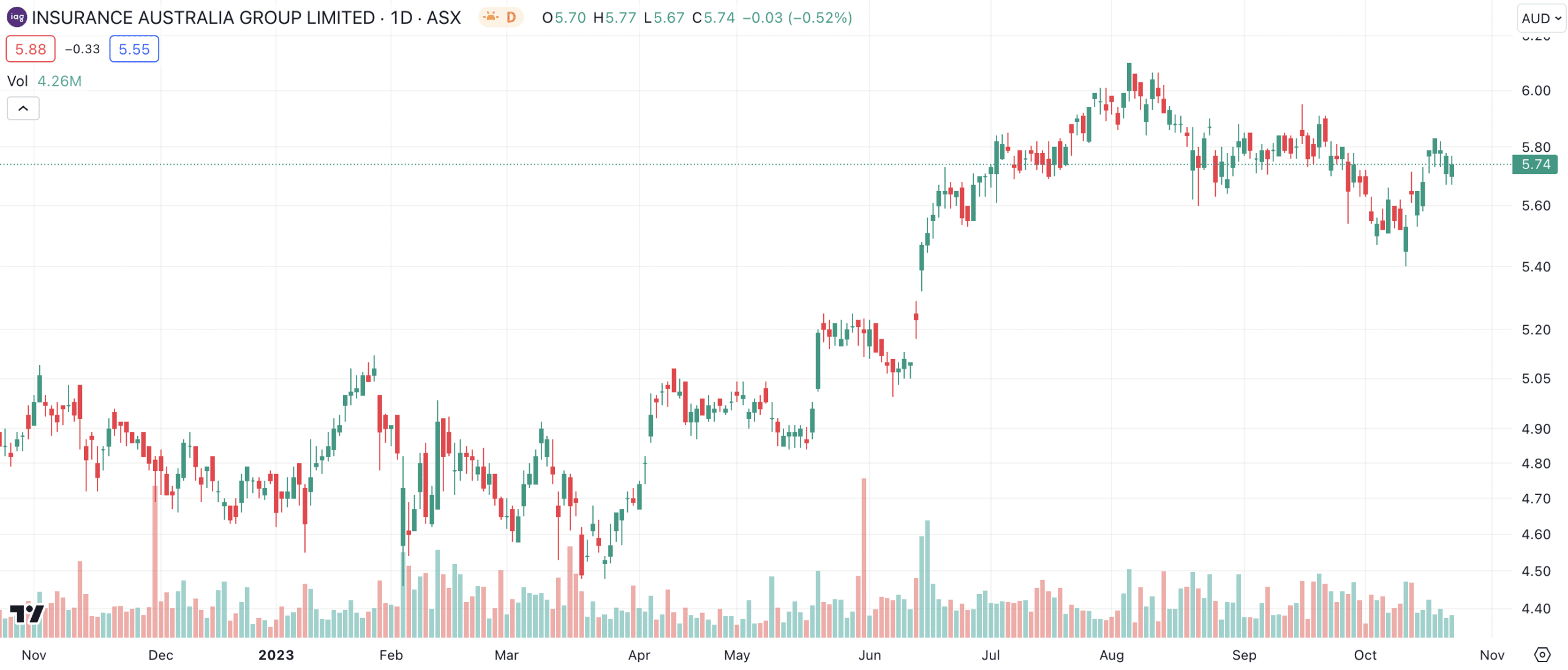

QBE (ASX:QBE) share price chart, log scale (Source: TradingView)

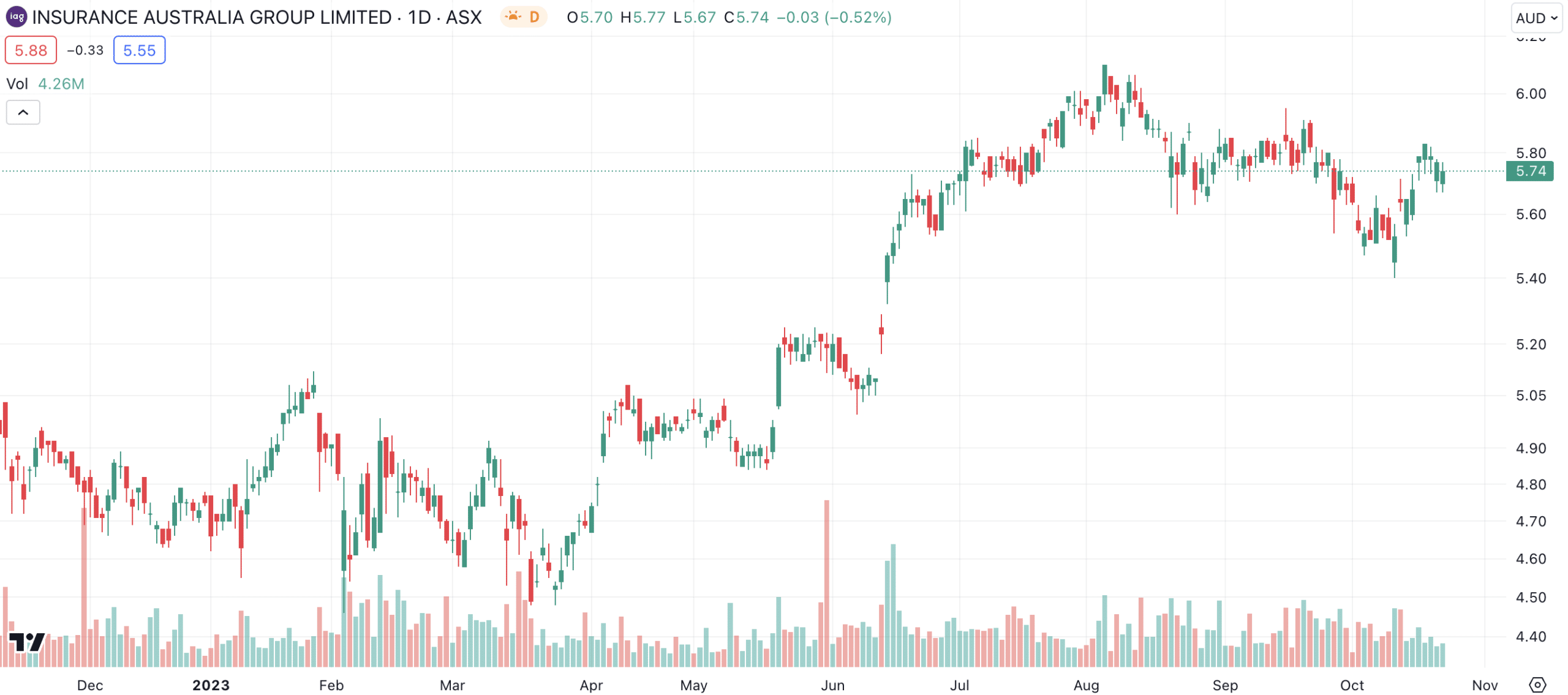

IAG (ASX:IAG) share price chart, log scale (Source: TradingView)

Yes, even IAG after it faced 15,000 claims worth A$350m after Cyclone Gabrielle back in February. Although it paid a total of $10.2bn in claims (a figure up 20% in 12 months) in FY23, this stock wrote $14.7bn in premiums (up over 10%) and made a profit of over $800m (more than double from last year).

As for QBE, it made wrote US$20bn in premiums in FY22 (which is the calendar year) and made a US$750m profit. For the first half of CY23, it wrote $12.8bn in premiums and made a US$400m profit (well ahead of the US$48m profit it made in the first half of CY22).

Consensus estimate for FY24 expect over 20% earnings growth for QBE but only 9% growth for IAG. The mean target price for IAG is only 3% higher than the current price but 16% for QBE. And so investors looking into insurance stocks may want to consider QBE ahead of IAG.

Conclusion

Insurance companies play an important role in protecting individuals and businesses from potential financial losses. By effectively managing risks and utilising various strategies, they are able to provide a safety net for consumers and businesses who may face unexpected events.

Understanding how insurance companies operate and protect themselves can help individuals make informed decisions when it comes to purchasing insurance coverage. So, it is important to research and carefully consider the different types of insurance stocks available to investors.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…