Intelligent Monitoring Group (ASX:IMB): It is Australasia’s largest independent security monitoring provider and is up >200% in 12 months!

![]() Nick Sundich, September 17, 2024

Nick Sundich, September 17, 2024

Intelligent Monitoring Group (ASX:IMB) has had a terrific FY24. It made >$40m EBITDA, went from being the 3rd largest company in its industry to the largest and set the foundations for future growth.

Intelligent Monitoring (ASX:IMG) share price chart, log scale (Source: TradingView)

Introduction to Intelligent Monitoring Group (ASX:IMB)

Intelligent Monitoring Group is a provider of security solutions. It is Australasia’s largest independent security monitoring provider that ensures the safety and protection of over 200,000 businesses, homes, and individuals, round the clock. In August 2015, the company was listed through the reverse takeover of East Africa Resources. It was known as Threat Protect Australia until adopting its current name in 2021.

The company has grown both organically and through acquisitions, most notably, the acquisition of ADT. ADT did several things for IMB including taking it from the third largest provider to the first largest, it added 340 staff members and A$95m in revenue as well as DIY solutions to the company’s portfolio.

CY24 has been a pivotal year too with the company snapping up Adeva, AGC Integration and Alarm Assets. Adeva is a national security provider that was founded in 2013 and provides premier security services and data management technologies. It serves both the commercial and home security markets with products including intercoms, CCTV, personal safety alarms and commercial payment solutions.

Less than a month after unveiling the Adeva acquisition, IMB announced the acquisitions of AGC Integration and Alarm Assets Group (AAG). The company raised $19m in a Placement to fund these acquisitions. AGC is an enterprise-focused security provider that offers physical solutions such as IP Video Surveillance and Access Control, backed by technicians and service management staff. AAG is a diversified provider, offering home and commercial security services, including the installation, maintenance and monitoring of such systems. It too has a blue-chip client base including government clients and ASX 100 companies.

In a secure industry, facing further growth

The security industry is a highly defensive industry to begin with. That is to say, the industry tends to be immune to macroeconomic conditions. The company has protected itself further with a defensive business model based on recurring revenue on a subscription basis, generated from a sticky customer base including government, personal emergency response, and other commercial customers.

Moreover, the security monitoring industry in Australasia is highly fragmented with a large number of small players. This situation works in favour of larger players such as Intelligent Monitoring Group which can use its strong market and financial position for further consolidation.

We see potential for further industry growth in 2 respects. First, the growth in DIY solutions. The penetration rate of 24-hour home security monitoring services in Australia is only 5%, compared with 23% in the US . The adoption of DIY security systems is the primary reason for higher penetration of home security products in the US. The popularity of such systems has increased due to their low cost, ease of setup, and smartphone-friendly implementation. The versatility of DIY home security will allow non-traditional home security service providers to boost the overall home alarm system adoption rate.

Second, the growth in AI. Yes, we know the phase ‘AI’ is thrown around a lot and may not disrupt every single industry, and we do acknowledge that human control and intervention will be essential, but hear us out. IMB’s position as the largest player and its AI-solutions will ensure that it derives benefits.

AI-powered video analytics will allow security systems to automatically detect and track suspicious behaviour, and identify potential threats in real time. AI-powered security systems will progressively integrate with other technologies, such as drones, robots, and IoT devices, to create a more comprehensive and efficient security infrastructure. This will enable security systems to monitor and respond to threats across a wider range of environments and contexts.

FY24 was a great year

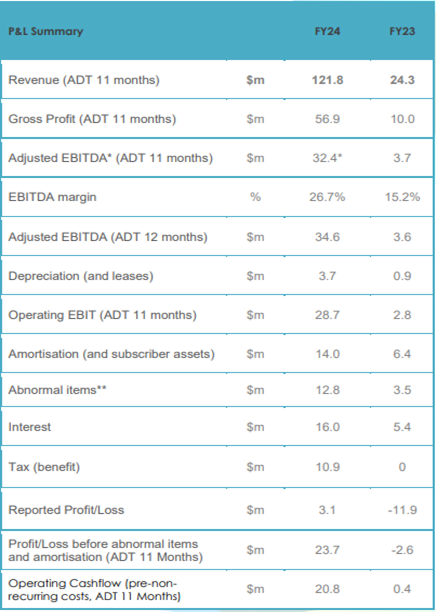

Intelligent Monitoring recently released its results for FY24, the 12 months to 30 June 2024. The acquisition of ADT was only completed on 1 August, hence it was only reflected in 11 months of the 12 in FY24. The company’s revenue was 400% higher than the year before. Of course, IMB’s revenue was increased by the ADT acquisition, although the result was aided further by IMB’s enhancement of the business. The monthly revenue run rate was doubled in 12 months.

IMB had guided to $33.5-34m normalised EBITDA and $32-32.5m adjusted EBITDA. It exceeded its normalised EBITDA guidance and met the higher end of its adjusted EBITDA guidance, recording $34.6m normalised EBITDA and $32.4m. The company’s EBITDA margin increased from 15.2% in FY23 and 26.7% in FY24. The company recorded a $13.9m loss on a statutory loss including abnormal items (including ADT acquisition, refinancing and other one-off costs). Without abnormal items, the company would have made a $12.9m profit.

Turning to its cash flow statement, the company was able to generate positive cash flow from its operations even with the abnormal costs, generating $8.1m as opposed to a $3.1m outflow the year prior. It closed the period with $25.5m in cash and cash equivalents, nearly five times more than the year before (Figure 2). With an adjusted net debt of $68.3m, the company is at a Net Det to Underlying EBITDA of 2x and Net Debt to proforma EBITDA of 1.7x. The company successfully refinanced its debt and twice raised equity.

Source: Company

Looking to FY25, the company’s goals include:

- Surpassing >$40m in EBITDA

- Refinancing its debt to a commercial banking facility

- Growing national coverage of its people

- Enhancing its technology operating platform, and

- Improving supplier relationships.

IMB has told investors it would be open to further M&A activity, subject to capacity, strategy and value accretion.

Conclusion

Our friends at Pitt Street Research have covered the company since December last year, initiating coverage at A$0.57-0.75 per share, but recently upgraded its target to A$1.05-1.23 in light of IMB exceeding the initial target price and its FY24 results. We encourage readers interested in finding out more about the company (its history, the management, the forthcoming catalysts and risks associated with an investment in the company) to read Pitt Street’s in-depth reports.

As FY25 gets underway, IMB investors can be confident in the company. It is a leader in a defensive sector with tailwinds for organic growth and is coming off a record year so far as sale and customer numbers are concerned.

Intelligent Monitoring is a research client of Pitt Street Research.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Paladin Energy (ASX:PDN) Jumps 10% as Revenue Surges Past A$177M

Paladin Energy (ASX: PDN) Surges as Uranium Producer Era Begins Paladin Energy (ASX: PDN) gave investors reason to cheer as…

Metal Powder Works (ASX: MPW) Falls 14% — Growing Pains or a Setup for Long-Term Gains?

Metal Powder Works Plunges 14% as Growth Story Faces Reality Check Metal Powder Works (ASX: MPW) took a sharp fall…

Blinklab (ASX:BB1): Is this exciting company the next ResApp?

Blinklab (ASX:BB1) is the answer to the question of how you could help children with autism – a response that…