Ioneer (ASX:INR): How has this ASX lithium stock gained 35% in 2024 in spite of the lithium bear market?

![]() Nick Sundich, November 18, 2024

Nick Sundich, November 18, 2024

Ioneer (ASX:INR) is one of the few lithium stocks to have had a good 2024, even with lithium prices in the toilet. When we were looking at a list of ASX lithium shares, and saw this company as one of the few winners in the lithium space (with a 35% gain in CY24), we couldn’t help but investigate as to why this is the case.

Ioneer (ASX:INR) share price chart, log scale (Source: TradingView)

Are investors overly optimistic about the company’s project? Has it made more concrete progress than many of its peers? Is it driven by NASDAQ investors, given the company is dual listed? It is because it has a high level of institutional ownership and analyst coverage? Perhaps all those factors are relevant. But arguably, the biggest factor is that Ioneer has become the first US lithium project approved by the Biden administration.

Ioneer’s Rhyolite Ridge Project

Ioneer picked up the Rhyolite Ridge project, which lies in the far west of Nevada, in 2016. The project has 3 distinct streams with their own mineral resources.

- Stream 1 has 153Mt containing 1.33Mt lithium and 11.26Mt boron

- Stream 2 has 142Mt containing 1.2M lithium and 1.16Mt boron

- Stream 3 has 56Mt containing 0.72Mt lithium and 0.39Mt BAE.

75Mt across all three streams are Measured.

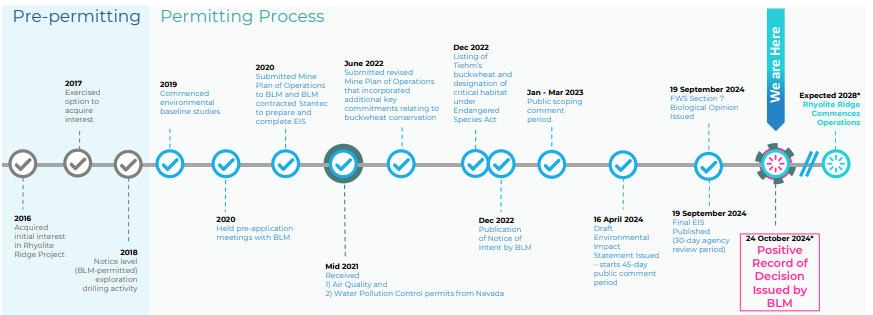

It has been a long journey to get to the point it is at now, but that point is the point of being about to commence construction with production scheduled for 2028. Once production commences, a 26-year life is anticipated.

Only last month, the company received its federal permit, making it the first US lithium project approved by the Biden administration, not to mention the first new lithium production in 6 decades. A Final Investment Decision has not yet been made, but this is anticipated during the March quarter of CY25.

Source: Company

Source: Company

It is hoped that the project will supply batteries for more than 370,000 US-made EV vehicles, and will provide 500 jobs during construction, along with 350 during production. The project will quadruple US lithium production and account for 5% of demand in 2030.

Getting the project to this point was not all a smooth process for Ioneer – the company had to change its plans a number of times due to environmental concerns (particularly to avoid an endangered plant species called Tiehm’s buckwheat) as well as Indigenous heritage concerns.

Ioneer has multiple offtake agreements including with Ford and PPES (a joint venture between Toyota and Panasonic). The company has signed a deal with Sibanye-Stillwater to be a 50% JV partner for US$490m, and has made a conditional commitment with the US Department of Energy Loan Programs Office for up to US$700m. Even though construction has not commenced, over 70% of the engineering work is complete.

A Lithium boron project

Crucially, the project is a lithium-boron deposit and one of only two such deposits in the world – with the other one in Turkie. Rio Tinto has a couple of boron projects, one in Serbia and the other in California’s Mojave Desert, although the former has been in the PFS stage since 2012 and the latter’s reserves are diminishing.

Boron is a very versatile element and is used in so many applications such as magnets in wind turbines, computer screens and fertilisers. There are very few substitutes for it. Rhyolite Ridge will produce boric acid which is the primary feedstock chemical for the industry. Demand has been growing by 4% per year and 2024 is expected to be the year that demand will exceed supply.

2025 will be a big year

So there you have it. It turns out lithium companies can do well at low prices, if they have a spectacular project with big resources, binding off-take agreements and blessings from regulators. And so maybe investors should not shun the sector altogether.

Looking specifically at Ioneer, should you buy now or is it too late? If all runs smoothly and you’re willing to hold for several years, it probably isn’t too late to hop on board now. But any delays to the FID, construction or commencement of production would not help the company’s cause.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…