IPD Group (ASX:IPG): Its the best way on the ASX to gain exposure to electric vehicles, but still cheap

![]() Nick Sundich, October 24, 2024

Nick Sundich, October 24, 2024

If you thought all IPOs that listed during the pandemic turned out to be flops, you’d be wrong – because IPD Group (ASX:IPG) has been one exception. It has grown from a $100m company to a $500m company in less than 3 years…but it still could be a bargain. Hear us out.

Who is IPD Group?

IPD Group is a company that provides electricity services. Its flagship brand IPD is a distributor of electrical equipment, such as distribution boards, switchboard systems and power meters. IPD has thousands of customers which include switchboard manufacturers, electric wholesalers, and electrical contractors.

The group has 3 other businesses:

- CMI, a manufacturer and distributor of electrical cables and speciality plugs

- EX Engineering, specialists in the supply, modification, repair and design of hazardous area electrical equipment,

- Addelec a provider of engineering services with EV charging infrastructure specialisation

The former two businesses were bought during FY24 with $65m in fresh capital.

Why IPD has done well

Australian power consumption keeps going up in conjunction with population growth and adoption of new technologies, from EVs to data centres. Although the average energy use per person can fluctuate annually, the country’s total generation and consumption are only going in one direction. In 2022-23, 274.5 terrawatt hours were generated, up 10% from a decade ago.

Because of rising energy usage (and costs), infrastructure operators are upgrading their assets and putting more effort into proactive maintenance to avoid the costs of potential malfunctions. According to the Australian Bureau of Statistics, private capital expenditure on equipment, plant and machinery grew by 14% – from $13.8bn to $15.8bn – in the past five years.

Additionally, asset owners monitor their energy usage more regularly, which IPD can also help with. The company sells products to commercial buildings and utility operators, providing them with the ability to analyse energy usage at a granular level., Using IPD’s equipment, customers can also get early indications of problems and obtain necessary data to ensure they can earn and maintain sustainability certifications, such as Greenstar and NABERS.

A way to gain exposure to EVs on the ASX – and perhaps the best way

IPD’s most significant end-market users are commercial construction, infrastructure and resources companies, which account for 60% of its revenue. But IPD is one of a few ASX companies offering exposure to electric vehicles, albeit indirectly. Australia’s EV sales are beginning to take off – sales grew from 6,900 in 2020 to over 20,000 in 2021 and are set to be over 85,000 in 2024. Although this is far behind other markets such as North America and Europe, and growth is nearly flat in 2024, the Australian market is taking off thanks to government support, declining upfront costs and growing public support.

But it’s not just car makers that will benefit. Companies that provide the necessary infrastructure for EVs will benefit as well. European equipment and automation company ABB, which was IPD’s largest supply partner by share of revenue at the time it listed, provides electric vehicle chargers – both alternating current (AC) and direct current (DC) chargers. IPD provides installation, testing, commissioning and ongoing maintenance services required for the charging stations and any associated infrastructure that provides the energy to feed these outlets. In its prospectus, IPD credited the latest distribution agreement with ABB, which includes EV chargers, as a key catalyst for revenue growth. Without this deal, FY22 revenue growth would have only been 5.9% instead of 18.9%.

Good results in FY24, with more growth to come

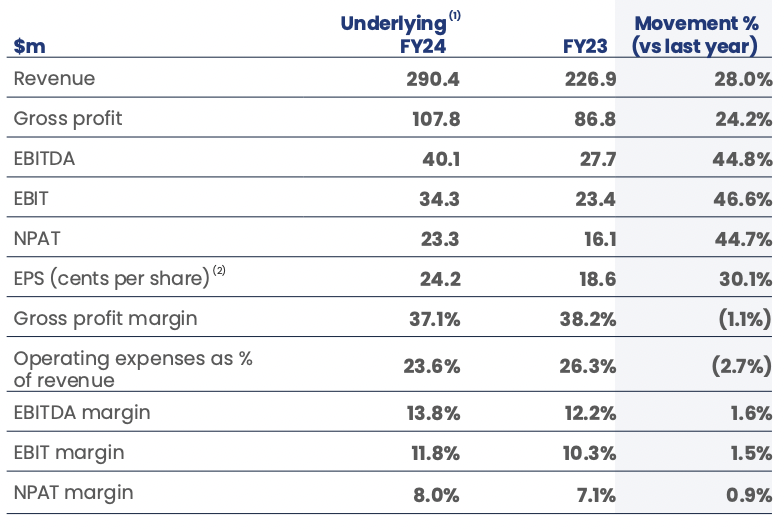

The company closed FY24 with $290.4m revenue (up 28%), $40.1m EBITDA (up 45%) and a $23.3m profit (also up 45%). It paid 10.8c in dividends across the year.

Source: Company

Consensus estimates for the years ahead suggest the company is just getting started. For FY25, they call for $382.3m revenue (up 32%) and a $31.1m profit (up 34%). For FY26, $419.3m revenue and a $34.2m profit (both up 10%). And for FY27, $459.3m revenue and a $37.3m profit (up 10% and 12% respectively). Even so, the company is reasonable priced at 16.5x P/E, a PEG of less than 0.5x and of course a market cap of under $500m.

Just look at Quanta Services (NYSE:PWR), it is also an infrastructure services provider for the electricity sector in the US – it is a US$46.3bn company and it is off the back of demand for EV infrastructure. If EV penetrations grows in Australia, IPD Group may not reach that level, but it may have some growth runway left.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Lithium Prices Recovering: Is Now the Right Time to Buy ASX Lithium Stocks?

The global lithium market has experienced a steep downturn, but recent signs suggest that the worst may be behind us.…

Is It the Right Time to Buy Tech Stocks in June 2025?

The technology sector has always played a key role in driving market performance, but 2025 has introduced a renewed sense…

8 ASX Small-Cap Stocks to Watch in June 2025

Small-cap stocks, typically companies with a market capitalisation between $50 million and $500 million, are where some of the ASX’s…