Fortescue is reliant on iron ore demand from China, but is the party over?

Iron ore demand from China has been the driving force behind the global iron ore market for the past two decades. With Beijing being the world’s largest steel producer and iron ore importer and because it has had what has seemed an insatiable appetite for iron ore, China has shaped the dynamics of the industry. However, recent trends suggest that the Chinese iron ore party may be over, with demand expected to plateau and market dynamics shifting. What will this mean for iron ore miners such as Fortescue? Spoiler alert: They’ll need to adapt.

The Peak of Iron Ore Demand from China

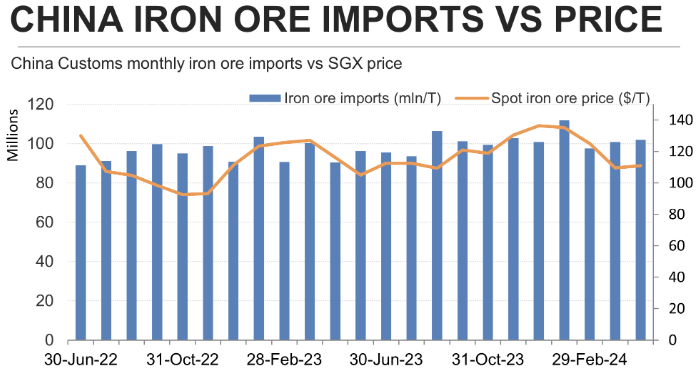

In 2023, China imported a record 1.18 billion metric tons of iron ore, according to customs data. Despite this peak, imports have been relatively stable since 2019, hovering between 1.07 billion and the 2023 high. The consensus at the recent Iron Ore Forum in Singapore, which brought together miners, traders, and steel producers, was that China’s demand will likely remain flat around these levels.

Two critical factors underpin this view: Beijing’s informal policy of capping annual steel production at around 1 billion tons and maintaining domestic iron ore output. If these conditions hold, Chinese demand is expected to stagnate, albeit at a high level.

Source: Reuters

The market is shifting, and it is unfavourable for iron ore miners

For nearly two decades, the global iron ore market has been driven by China’s relentless growth, which saw imports surge six-fold between 2004 and 2024. However, this era of exponential growth appears to be ending. While China will remain the largest buyer, its dominance is expected to diminish as other steel producers in Asia, particularly India and Southeast Asia, ramp up production.

India, currently the fifth-largest exporter, may transition to a net importer by the 2030s as its domestic industry expands. Countries like Vietnam and Thailand are also poised to increase steel production, relying heavily on imports. There are three other key factors impacting the market including decarbonisation, increased challenges for the production of high-grade iron ore, and demand-supply dynamics.

The Decarbonisation Drive

One of the most significant factors influencing the future of iron ore demand is the global push for decarbonisation. Steel production accounts for about 8% of global carbon emissions and 16% of China’s total emissions, making it a critical target for reducing emissions. To achieve net-zero goals, steelmakers are focusing on using higher-quality iron ore to improve furnace efficiency and reduce the need for sintering, which involves using heat to agglomerate iron ore fines for use in basic oxygen furnaces (BOFs).

Chinese steelmakers at the Iron Ore Forum in Singapore expressed a strong commitment to reducing their carbon intensity while continuing to use existing technology. This approach is logical, as much of the steel mills’ capital equipment is relatively new and has a long lifespan ahead.

Higher-grade agglomerates such as pellets and hot briquetted iron (HBI) are seen as a solution. Upgrading iron ore fines, even lower-grade material, into pellets and HBI is possible using green energy sources like hydrogen or less polluting fuels like natural gas.

Major miners are already taking steps in this direction. Brazil’s Vale is advancing plans to build hubs in the Middle East to produce HBI using natural gas. Additionally, studies are underway to use green hydrogen to produce HBI in Western Australia, where top exporters like Rio Tinto, BHP Group, and Fortescue Metals Group (FMG) have mines and port facilities.

The Challenge of High-Grade Production

A key issue is whether the cost of producing higher-grade material can be offset by more efficient steel production or whether carbon taxes will be necessary to make the process viable. As Eduardo Mello Franco, marketing manager for pricing at Vale, highlighted at the Iron Ore Forum, China’s near-term iron ore imports are expected to be around 1.170 to 1.180 billion metric tons, similar to 2023 levels. This projection is based on the resilience of the Chinese economy, despite a slowing property market.

China’s domestic iron ore concentrate output is expected to rise by 5 to 10 million metric tons in 2024, thanks to efforts to increase production. However, the goal of producing 370 million tons of iron ore concentrate domestically by 2025 remains ambitious, with many participants doubting its feasibility.

A Surge in Supply

Global iron ore supply is projected to grow by more than 50 million tons in 2024. The giant Simandou project in Guinea, set to become the world’s largest and highest-grade new mine for this commodity, is expected to commence production by the end of 2025. It will add around 120 million tons of high-quality iron ore annually once it reaches full capacity. Improved shipments at the start of the year and poor demand recovery have led to an oversupply, putting intense downward pressure on prices.

What will happen with Fortescue Metals and other Exporters?

Fortescue Metals (ASX:FMG), Australia’s largest (and one of the world’s largest) iron ore exporters, faces a challenging road ahead as China’s demand stabilises and supply increases. FMG, along with other key exporters like Rio Tinto and BHP, must take this new reality by focusing on efficiency and sustainability. FMG has been investing in projects to reduce carbon emissions, including exploring the use of hydrogen in iron ore processing. It has also sought to diversify into renewable energy sources, such as hydrogen, but they remain a pipe dream for now (pardon the pun).

The future for iron ore exporters will hinge on their ability to adapt to changing market dynamics and the global push for decarbonisation. This includes developing higher-grade products, investing in green technologies, and expanding into emerging markets where steel production is set to grow.

The concern many investors should have is whether or not these companies will continue to make the same returns as before. Consider that Fortescue made the 2 highest profits in its history in FY21 and FY22, US$10bn and US$6.2bn respectively off the back of iron ore prices. In the latter year, it paid a yield of 12.5%. This fell to US$4.8bn in FY23.

Granted, FMG made US$3.3bn in 1HY24 (up 41% from 1HY23) and consensus estimates (drawn from 17 analysts) call for US$6.2bn for the full year. But this is only meant to be a temporary reprieve. Consensus estimates suggest terminal decline in the company’s profit for the next 4 years at least: US$4.7bn in FY25, US$3.9bn in FY26, US$3.3bn in FY27, and US$2.6bn in FY28.

Revenues are similarly expected to see a slight spike in FY24, but decline thereafter (albeit, not as much as the bottom line). US$18.5bn in FY24 but then US$16.8bn in FY25, US$15.7bn in FY26, US$15.0bn in FY27 and US$14.3bn in FY28. What adds insult to injury for Fortescue is its heavier reliance on China compared to BHP and Rio.

What’s Ahead?

The era of explosive growth in China’s iron ore demand may be over, and while this doesn’t mean the entire market is dead, it will be a different era for companies such as Fortescue. Factors such as rising demand from other regions like India and Southeast Asia, the global push for decarbonisation and demand for higher-grade iron ore, present both challenges and opportunities for major exporters like FMG. The challenge is adapting to them.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…