After a 80% plunge in 10 months, Mineral Resources (ASX:MIN) is back with a vengeance and has nearly tripled!

Mineral Resources (ASX:MIN) has had quite the rollercoaster ride in recent years.

It avoided much of the lithium price rout, until mid-2024 because of its diversification. For investors, the company’s diversification and the hope that the downturn was a short to medium trend was enough to keep the faith.

Yet the fact that prices went even more downhill in the first half of 2024 was a straw that broke the camel’s back for Mineral Resources, which has had to cut jobs. And lithium prices were just one of the company’s problems with investigations into Chris Ellison adding another spanner into the works.

But now, in late 2025, all that is ‘by the by’ and recent financial updates have led investors very optimistic. Overall, shares are up 90% in 5 years and >150% in the last 6 months.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Who is Mineral Resources?

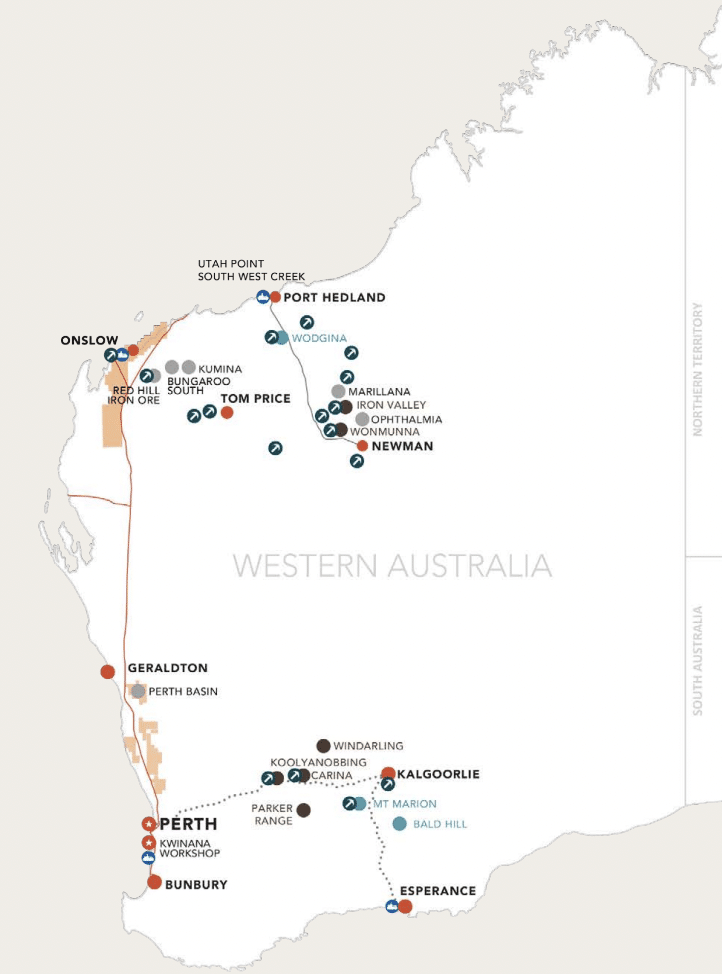

Mineral Resources ASX 50 company provides mining services, but also owns its own mines, including lithium, gold and iron ore mines. It is even an investor in micro-cap explorers, with one example being lithium newcomer Kali Metals (ASX: KM1) and another Delta Lithium (ASX:DLI). It may not be held in the same regard as BHP, Rio Tinto and Fortescue, but perhaps it should be.

Investors at Mineral Resources who attended the company’s post-FY23 AGM in November 2023 would’ve been greeted with a PowerPoint slide with Chris Ellison declaring ‘The past 12 months have been the most productive in MinRes’ history’. That statement may be up for debate, although there’s no doubt that FY23 was successful.

The company increased revenues by 40% to $4.8bn and its operating cash flow by 383% to $1.4bn. It spent $1.8bn in capex and managed to generate a 6.7% Return on Invested Capital and close the year with $1.4bn in cash. It paid $1.90 per share. We are more impressed with its track record over 5 years. It had quadrupled its EV, grown its ROIC by 22% on average and made 44% in Total Shareholder Returns (TSR) per annum.

Source: Company 2023 AGM presentation

FY24 and FY25? Not so much

The company was been a victim of the lithium price rout. This was been the biggest of its problems, but not the only one. Others have been:

- Weak iron ore prices (coming just as the company begins iron ore exports from its new mine at Onslow) and high costs in the sector,

- Concern that Mineral Resources won’t be able to access US critical minerals subsidies because it does business with China and Mt Marion is co-owned by a Hong Kong-registered subsidiary of Ganfeng,

- Even if it can be accepted lithium prices will rebound, the fact that Mineral Resources will need to sell lithium on an auction platform rather than rely on individual contracts, and

- The company’s debt burden. It was $4.4bn at the end of 2024, up from $1.9bn 12 months prior and then reached $5.8bn 6 months later due to increased development costs at Onslow (totalling $3bn). Fitch downgraded the debt to BB- with a negative outlook and flagged higher risks to its strained balance sheet.

In June 2024, the company announced it was shutting down its mines in the Yilgarn (in the south of WA), although it would look to redeploy workers in other mines. It has also announced cuts in its white-collar workforce.

At its FY24 results, the company decided not to pay a dividend for the first time in a decade. The company’s underlying net profit was only a fifth of FY23, at $158m, while its underlying earnings fell by 40% to just over $1bn. If it is any consolation, the company has not tried to sugarcoat things, with Chris Ellison admitting,’ It’s not a fun time to be in business’.

The only thing that spared Min Res’ group revenue from declining was its Mining Services Business.

The company posted an $807m interim loss in 1H25, and as we mentioned above, its debt blew out to >$5bn due to Onslow costs. And for the full FY25, revenue was down 15% to $4.5bn, and the company made a net loss of $112m on an underlying basis. On a statutory basis, this was $896m. Moreover, the company did not pay a dividend and recorded a 6.4% ROIC.

More problems…and they’re right at the top

On top of all this, Chris Ellison has his own personal problems and these are impacting Min Res’ reputation. In October 2024, the same week the Richard White scandal broke out, While the Richard White scandal ultimately ended with a power struggle where White was victorious and his dissenters quit, this did not happen here. Nine/Fairfax reported allegations of tax evasion involving a company in tax-free territory British Virgin Islands (BVI).

Min Res hired Herbert Smith Freehills to investigate the matter and it found that Ellison had a financial interest in a BVI company a Min Res subsidiary bought almost $4m of mining equipment from in the early 2000s. To his credit, Ellison disclosed that income to the ATO in 2021 and paid $4m in unpaid taxes in 2023. Herbert Smith Freehills then looked into other financial matters and found company funds were also used to benefit entities in which his daughter had an interest without the company’s knowledge.

The promise was that Ellison would be succeeded in the next 12 months. That was 12 months ago, and he’s still there. Chairman Malcolm Bundey has said that it would depend on the ‘best interests of shareholders’. ‘This must be a process, not an event’, he declared in the FY25 Investor letter.

Cause for optimism

But, shares have rallied significantly in recent months. Investors are confident things are turning around. Bundey promised things were turning around as Onslow ramped up and capex decreased. The company also hinted at asset sales, noting it had a ‘demonstrated track record of disciplined asset recycling’, and,’ We continue to assess avenues for inorganic deleveraging to strengthen our capital position and maximise returns for shareholders’.

Bundey could not talk highly enough about the progress made at Onslow, promising future cash flows. Investors could see evidence things were progressing in its recent quarterly report. In the September quarter of FY26, the company reported there was 35Mtpa capacity and that full year volume and cost guidance was on track.

Also, lithium prices went on a run meaning the average sale price was 31% higher than just 3 months prior. Of course, there were reasons for this: Lithium prices went on a rally in that quarter but seem to have fizzled out.

As for iron ore, The company guided to 17.1-18.8M wmt and 9-10wmt at Pilbara. With a 37% rise in production quarter on quarter, it appears there is reason to be optimistic.

Net debt was $5.4bn, although the company implied it would reduce (if not overall, certainly by burden) in noting net debt to EBITDA was going down.

The update did not provide full-year guidance, although consensus estimates expect good results with $5.28bn EBITDA (up from $4.47bn the year before) and $0.98 EPS which would be a $193.7m profit. Nonetheless, analysts have a mean share price of $39.64, below $47.91 that it is trading at today, and some think it could go as low as $15.

MinRes’ EV/EBITDA is just 9.1x but its P/E is 35.6x. This is below Pilbara Minerals which is over 60x, although South32 is at 15x and Fortescue is at 10x.

Conclusion

There’s no doubt the company is in better shape than 12 months ago.

But we think there is a risk of ‘buying the hype’. In our view, investors should wait to see two things: First who the successor CEO will be, and second if lithium prices recover – not to 2021 levels, but above levels that render many projects unprofitable. So perhaps wait until the new calendar year to buy in…or perhaps earlier if lithium prices rally.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…

Rio Tinto (ASX:RIO) Drops 3% Despite Record Copper Output: Is This a Buying Opportunity for Income Investors?

Rio Tinto’s FY2025 Result: What Income Investors Should Know Rio Tinto (ASX: RIO) dropped 3.1% to A$163.30 on Friday after…

Long-term vs. Day Trading: Choosing Your Winning Strategy for Your ASX Portfolio

When it comes to investing in the Australian Securities Exchange (ASX), two predominant strategies often emerge: long-term investing and day…