JB Hi Fi (ASX:JBH): The ASX’s most in vogue retailer as of 1HY24 can seemingly do no wrong (for now)

![]() Nick Sundich, February 14, 2024

Nick Sundich, February 14, 2024

Few stocks would surge after a 20% profit decline, but JB Hi Fi (ASX:JBH) is so in vogue with investors that share still went up after its first half results for FY24 (1HY24) were released on Monday. While many ASX retailers’ customers have substantially cut back spending, this has not been the case with Australia’s largest electronics retailer, at least enough to concern investors.

What many seem to forget is that JB Hi-Fi also owns white goods retailer The Good Guys and solid results from its namesake electronics stores have masked underperformance here. Could things turn around and The Good Guys contribute to growth in the business, or could it continue to underperform to the extent investors might actually worry?

Who is JB Hi Fi (ASX:JBH)?

JB Hi-Fi is one of those companies that needs little introduction, in being Australia’s pre-eminent retailers, selling consumer electronics and home appliances. It was founded in 1974, listed on the ASX in 2003 and today has over 300 stores in Australia and New Zealand. In addition to the stores bearing its name, it also owns the Good Guys, having purchased it for $870m in 2016, in an aim to increase its market share.

Avoiding the pandemic, then avoiding inflation

The company avoided a downturn during the pandemic thanks to its significant online presence that had been built during the 2010s. And it was seeing an unexpected boom from customers looking through products that would help them both work and relax at home during lockdowns. Indeed, the company grew its sales by 12% in both FY20 and FY21. It is important to note the company has stores in New Zealand that actually lagged in FY20 (declining over 5%) but rebounding in FY21 (growing by 17%).

Many companies saw booms due to the pandemic too, only to see demand drop off – Kogan (ASX:KGN) is one company that springs to mind. Also not helping matters was high inflation that would eat into margins, even if revenues were stable.

That was not the case here. FY22 saw 3.5% growth to $9.2bn and its profit was $544.9m (up 8%). FY23 saw $9.6bn in sales (up 4.3%) although its profit declined by 3.7% to $524.6m. Considering it made $6.85bn in sales in FY18 and a $233.2m profit, not a bad result when you put it into the context of several years.

Warning signs brewing?

JB Hi-Fi released its 1HY24 results earlier this week and shares rose. This was despite the company’s profit falling 20% and its sales declining 2.2%. Its dividend was cut 20% to $1.58 per share, but still rose 7%. This was also despite shares being at an all time high even prior to the results.

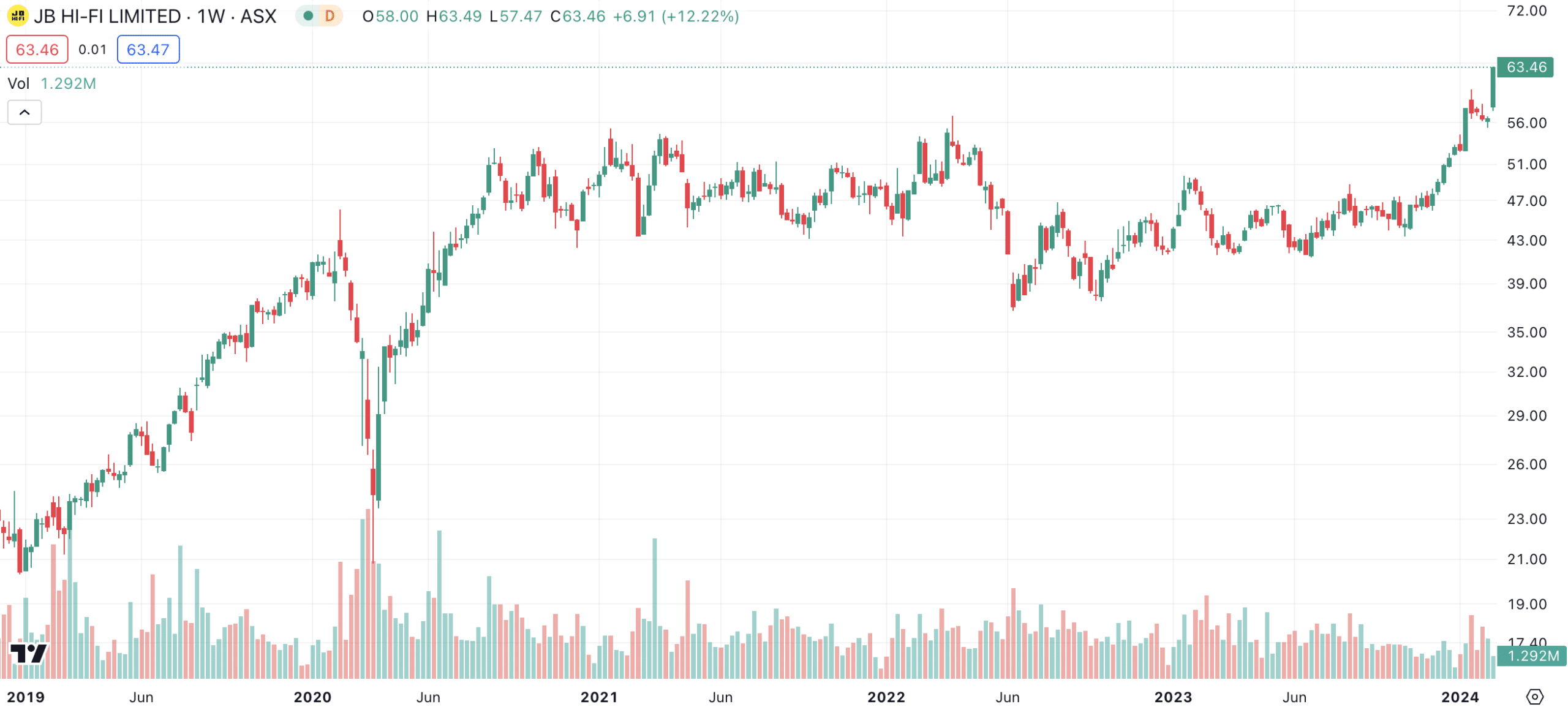

JB Hi-Fi (ASX:JBH) share price chart, log scale (Source: TradingView)

Why? Perhaps JB Hi-Fi investors think the Stage 3 tax cuts will help. And not just towards its JB Hi-Fi stores, but towards the Good Guys too. An extra $1,100 in most people’s pockets could tempt them to buy some new white goods, or a new laptop.

This thesis sounds like a dream scenario, but it is predicated on everything going right. No further increases to the RBA cash rate, or Black Swan events to smash consumer confidence. And it also assumes people spend the extra money rather than save it.

So should you buy JB Hi-Fi shares?

Not if you trust the 14 analysts who cover JB Hi-Fi – they have a target price of $56.71, a near 10% discount to the current share price. They forecast a slight revenue decline to $9.5bn in FY24, only for $9.8bn in FY25 and $10.2bn in FY26, both representing 3% growth.

But profits are predicted to be lower than FY23 for some years, $423.0 in FY24, $416.4m in FY25 and $432.8m in FY26. What many investors are forgetting is even though inflation is slowing, it is not as if we’re entering deflation – prices like labour costs, shipping and raw materials are substantially higher than they were prior to the current bout of inflation.

JB Hi-Fi is trading at 15.92x P/E for FY25 and 7.8x EV/EBITDA. Not bad, although it is meant to have negative growth. In FY26, it has a P/E of 15.3x but a PEG of 2.9x considering the 3.6% EPS growth. Our DCF modelling for JB Hi-Fi suggests it is worth $68.77, a premium of just under 10% to the current price. A premium, but a small one nonetheless.

In our view, you should only buy JB Hi-Fi if you think the Good Guys can propel it to further growth.

The Good Guys will be key

We observed that The Good Guys (responsible for ~30% of sales) has lagged other divisions. Sales in FY23 only rose 0.8% and 1HY24 (the first half of FY24) saw a concerning 9.9% slide. This was despite the Black Friday and Christmas shopping periods.

Perhaps the Stage 3 tax cuts will see people spend their money on new home appliances and specifically at the Good Guys…but maybe it won’t be the case, either they’ll go to competitors or just save that money. Investors wanting to bet on the first of those three scenarios might be able to realise significant upside on this one, otherwise it is anyone’s guess how shares will perform.

In the end, this is a solid business with a strong footprint of consumer electronic stores that (as we’ve seen of late) are solid enough to keep the Group’s top and bottom lines growing.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…