Judo Bank (ASX:JDO): Is it finally getting the recognition it deserves?

![]() Nick Sundich, February 8, 2024

Nick Sundich, February 8, 2024

Judo Bank (ASX:JDO) has had a difficult couple of years since listing, but is it bound for better times in CY24? The recent trading update for the first half of FY24 (1HY24) and positive investor reaction implies that it could be. It still has some ground to make up, however.

Who is Judo Bank?

The Melbourne-based Judo Capital Holdings is the owner of Judo Bank, Australia’s first ‘challenger’ bank for Small and Medium-sized Enterprises (SMEs). Judo was founded by David Hornery and Joseph Healy, two former NAB bankers, in 2016. You might be thinking of the word ‘neobank’ at this time and the fate of some peers like Xinja, but Judo is different. It is not just a digital fintech app for milennials, it is a full-on bank for SMEs. By full-on, we mean it has relationship managers and a full banking license. The bank has been rapidly growing its loan book that reached ~A$9.7bn in December 2023. Judo Capital believes the book can ultimately get to A$15-20bn in the medium term.

In November 2021, Judo Bank became the first fully licensed Australian bank to IPO on ASX in 25 years. Judo Bank was granted a full banking licence in April 2019.

The bank doesn’t pay a dividend at this stage, so dividend junkies will not be interested in this stock. We also think short-term day traders won’t be interested; this is a medium-term hold (over 12-18 months).

Why we’ve long been fans of Judo Bank

We have 3 reasons.

1. Judo’s focus on SMEs

Judo bank’s decision to focus on SMEs, and do so via specialist relationship bankers, allows it to grow in an underserved niche with superior expertise.

Judo has an ideal customer base. It is no accident that Judo is recording loan book growth. Having been let down by the big banks, sometimes having to wait weeks to get a response, customers need a bank that can understand their needs and give them a response (one way or the other). Judo is picky with who it does business with, turning down roughly half of would-be customers. Those it does business with are resilient to rising interest rates and tend to be able to repay loans from core operations. Keep in mind as well that interest on business loans is generally tax deductible, so higher rates could ironically be a good thing.

The Judo loan book is growing strongly because its customers love it. In FY22, the loan book grew 73% to A$6bn and a further 23% to reach $7.5bn in 1HY23. It reached $8.9bn by June 2023 and $9.7bn by December 2023. We think this is because it is popular with customers. Keep in mind that it had a Net Promoter Score (NPS) of 77 last year. Anything over 50 represents ‘excellent’, while the big banks get excited if it is anything above 0. Judo expects its loan book to get to $15-20bn.

2. The growth opportunity

We noted already the bank is growing its loan book. It has ambitions to expand into new segments. The bank is targeting expansions in the important agribusiness and health sectors, having recently added relationship bankers in these sectors. Each banker only serves about 25 customers, so there is a very high level of engagement with the client base, which we believe will limit loan losses in the long term.

3. In financially solid shape

Judo Bank is both profitable and financially conservative. Tier 1 capital as at December 2023 was a massive 16.2% while in September 2022 it was 19.5%. APRA only requires Australian banks to hold total capital of 8% of risk-weighted assets, of which Tier 1 must be half. Tier 1 capital is mostly retained earnings and ordinary shares. Based on this Tier 1 capital, JDO has ample room to grow just on its current balance sheet. Furthermore, the bank has modelled that even in a doomsday scenario, where 3% of Gross Loans and Advances (GLA) were in default (double the average sector rate during the GFC), it would be safe – its CT1 ratio would still be well ahead of its peers.

Judo is performing well financially. It exceeded prospectus forecasts in FY22, with Profit Before Tax coming in at $15.6m versus $7.4m in the prospectus and all other forecasts exceeded. In FY23, it was $107.5m – a seven-fold increase and achieved a 5.1% Return on Equity. It has grown its Net Interest Margin (NIM) to 3.53%, up from 2.79% 12 months earlier.

Struggles in 2022 and 2023

It has been a difficult time for Judo since it listed, at least from a share price perspective.

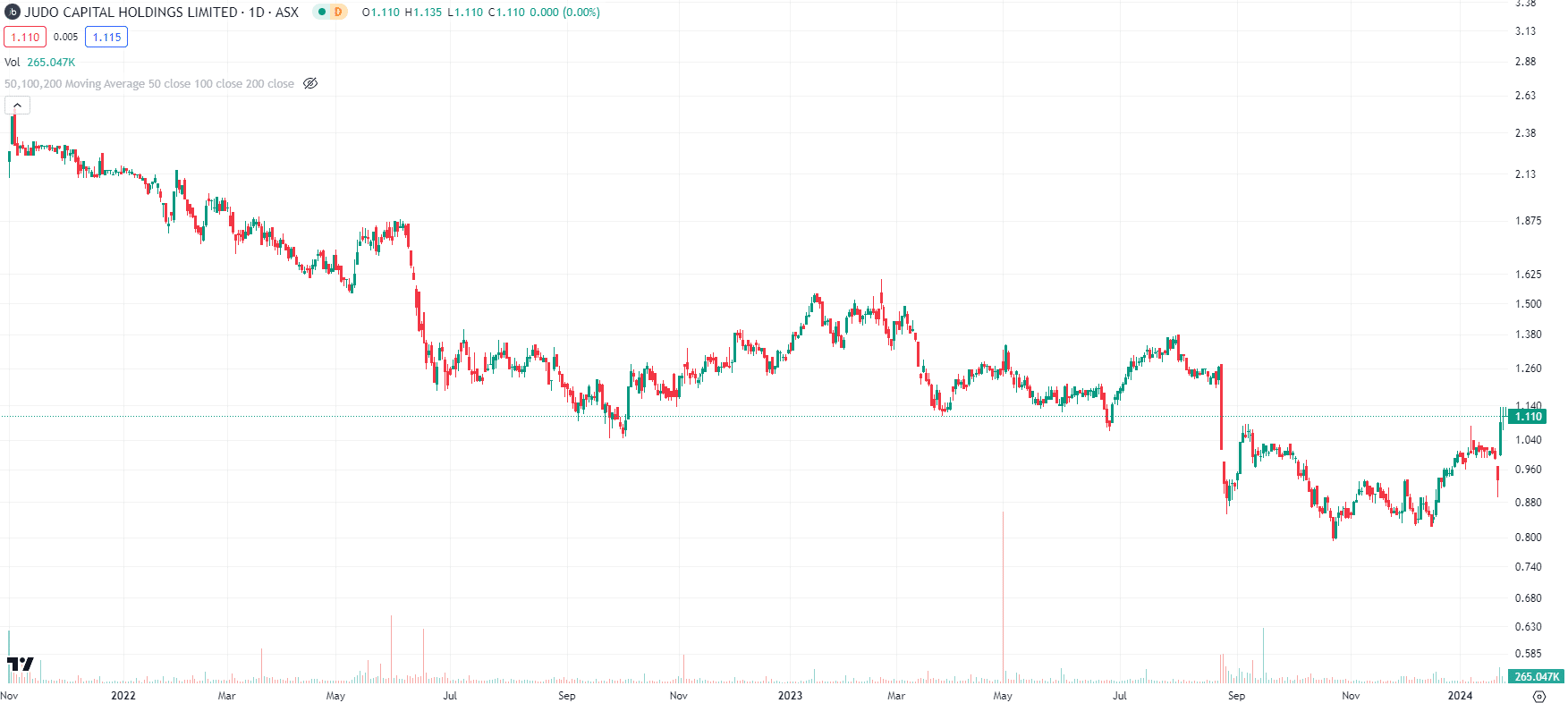

Judo Bank (ASX:JDO) share price chart, log scale (Source: TradingView)

We think the main reason for the decline is the unpopularity of bank stocks in a rising interest rate environment. We also think it has suffered from investor perceptions that SMEs will endure difficulties in a high-inflation environment.

Judo Bank may have been impacted by sentiment towards the so-called ‘neobanks’ because of two failures – Xinja in December 2020 and Volt in June 2022. Both these banks failed because they couldn’t raise enough capital. That is not Judo’s problem. Judo is also a very different beast to Volt, being SME-focused rather than consumer focused.

However, there’s no shying away from the fact that the company’s FY23 results were received badly, with shares falling 20% on the day. The bank on its investor calls admitted it was seeing a slight uptick in defaults as well as a margin headwind from the refinancing of $2.8bn of special RBA facilities with more expensive deposits and warehouse funding.

2024 might be better?

Only time will tell, although it has started well after a trading update. It told investors that:

- Its PBT for 1HY24 was $67m, up 24%

- Net lending grew $800m, 3 times system business credit growth

- The average gross lending margin was 464bps, up 398 from 3 months ago

- Its NIM was 3.02%, a moderation but ahead of the big banks

- Its CET1 was 16.2%

The bank told investors it anticipated $40-45m profit for the second half, representing in $107-112m for the full FY24. The TFF would be repaid by June 2024, enabling funding costs to formalise. It is anticipating at least 15% profit growth for FY25.

If the company can achieve this, we are confident that it can continue to re-rate, although this will be a 12-18 month hold.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…