Is Karoon Energy (ASX:KAR) a ‘falling knife’, too risky to invest in or both? Or maybe neither?

Investors who bought Karoon Energy (ASX:KAR) during the depths of the pandemic would be please, but investors who bought at the start of 2024…not so much. The latest incident to have hit the company this year led to a 6% intraday fall and bought its losses for 2024 to over 30%. Is this a ‘buy the dip’ opportunity, or a ‘falling knife‘?

Karoon Energy got into North America

Karoon has several oil and gas assets in the Americas. These include the Who Dat, Dome Patrol and adjacent acreage in the Gulf of Mexico. It has multiple blocks off the coast of southern Brazil including the Bauna Project. Bauna is operated by Karoon but the US GoM assets are operated by other operators.

The company has a 30%-stake in the US GoM assets (although it would have a higher stake in certain fields) and only signed a deal to acquire them in November 2023. The company promised it would add up to 4.5m BOE (Barrels of Oil Equivalent) to the company’s 2024 production figures. The ‘Who Dat’ came on stream in 2011 and was already producing 42,000 BOE per day, but it was hoped that an in-field development program would increase the figure in 2024, and it could be higher in the future if an appraisal well was bought in line (Who Dat South and West).

Exploration was never expected to be a cheap exercise. Drilling costs were estimated at $60m per well. But if it could offset the natural decline in Bauna, perhaps it could pay for itself.

Karoon Energy’s 2024

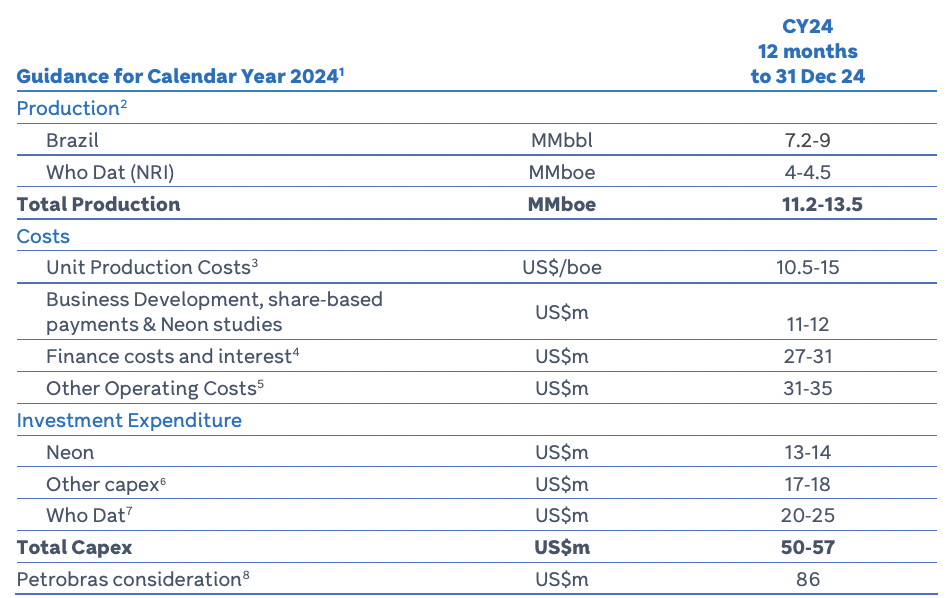

For Karoon investors, the first quarter of the year wasn’t bad. Shares gained 10% from early January until mid-April. The company was transitioning from a July-June 30 financial year to a calendar year and so released ‘Transition Year 2023’ results on Leap Day (February 29 2024). It reported a profit more than double the prior period – US$144.7m – off the back of higher sales, improved prices, and lower unit production costs. It provided the following guidance for CY24.

Source: Company

In early April, Karoon told investors its drilling plans for Who Dat were approved and this campaign began in the subsequent weeks. By late June, it was averaging 40,000 boe per day on a gross basis. In August, the company told investors things were on track and announced its inaugural dividend. But investors were not pleased about a few other things including that its statutory NPAT halved, Who Dat’s production did not offset the decline in Bauna and its costs were on the rise. Its unit production costs were US$13.51 and it told investors its capex would be US$150-177m.

In the second half of the year, Who Dat was interrupted by Hurricanes Helene, Francine and Rafael. And while Karoon was able to quickly shut it down, ramping up production again couldn’t be done as fast. Not the company’s fault, and to its credit, it announced a 2C Contingent Resource that was nearly triple what it had been before – 15.7MMboe vs 5.4MMboe before.

And just this week, Bauna was impacted too. It had been shut-in on December 11 due to failure of two anchor chains of the floating vessel. While the vessel is stable, production has been stopped and there is no certainty as to how long it might take. Karoon has admitted that it will not be enough to just repair – it will need obtain approval to recommence operations and undertake works to mitigate the chance of a reoccurrence.

Karoon has told investors to expect Group production 10.1-10.3 MMboe production for CY24, down from 10.5-10.7 MMBoe. Of this 7.2-7.4 MMbbl would come from Bauna, with the balance from Who Dat (2.7MMboe).

What does 2025 hold for Karoon?

Whilst these problems were unideal, they weren’t Karoon’s fault and hardly unforeseen for a company seeking to extract oil offshore. But of course, when you set the bar of expectation, you have to meet it no matter how high it was set or pay the price.

In our view, 2025 could be another year of ‘growing pains’, particularly if the hurricane season in the US is another difficult one. This goes to show that investing in oil and gas stocks is not for the faint-hearted investors. And that is before you even consider the future of oil amidst the transition for renewable energy…but that’s a discussion for another article.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…