Is Lendlease (ASX:LLC) out of the doldrums for good?

![]() Nick Sundich, February 20, 2025

Nick Sundich, February 20, 2025

Lendlease (ASX:LLC) has for the past several years been the classic definition of a ‘value trap’.

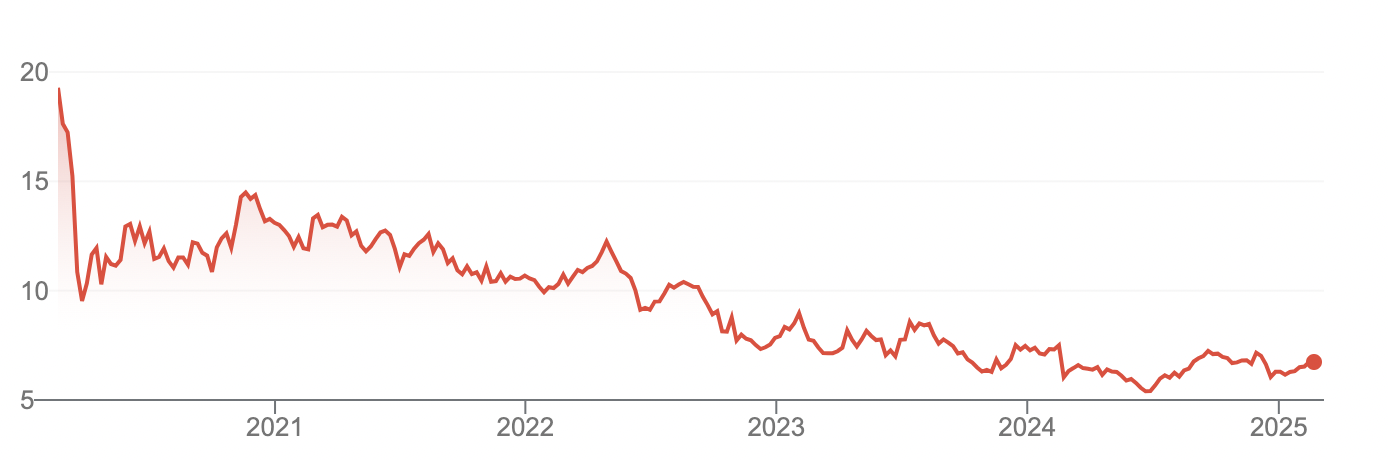

You think a good company is trading at a bargain price due to a ‘temporary setback’, but the setback turns out to be a lot more than temporary or just the tip of the iceberg. If you bought Lendlease in the 2nd half of 2019 and held since then, your shares would now only be worth a third of what they were back then. But the past is the past. The question now is: When will things get better?

Lendlease (ASX:LLC) share price chart, log scale (Source: TradingView)

Introduction to Lendlease and how it got itself into a mess

Lendlease is a real estate company that has been both an investor and a builder of properties. What types, you ask? Just about anything – residential developments, office skyscrapers, other commercial assets, social infrastructure, defence infrastructure…you name it, Lendlease has probably been in that space since its 1958 founding.

There are varying degrees of profitability amongst real estate projects and no two sectors can have the same outlook. But they all have significant upfront costs in any economic times. The accounting is complex too – even if the company demands cash upfront for future owners, it may not be able to be recognised from an accounting standpoint until later on. And the bout of post-COVID inflation hit the construction sector amongst the worst of any sector.

The company has all but admitted that it did not have sufficient risk assessment and due diligence procedures on its projects in years gone by. Take it from the board itself, the fact that new procedures were announced in May last year as part of a simplification strategy all but confirmed this. It also exited over $4bn worth of unprofitable international projects, as well as its entire master-planned communities business, promising to use proceeds to pay down debt and return capital to shareholders. Public demands from activist investors, most prominently Tanarra Capital’s John Wylie, didn’t give the best look for prospective investors.

A different future, but potentially a better one

So it is clear Lendlease no longer wants to be a major global player and is content with being a major Australian player. But where to next? It would seem building apartments for wealthy Baby Boomers downsizing. Just look at one of its most recent property proposals.

Lendlease bought 1 Darling Point Road at Edgecliff (in Sydney’s Eastern Suburbs) for $132.5m and wants to build a $500m 17-story residential tower on that site. This is being done in a Joint Venture with Mitsubishi’s real estate arm and it is not the first time Lendlease has partnered with them. Amongst other projects is its Residences Two tower at One Sydney Harbour. The company flagged in its 1H25 results that it’d get a $118m EBITDA boost from settlements.

Let’s turn to the company’s results. FY24’s results were poor on face value with a $1.5bn net loss, a figure blown out due to impairments and lower property valuations. It’s 1HY25 results saw its operating profit come in $133m in positive territory and its statutory profit was $48m compared to a $136m loss in the prior corresponding period. But its revenues were down 8% at $4.5bn and it paid out dividends of under 40% of its earnings. The company confirmed it completed $2.2bn out of the $2.8bn planned capital recycling.

Looking at individual segments, its investments segment was positive, with segmental EBITDA more than doubling – led by the establishment of a new joint venture with Vita Partners for life science properties. Development work performed solidly too with a key contribution coming from One Sydney Harbour. The construction segment revenues fell $400m to $1.5bn because various projects were taking longer to commence, and a number of projects were completed in the previous period. Its new work increased from $0.7bn to $3.9bn as the company pivoted to fee-based work.

Lendlease has told investors to expect EPS of 54-62c per share – with this being skewed 60-70% to the secon half. Its gearing would fall and be within 5-15% by the end of FY26. Of course, this is subject to many variables including interest rates, forex movements and capital markets. Another challenge is that it has to bid for large precedent projects with rival companies like Mirvac and Stockland – it may not always win out.

Lendlease is trading at a P/E of just 11.9x, but at a PEG multiple of 2.53x.

Is now the time to get into Lendlease?

We think Lendlease won’t decline much further, but could take some months to gain momentum. So for investors willing to wait at least a couple of years, and aren’t really concerned with dividends – it could be one to consider.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…