Light and Wonder (ASX:LNW) is up 15% since its secondary ASX listing! But is more growth to come?

![]() Nick Sundich, July 6, 2023

Nick Sundich, July 6, 2023

It has been little over a month since Light and Wonder (ASX:LNW) debuted on the ASX, but it has been a solid performer, gaining ~15% in just a few weeks.

Who is this company? Is there more growth to come from it? And if you were burnt by PointsBet (ASX:PBH), does this stock represent a chance to win back some of your losses?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Meet Light and Wonder

We used a picture of Las Vegas for this article for a good reason, because the company (fittingly) is based there.

Light and Wonder has had a long history which traces back over a century, but it only got into lottery systems in the 1970s.

It became Scientific Games Corporation in 2001 after acquiring a company by that name which made instant lottery equipment.

By 2020, it had a diverse business in the gambling industry.

However, it also had $9.2bn in debt and was forced to sell its lottery and sports betting business to focus on casino gaming. It adopted the name Light and Wonder in March last year.

It has been listed on the Nasdaq for several years but only listed on the ASX at the end of May last year. The company opted to list Down Under due to interest from Australian fund managers that could only invest in Australian-listed shares.

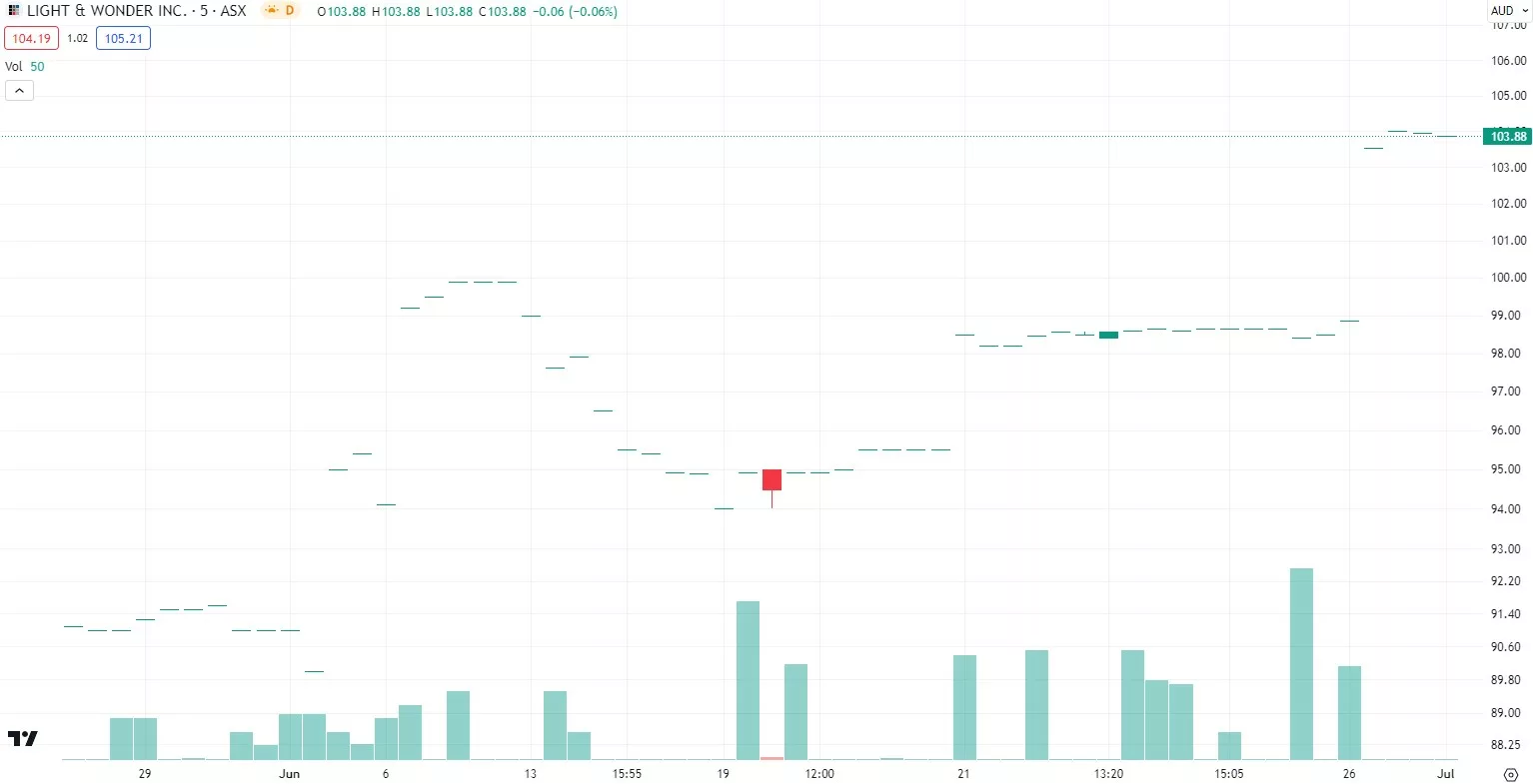

Shareholders have liked the company so far, sending shares up nearly 15% in the first few weeks.

Light & Wonder (ASX:LNW), log scale (Source: TradingView)

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

So what now?

There’s a lot to like about Light and Wonder. After the departure of Crown and the PointsBet deal, it is arguably the best prospect for ASX investors interested in the US betting space.

Obviously it is present in the USA which is an exciting opportunity. Estimates from ResearchAndMarkets suggest the global market for Online Lottery was US$15.2 Billion in 2022 and is projected to reach a revised size of US$29.9 Billion by 2030, growing at a CAGR of 8.8% over the analysis period 2022-2030.

But it is present in all 6 continents and made US$2.5bn in consolidated revenue and $913m in EBITDA during 2022.

It is trading at just 8.4x EV/EBITDA and 25.3x P/E for FY24. And in FY23, consensus estimates call for 10% revenue growth and 11% EBITDA growth.

However, there are some factors working against it.

Although LNW’s market penetration is better than PointsBet, the gambling market is still highly competitive.

Even though it has cut its debt by $4.8bn, there is still $3.9bn on the balance sheet, representing a net debt leverage ratio of 3.1x. The consensus share price in USD is roughly in line with what it is now.

And how the macroeconomic environment will impact the company is anyone’s guess. As we noted a few months ago when we did a deep dive on Jumbo Interactive (ASX:JIN), there is evidence to suggest that people experiencing financial difficulties are more likely to participate in lotteries.

But this was not borne out in the performance of most betting stocks during the GFC.

Should you take the risk?

Ultimately, we wouldn’t be taking a punt on this stock right now. Simply put, we think are there better opportunities elsewhere in the market.

There is less downside risk than PointsBet, but we still think there is some because of the risk of a recession and the fragmented nature of the gambling industry.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…