How much will lithium demand skyrocket during the rest of the 2020s?

Nick Sundich, May 16, 2023

Lithium demand is only going in one direction – up. And if you hadn’t realised this, you’ve probably been living on Planet Mars. But what investors may be forgiven for not knowing is just how much demand will increase in the rest of this decade and beyond?

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Why is lithium demand expected to increase so much?

Lithium demand is expected to surge over the next decade, mainly due to its role in renewable energy storage. Lithium-ion batteries are increasingly being used in electric vehicles, home energy storage systems and stationary industrial energy storage applications. Additionally, lithium is also an essential component in grid-scale energy storage solutions, such as large-scale batteries. With governments around the world promoting clean energy sources, demand for lithium is likely to increase significantly as renewable energy sources become more prominent.

Other contributing factors to the exponential growth in lithium demand include the decreasing cost of lithium ion batteries and growing consumer demand for portable electronic devices like cell phones and laptop computers.

As these markets continue to expand, manufacturers are turning to lithium-ion batteries as a reliable power source that can store substantial amounts of power while taking up minimal space. This has led to a steadily increasing demand for lithium over recent years. The outlook for continued growth in the near future is positive given that technological advances are making lithium even more attractive for use in a variety of applications. Moreover, the development of new production processes and efficient recycling technologies could further boost demand for this metal over the coming decade.

But how much?

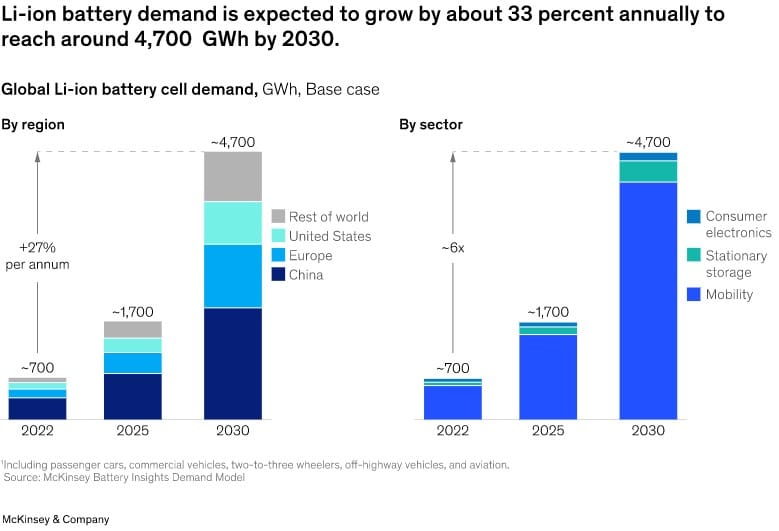

There are varying estimates, but one of the more reliable in our view is from management consulting agency McKinsley. Analysis from McKinsley last year estimated that the entire lithium-ion battery chain (from mining through to recycling) could grow over 30% annually every year up to 2030, by which point it would reach US$400bn and a market size of 4.7TWh.

Source: McKinsley

Another recent estimate came from industry player Albemarle (it is a part owner of the Greenbushes and Wodgina mines in Australia). It predicts global revenues would rise from US$4.7bn in 2022 to as much as US$15.7bn in 2027. It also anticipated the world would consumer 1.8Mt of lithium carbonate equivalent in 2025 and 3.7Mt in 2030. It also estimated that electric vehicle production would grow from 11.2m in 2022 to 46.9m in 2030.

We’ll show one final estimate for future lithium demand. Public-private alliance Li-Bridge expects demand for batteries to increase more than five-fold by 2030. You can clearly see that there are various estimates but they all point to the same direction – namely onwards and upwards by a very long way.

So what this growth in lithium demand mean for investors?

With this growth in lithium demand comes potential opportunities for investors. In particular, there are opportunities in the form on companies that produce or supply lithium-based products, such as battery manufacturers or raw material suppliers. Furthermore, companies that prospect or produce lithium might be ones to consider. We wrote about our 5 favourite ASX lithium shares last month.

Investors should pay close attention to the growing global lithium demand and evaluate ways they can benefit from its increasing use in various industries.

Just last week, we sent an alert to the subscribers of Concierge to a new lithium stock on our BUY list. It’s already up 16% after 5 days! Find out which stock with a free trial to Concierge!

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…