LiveTiles (ASX:LVT): Here are 5 things all ASX stocks should learn from its demise

![]() Nick Sundich, January 2, 2024

Nick Sundich, January 2, 2024

LiveTiles (ASX:LVT) formally entered into receivership about a month ago, ending a near-decade tenure on the ASX. It was a very eventful period, with the company’s market capitalisation surpassing $250m at its all time high. Unfortunately, things all went downhill in the past couple of years, culminating in its receivership.

We won’t comment on the toing and froing between the company and the ASX in its final days. Yet even that aside, we think other ASX companies can learn a few lessons from LiveTiles’ collapse and here are 5 of them.

5 lessons for all ASX stocks out of LiveTiles’ (ASX:LVT) collapse

1. Be more concise about what you do

LiveTiles had employee experience software and plenty of products. Nonetheless, we think the company didn’t do a good enough job in selling to investors the simple and compelling thing (or two or a few things) that the software does and why to consequently buy the stock. Maybe this is an issue with employee experience software companies generally, with Limeade being a flop of a listing as well.

2. Try to name some of your clients

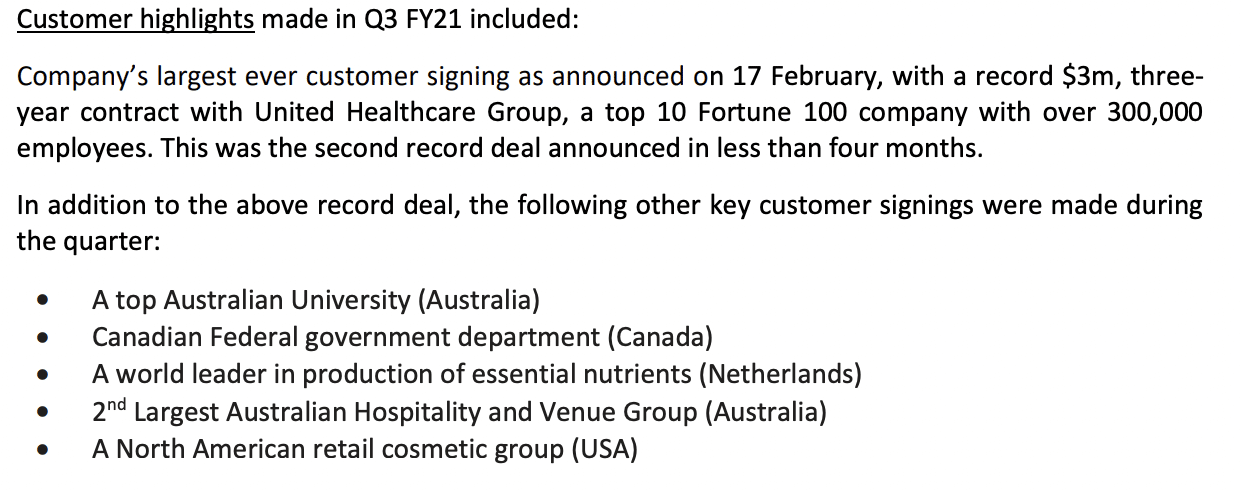

Check out LiveTiles’ quarterly announcement for Q3 of FY21. You see that the bulk of the company’s clients are unnamed.

Source: Company

Yes, there is one company named, but notwithstanding the name, $3m is penny change for a US$500bn company as United Healthcare is. We acknowledge that some clients may not want to be named and this could be the difference between getting the money from those clients or not. But at the same time, do these clients really like the products if they aren’t willing to put their name to it? In our view, plenty of investors struggled with this question too. We admit that the above is one example of an announcement, although (with this author having observed LiveTiles as an IR client in a precious career) it is far from the only announcement where this was the case.

3. Manage staff turnover

This is both applicable at a management level and staffing level. We will give the company credit for having stable leadership for the bulk of its existence. At the same time, things began to fall off the wheels in the last year. It saw two CEO replacements in the last 15 months of its existence with Karl Redenbach stepping away from the CEO’s seat in November 2022 (although staying on the board) and his replacement David Vander announcing his resignation in less than a year. This is a bad sign for a company – when a CEO leaves in less than a year.

Further worrying investors was a cost-reduction program which saw 48 employees and contractors go, among other changes. The company claimed the program would save $8.4m in FY24, although this was enough to save it from liquidation

4. Expansion to the US is the start of a journey not the end

One of the key selling points of the company was that it was present in the US market. Indeed, it had a global office in New York. Nonetheless, expanding to the US is only the start of a journey and not an end in itself. It is a lucrative market, but a highly competitive one at that and it can be difficult to break into. Just ask Tinybeans (ASX:TNY) as one example.

For all the success stories like ResMed (ASX:RMD) and Cochlear (ASX:COH), there are other tales that didn’t go so well, including some that started well but all went downhill. Do you see where we’re going with all this? It’s not worth crowing about entering the US and securing a contract or two, actually make it in the market.

5. If you leave profitability until it is too late, it will be

Many tech stocks are guilty of this and have not gone into liquidation, yet. But too many have focused on growth at any cost and neglecting profitability. Some have tried to become profitable once interest rates have risen, although it was too late for some. And please do not pretend EBITDA is profitability. Even if it was, LVT was negative by $3.5m and it saw a 42% fall in revenues to US$30m.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…