Merck & Co (NYSE:MRK): Its a top 5 healthcare company, but needs to figure out its post-Keytruda future

![]() Nick Sundich, August 19, 2024

Nick Sundich, August 19, 2024

Merck & Co (NYSE:MRK) is one of the world’s most prominent healthcare companies. The healthcare industry is perceived by many investors to be one of the best industries to invest in because it is resilient to adverse economic conditions, but also offers substantial growth opportunities as new innovations can quickly take off given the impact they can have on people’s lives.

Merck & Co (NYSE:MRK) share price chart, log scale (Source: TradingView)

Merck traces its history back longer than most other Western companies. Merck & Co was named for a German company called Merck Group, founded by pharmacist Friedrich Jacob Merck in 1668 and is still around today (often confusing many investors given it too is a major listed company) and owned by the 13th generation of the Merck family. The Merck we are talking about was founded in 1891 as the German company’s American affiliate – German employee Theodore Weicker was sent to the United States to found it. During World War One, the US government seized 80% of the company’s shares, only for the family to buy it back after the war – although the companies have been separate entities ever since.

During the wars, Merck delved into R&D through a number of M&A deals, and the rest is history. Key achievements have been the introduction of the first effective treatment for tuberculosis in the 1940s, the Measles-Mumps-Rubella (M-M-R) vaccine in 1971, the first pneumonia vaccine in 1977, a Hepatitis B vaccine in 1986 and Crixivan in 1996 (the first treatment for HIV/AIDs). It is always buying smaller cap companies with drugs that show potential to be game changers.

Overview of Merck and its products

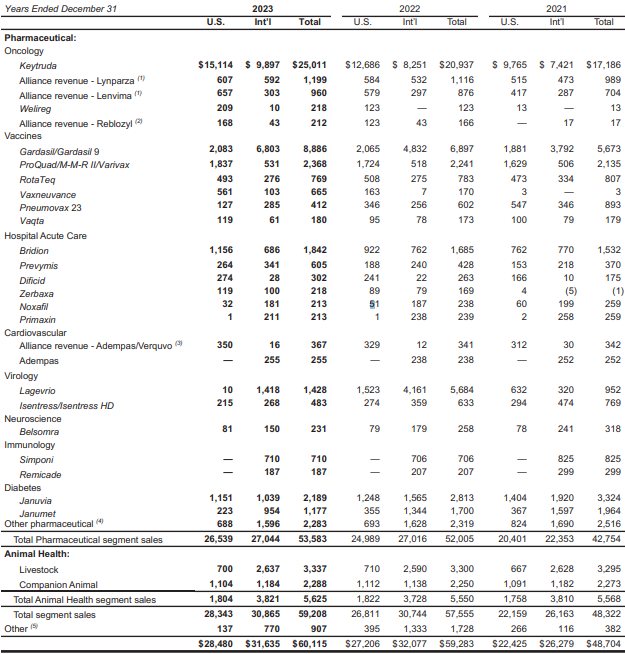

Today, Merck has a very diverse portfolio of products. Just take a look at all its revenue streams.

Source: Company

You can see that there are a few products responsible for a high proportion of its revenue. The key product, accounting for US$25bn of the company’s total US$60bn revenue is Keytruda, or pembrolizumab. It is a cancer therapy that is the first anti-PD-1 (programmed death receptor-1) therapy used to treat cancers, particularly head and neck squamous cell cancer.

Gardasil, a HPV vaccine, is next with over US$8bn in revenues along with the aforementioned M-M-R II vaccine. Bridion is a treatment for the reversal of neuromuscular blockade that can occur in patients under general anesthesia.

Lynparaza is worth mentioning because it was only FDA approved in mid-2023. The prostate cancer treatment was jointly developed and commercialised with AstraZeneca, hence it has to share profits. Lenvima was developed with Ensai and is another cancer treatment, although investor excitement hit a dead end after a clinical trial was run to see if a combination of it and Keytruda could be effective, but was shut down before it ended due to poor efficacy data.

Being a big company is a blessing and a curse

It is not all smooth sailing for Merck. Many of its drugs do so well because they are subject to patents and market exclusivity periods, but neither last forever. Keytruda comes off patent in 2028 and there could be competition from biosimilar versions. Analysts predict sales could fall by up to 20% in the year after. You can see this is why big pharma loves buying out little pharma. Merck does have to be cautious with a cash balance of US$6.8bn and just over US$33bn in long-term debt.

Regulatory crackdowns can (and do) hurt the company. For example, there has been decrease in sales of Gardasil in China during 2024, even surprising the company. Yes, sales still rose overall but far slower than the pace that enabled sales to double from 2020 to 2024. In the past year, Beijing’s anti-corruption crackdown hit the medical sector and has led to hospitals being more hesitant to do deals with international pharmaceutical companies.

The next 5 years should be good, but it is anyone’s guess after that.

Merck & Co is one of those stocks that might be good for the short-term, but not for the long-term. Analysts’ target price is US$140.25, 20% ahead of its current price. And they expect a rebound in its profit after falling from $14.5bn to just US$377m due to R&D expenditure doubling. They call for $64.2bn in revenue and a $19.1bn profit for CY24, followed by $68.6bn in revenue and a $22.9bn profit in CY25, then $72.8bn in revenue and a $25.4bn profit in CY26. After Keytruda’s patent expires, both the top and bottom lines are expected to stagnate.

But all this being said, Merck is trading at cheap multiples – 11.1x EV/EBITDA, 13.9x P/E and just 0.3x PEG right now. Many of its peers are higher, Novo Nordisk is over 30x , Novartis is over 14x and AstraZaneca is 18x. Our valuation is US$147.83, using consensus estimates and a 7.8% WACC.

Investors can make some money out of this one in the next year or two, but we still think it needs to work on a plan for a post-Keytruda world.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Why TPG’s $651M Bid for Infomedia Could Backfire

What does it say about a company when one of the world’s biggest private equity firms offers a 30 percent…

Shopify Jumps 100% — Can Its Q2 Momentum Hold in H2

What if the real winner of the AI and e-commerce boom isn’t a retailer, but the platform quietly powering their…

What if the future of global clean energy hinges on a remote hillside in Malawi?

As governments race to secure rare earths, the essential ingredients in electric vehicles, wind turbines, and military tech, investors are…