Which Big Bank stock will win the mortgage wars?

![]() Nick Sundich, August 1, 2023

Nick Sundich, August 1, 2023

The average home owner paying down a home loan would think the term ‘mortgage wars’ would allude to their struggle to keep up with repayments. But it is actually a thing amongst big bank stocks. Yes, banks are seeing the average loan going from 2% to 6% but they obviously won’t reap the benefits if customers move to another bank.

And they may reap some benefit if they are keeping them, that obviously declines if they have to offer cash-back offers and a lower rate to keep those customers – ditto any bank that manages to win across new customers. But we think there is one big bank stock that will win the mortgage wars – and that is CBA (ASX:CBA). In this article we outline why and ask whether or not you should invest in the company as a consequence.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

4 reasons why CBA will win the mortgage wars

1. Big loan book to begin with

According to APRA, CBA’s owner-occupied book is $365.3bn as of the end of June 2023 while the investor book is $179bn. Yes, this is not a big share of the $2.1tn home loan book in Australia. But it is biggest of all its peers by far. The next largest, Westpac has $290bn in owner-occupied loans and $155.2bn in investor loans.

That places CBA in a good position to win the mortgage wars, or at least emerge better off than its peers. Because each loan issued with reduced margins will have less of an impact on its overall business.

2. Higher proportion sold through proprietary channels and without cashback offers

We want you to think about the following statistics for a moment. According to analysis from the UBS, the average home loan that is sold through a broker channel, has a $3-4,000 cash-back offer and churns after 2 years has an IRR of -58.4%. No that minus sign is not a typo. You can clearly see how banks could be engaged in ‘mortgage wars’. Because they want business, but profitable business rather than loss-making business.

CBA was one of the first lenders to ditch its cash-back offer, doing so back in May, and it was never that generous to begin with (at only $2,000). It generates the highest proportion of loans through its proprietary channel, in other words from people who are acquiring a home loan ‘DIY’ rather than using a mortgage broker – at ~60% (excluding BankWest).

CBA’s next competitor, Westpac has 51.8% of its loan book through the proprietary channel. And it is unclear whether this is just Westpac or including its subsidiaries like St George – if not, we would be surprised if the former figure was not lower.

The average loan sold through a proprietary system, without a cashback offer and lasting 6 years has an IRR of 16.7%. So, CBA stands to make a lot more money from its loans than its peers.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

3. Good customers

CBA has home loan arrears of just 1%, making it one of the best positioned peers in the market to thrive amidst the mortgage wars. We will admit that CBA’s figure is not the lowest – ANZ is just below 1%. But when you consider that the 3 worst in the market for home loan arrears (VMG, Pepper and Bluestone) have a figure of >5%, CBA is well positioned.

4. A big savings book without high interest rates

It is easy to forget that one of the key reasons why banks are losing the mortgage wars is because many are passing on rate hikes to customers on deposits too. Deposits are cheaper than wholesale funding, but they do come at a cost.

CBA, however, is positioned to win the mortgage wars because of how it is placed. It has an enormous savings book at $368.8bn and it has very low interest rates compared to its peers. Consider Macquarie has rates at nearly 5% for its savings account (over 5% for the first 4 months) while CBA has an ongoing rate of just 1.65%.

This means it will have cheaper costs of financing relative to its peers. But won’t customers shift savings to banks with higher savings if CBA fails to deliver? This hasn’t been happening – its deposit book rose 3.1% in the 12 months to the end of March.

People may be complaining on Twitter, but when push comes to shove, they just can’t be bothered moving – at least not yet.

What about Macquarie?

Macquarie has been mentioned as a pick to win the ‘mortgage wars’. This company delivered non-stop growth over the past decade or so. However, it has stepped back since April and appears to be stuck with a market share of ~5.6% whilst CBA is over 20%.

And as we noted above, it has higher costs of funding compared to CBA because it has higher deposit rates. Therefore, CBA is the best positioned big bank stock to fight the mortage wars.

So should you buy CBA as a consequence?

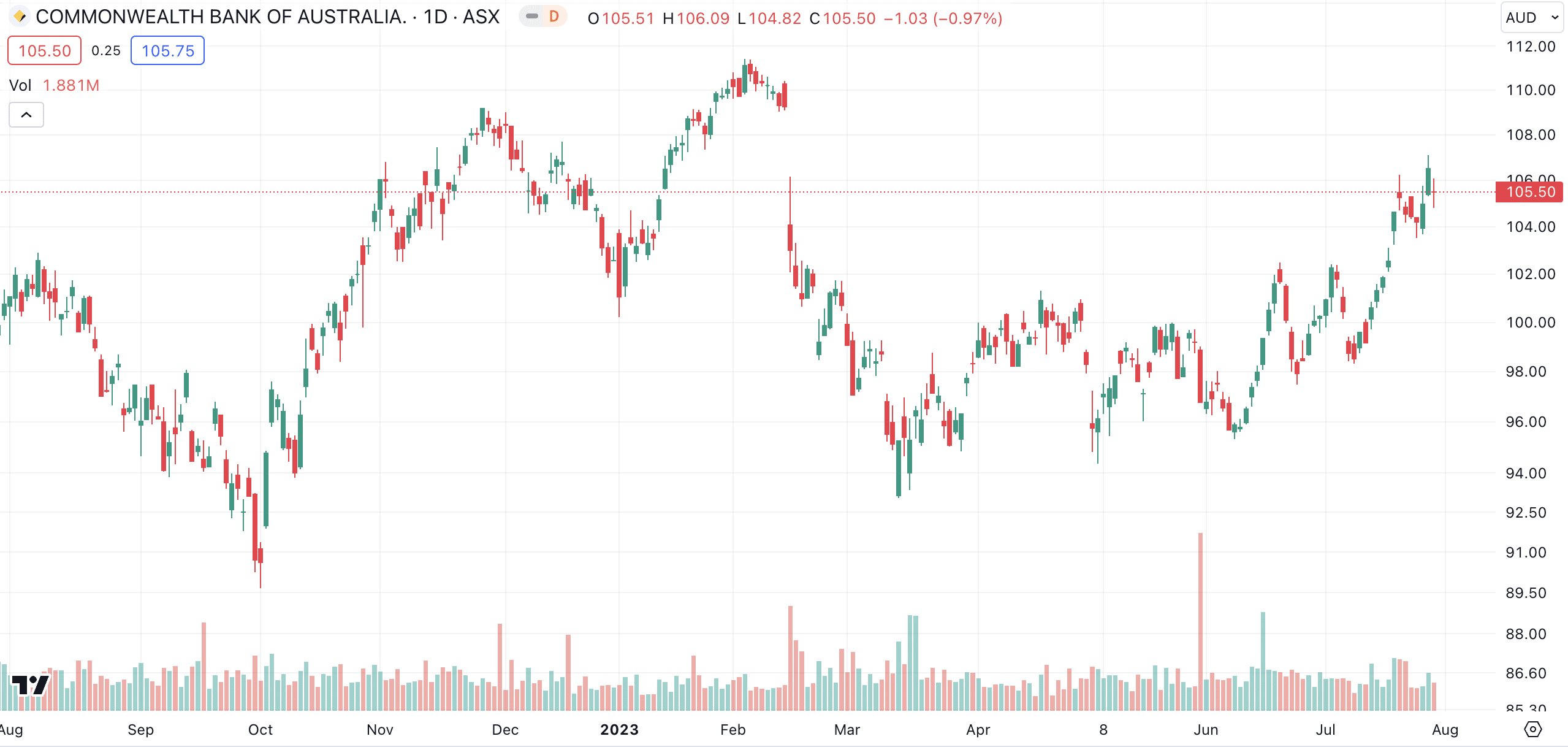

In short, not for this specific reason. The mortgage wars are called ‘wars’ for a reason, because they’re having to pursue business that has lower margins to avoid margins that if they don’t pursue they’ll have margins fall. Talk about a lose lose situation. Although CBA has gained 4.5% in the last 12 months, it trails the ASX 200 which has gained 5.5%.

CBA (ASX:CBA) share price chart, log scale (Source: TradingView)

You shouldn’t buy CBA just because it is best positioned to fight the mortgage wars. You should if you think it meets your investment objectives and you think it is fairly valued.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge … for FREE.

GET A FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…