Myer is merging with Apparel Brands! Here’s what the ASX’s worst kept secret of FY25 means for investors

![]() Nick Sundich, October 30, 2024

Nick Sundich, October 30, 2024

The ASX’s worst secret is out – Myer is merging with Apparel Brands (some of the brands owned by Solomon Lew’s Premier Investments). This had been speculated on for some months, but this morning it was made official. Here’s what investors need to know about the deal, including why it is going ahead, and when we can expect it to be official.

Why Myer is merging with Apparel Brands

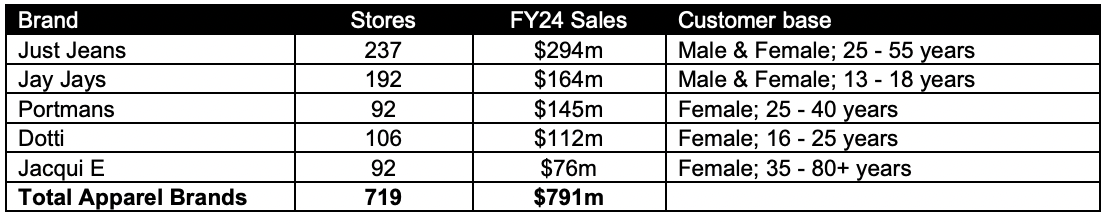

Because it will diversify Myer as a business and will help Premier Investments focus on its Peter Alexander and Smiggle businesses. Premier Investments (ASX:PMV) is an investor in and operator of consumer retail brands. Five of these are Just Jeans, Jay Jays, Portmans, Dotti and Jacqui E, all of which will belong to Myer. These will be put into a new company called Just Group, which Myer will buy.

Source: Myer

Myer will buy these brands for 890.5m of its own shares, worth $854m based on Monday’s $0.96 closing share price. This will result in Premier owning 51.5% of Myer’s shares, and Solomon Lew will join Myer’s board. Premier already owns 31.2%.

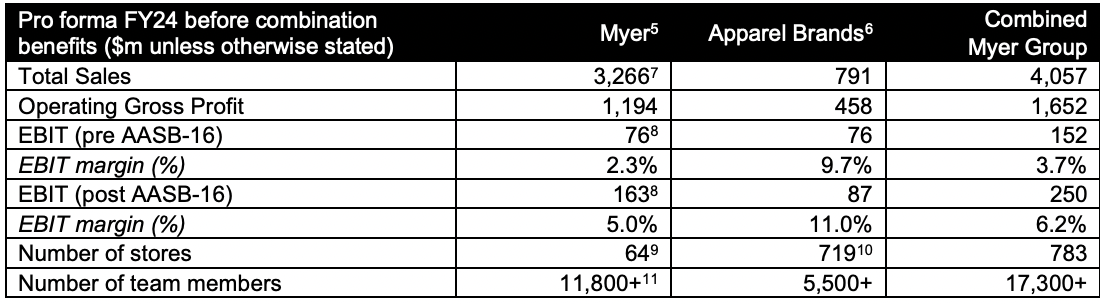

Myer has listed many specific reasons as to why the deal is good for investors. The most notable include the higher sales and operating leverage that would come from the combined business. Investors have been told to expect benefits of at least $30m per year in the short to medium term. The 5 brands made revenue of $791m and an EBIT of $76m in FY24.

Source: Myer

‘The combination of Myer and Apparel Brands is transformational for our business. If approved by shareholders, it will create a leading retail group with more than 780 stores across Australia and New Zealand, with a large and highly engaged customer base and capital to fund future investment and growth,’ said Myer boss Olivia Wirth.

‘Myer and Apparel Brands have highly complementary store footprints and customers who will benefit from an expanded omni-channel ecosystem that enables them to engage with the Group’s loved brands when and how they want.’

‘The combination will create significant opportunities to supercharge our leading Myer One loyalty program through greater reach, enriched data, enhanced cross-shop opportunities and increased personalisation to drive incremental sales growth.’

‘The combined business will also be well positioned to take advantage of capabilities in product development, design, sourcing and distribution to realise the full potential of Myer’s Exclusive Brands and private label portfolio and deliver improved margins for the Group.’

What next?

The deal is subject to both companies’ shareholders, ASIC and the ASX approving. Both shareholders are expected to meet in late January 2025, and the deal will be completed shortly thereafter, assuming it is approved.

There is no doubt that this deal diversifies Myer from being a ‘jack of all trades’ department store into a company with several niche brands. We cannot help but wonder if Premier is selling these brands because it cannot see more growth potential in them. And if Solomon Lew, for the industry legend that he is, cannot realise growth potential in them – it is hard to envision who can. Ultimately, as with all deals it is a case of ‘caveat emperor’ or buyer beware.

Only time will tell how this deal works out for all investors. It would not be going ahead if no opportunity could be seen at all, although just because there is a growth opportunity – it doesn’t mean it will be realised. After all, if all growth opportunities before ASX companies were realised, no ASX company would ever fail.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…