National Fuel Gas (NYSE:NFG): A great natural gas play

![]() Nick Sundich, September 12, 2023

Nick Sundich, September 12, 2023

This week’s international stock deep dive is National Fuel Gas (NYSE:NFG). Natural gas may not be the most friendly investment amongst ESG-minded investors or even growth given the run in gas prices after Russia’s invasion of Ukraine has halted. But we think it is one of those quiet achievers that generate some good returns for investors.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Introduction to National Fuel Gas

This company, which was founded in 1902, is based in the outskirts of Buffalo in Upstate New York and distributes and transports natural gas to customers in the surrounding region – Upstate New York and North-western Pennsylvania. NFG is a vertically integrated company with upstream, midstream and downstream operations. It has 1.2m net acres that produce over 1Bcf (billion cubic feet) per day along with substantial pipeline infrastructure and 754,000 utility customers. End users account for just 8% of customer transportation with 37% going to Local Distribution Companies, 34% to producers, 16% to outside pipelines and the balance to marketers.

NFG has paid dividends for 121 consecutive years and increased them for the last 53 straight. Its share price has yielded on average 3.7% per annum since 1970. And although upstate New York and Pennsylvania may not seem appetising markets, both are highly affordable markets for customers.

What is there to look forward to?

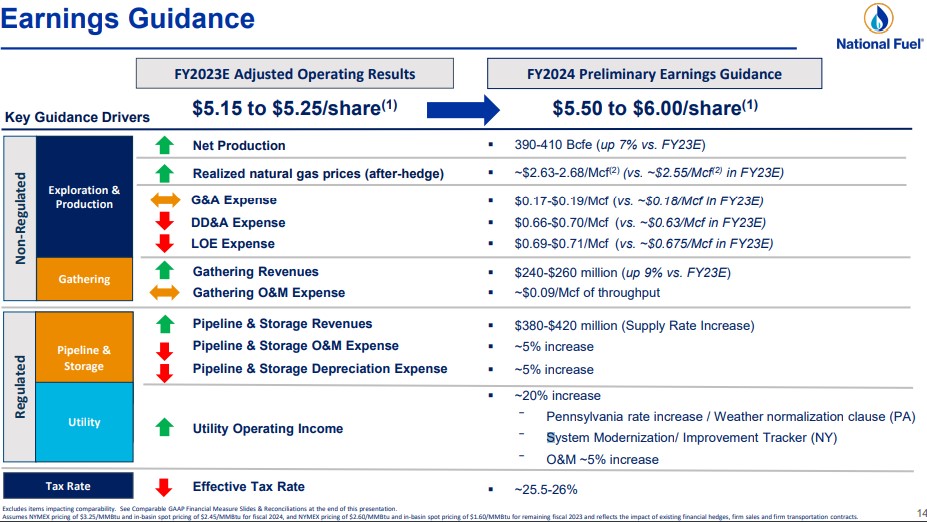

NFG shareholders have a lot to look forward to in the months ahead. Although gas prices have retreated from all time highs, they are expected to stabilise in FY24. And the company is expecting good earnings growth in the year ahead, the midpoint of its guidance pointing to 11% growth.

Consensus estimates for FY25 call for US$8.24 per share which would be 37-49% higher. And it is trading at just 8.9x P/E for FY24 and 0.86x PEG.

Source: Company presentation for 3Q23

There is a good ESG angle to NFG too as it reduces its emissions through sustainability initiatives. It is targeting 30-50% reduction in methane intensity across its divisions by 2030 and a 25% reduction in greenhouse gas emissions by 2030. Although the group has not reduced emissions since 2020, certain divisions have (pipeline & storage has cut emissions by 24.1% and the utility division is down 67% since 1990). Trading at US$51.86 per share (capping the company at US$4.7bb), NFG is trading at a 17% discount to the consensus target price of US$60.75.

Keys to its success

However there will be a couple of factors that will be crucial towards determining whether or not NFG can rerate.

The first is gas prices. To illustrate how crucial it will be, the company estimates that a NYMEX natural gas price ($/MMBtu) of $3 would deliver US$130m in Free Cash Flow while $3.50 will lead to US$200m. For the avoidance of doubt, this is not the crude oil price, it is natural gas futures on the New York Mercantile Exchange (NYMEX). In the most recent quarter, the realised price was $2.55. This example depicts that it can be a profitable business even without high gas prices. Granted, the company’s operating results went from $1.54 EPS in 3Q22 to $1.01 in 3Q23. And the company has done more than a reasonable job at maintaining cost inflation. NFG is anticipating 352 Bcf of production in 2024, 205Bcf has been locked in at US$2.70/MCF net of transportation, 64Bcf of non-cost collars with a US$3.43 floor and the balance being hedged. This compares well to FY23 to date where 91Bcf has been sold and 54Bcf was sold at US$2.28/Mcf.

The second of these is the company’s capex and how it will be financed. The company has debt of over US$2.5bn, more than half of its market cap. There are a few things in favour of the company including that it is planning on cutting back capex having guided to US$525-575 in FY24 and has a stable debt maturity profile – that is to say its current debts don’t all mature at once. We would also note that NFG capex can go some way towards paying for itself. The company’s modernisation spending in New York in recent years is expected to add $4-5m in gross margin in 2023 and $8-9m in 2024.

NFG is worth watching

There aren’t many companies trading at such a discount to its consensus price on Wall Street – but this company is one of them. We can appreciate some investors would be worried about gas prices, but we still think this company is one that can stand out in the months ahead.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge … for FREE.

GET A FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…