Northern Star Resources (ASX:NST): Weathering Market Storms to gain 19% in a year

![]() Ujjwal Maheshwari, November 13, 2023

Ujjwal Maheshwari, November 13, 2023

Northern Star Resources (ASX:NST), a stalwart in the gold mining industry, has dodged a broader market downturn. Despite the broader ASX 200 index and ASX 200 Resources Index being flat in 12 months, Northern Star has gained nearly 20%.

All about Northern Star Resources (ASX:NST)

Northern Star Resources is one of the ASX’s biggest gold mining stocks, capped at $13.7bn. In FY23, produced 1.6Moz of gold from its 3 operating mines – Pogo in Alaska, along with Yandal and Kalgoorlie in WA. The company made $1.2bn in cash earnings, has $362m in net cash and paid 26.5c per share in dividends.

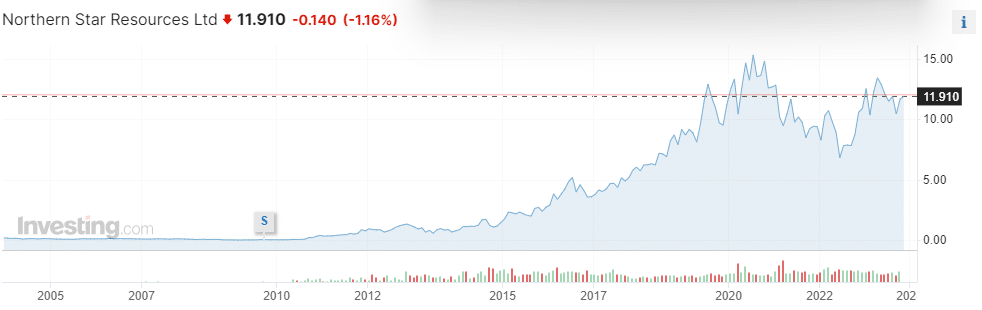

It was founded in 2003 and spent about 7 years as another small cap explorer. It became a producer in 2010 when it bought the Paulsens mine, and the rest is history. The returns that Northern Star Resources has generated for its investors are unparalleled among ASX companies over the last 15 years. And there are no signs of the company declining.

Northern Star Resources (ASX:NST) share price chart, log scale (Source: investing.com)

A good quarter

In its recently released quarterly update, Northern Star reported total gold sales of 369,000 ounces, a slight dip from the previous quarter’s 426,000 ounces. This decline was due to planned shutdowns at its three production centres. Notably, the company achieved an all-in sustaining cost (AISC) of AU$1,939 per ounce (US$1,260/oz), underlining effective cost management in gold production.

During the quarter, the gold was sold at an average price of AU$2,815/oz, resulting in a significant gold sales revenue of AU$1.04 billion. The company also provided insights into its hedging commitments, with a total of 1.68 million ounces at an average price of AU$2,929/oz. It’s worth mentioning that 330,000 ounces of hedging were added at AU$3,314/oz during the September 2023 quarter, while 125,000 ounces were delivered at AU$2,544/oz.

Many mining companies have seen squeezed margins and supply chain issues impact operations, so to see one that is performing well is one investors want to buy into (or if they have already bought in, don’t want to sell). It also helps that gold is seen as a safe haven and as a store of value in high-inflationary environments. Granted, it has taken longer during this high-inflationary cycle for gold stocks to rally, but now NST and its peers are rallying with a vengeance.

Guidance and Outlook

Looking ahead, Northern Star maintains its guidance for FY 2024, anticipating gold sales of 1.6 million to 1.75 million ounces at an AISC range of AU$1,730 to AU$1,790 per ounce. Of this, roughly half is expected to come from Kalgoorlie, 33% or so from Yandal and the balance from Pogo.

The company anticipates its capital expenditure for FY 2024 to be in line with the FY 2023, excluding the AU$525 million kept for the KCGM Mill Expansion project. It will spent a further $150m on exploration activities. Managing Director Stuart Tonkin emphasized the successful completion of planned shutdowns and the clear pathway towards achieving full-year guidance.

Mixed opinions

The brokerage community holds varying opinions on Northern Star Resources. While UBS is cautious with a sell rating, they still see potential for growth. Citi and Goldman Sachs both maintain a neutral stance, with Goldman Sachs highlighting valuation and execution risks. Macquarie, on the other hand, is notably optimistic about Northern Star, providing a high price target at A$15 and foreseeing substantial upside potential. The added bonus of expected dividend yields sweetens the deal for investors considering exposure to gold through Northern Star shares.

NST is not the only company to be exposed to gold mining, but it is one of the few companies that is thriving at a time many companies are surviving, but not doing much better than surviving.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…